The journey of company building is marked by value inflection points. As you progress from Minimum Viable Category to Initial Product Release to Minimum Viable Product, you must either bootstrap the company or raise angel and seed funding.

How do you find angel and seed investors?

Some angel investors act on their own. Some act in groups. Some are highly active, investing in ten or more companies a year; others might invest in just five companies ever. Incubators and accelerators are often seed stage investors.

The search for an angel or seed investor follows Metcalfe’s Law. The value of a network equals the square of the nodes in the network. The more nodes you activate, the more likely you are to find an angel investor who is ready, willing and able to invest. You activate nodes by networking. Talk to your lawyer, and ask for introductions. Post your angel search on Facebook and LinkedIn. Go to Gust.com and complete the common application for angel funding so it can be sent to a wide range of angel groups. Attend every event you can find that includes entrepreneurs and investors, like this one:

Post on AngelList and other online portals. Apply to accelerator programs. The “all of the above” approach to networking will maximize your likelihood of success. This is important, because for any single investor or investor group, your chances of success are slim. The screening process is brutal.

Angel groups

Band of Angels, a well known Silicon Valley angel group comprised of over 150 active angel investors, reviewed 1000 deals in 2017. Member investors invested in just 22 of these. In other words, almost 98% of the startups that took the time to apply struck out.

Some angel groups invest in a wide spectrum of companies. Others are more narrow. As CEO, you need to determine which groups are right for you. For instance, Tribeca Angels is focused on New York-based FinTech companies, and writes check sizes between $200K and $500K. Pipeline Angels, on the other hand, is comprised of 200 women investors who invest in women-led startups. Since 2011, Pipeline members have invested $4M in 40 companies — i.e. $100K checks on average. Be sure to check out the Angel Capital Association membership directory¹ for a listing of angel groups by region.

Reputable angel groups have stringent review processes, but don’t charge you to attend and do invest. For such programs, only a small percentage of companies will be accepted to pitch in front of the group’s monthly lunch or dinner. But if you do secure a pitch slot, a reputable angel group will be happy to buy you that dinner and welcome you as a guest.

If your company is working on its initial product release, or has launched a Minimum Viable Product, or has begun to prove Minimum Viable Repeatability, then you are right to focus on the angel investment class.

Incubators and Accelerators

In preparing its 2015 World Rankings of incubators, UBI Global assessed 1,270 incubators worldwide. A separate report, the 2016 Global Accelerator Report by Gust.com, sought data from 1,458 accelerators worldwide. From these two studies alone, we can infer that the number of labs, incubators and accelerators in the world numbers in the thousands.

Let’s take a look at the Global Accelerator Report. In 2015, 387 accelerators invested $192M in over 8,836 startups.² A leading network of accelerators called the Global Accelerator Network includes 85 accelerator programs. Across the GAN network, the acceptance rate of applicants into an accelerator program is 2%. In the past 10 years, 4700 startups have gone through a GAN accelerator program; 85% are still in business.

One way or another, funding is an integral component of all incubators and accelerators. Early stage companies have very little money, so access to capital is a critical factor in any startup’s decision to participate in such a program. Some programs provide direct investment. 500 Startups gives companies selected for its seed program $150K for 6% of the company, then charges back $38K for expenses. Y Combinator invests $120K for 7%. Techstars invests $118K for 7%-10% of the company. AngelPad offers startups accepted into its program $120K — $20K itself, plus $100K from partnering VCs. These four are generally regarded as among the top accelerator programs in the world. More broadly, according to the Global Accelerator Report, 64% of accelerators in the US and Canada invest cash and take equity in startups.³ Still more programs provide indirect access to investors, either through networking, events or Pitch Days.

Across the diversity of programs — the co-working spaces, labs, incubators, and accelerators — the boundaries are fuzzy. The emerging consensus is that an accelerator program has the following characteristics:

- Application-based and highly competitive

- A defined program and timeframe, with startups joining classes, or cohorts

- Mentorship

- The focus is on small teams, not just one founder

- Direct or indirect access to pre-seed funding

Incubators and labs, on the other hand, are more open-ended. Some are affiliated with and funded by universities. Others are businesses themselves and depend on rent from startups and corporate partners to operate. Still more are structured as non-profits, depending on grants and donations to survive. Hybrid programs abound. Plug & Play charges rent for its workspaces. It invests in some but not all companies. GSV Labs offers many events that attract investors, but charges rent. Neither of these programs operates on a cohort basis. Startups can stay as long as they want, so long as they can afford the rent.

As an early-stage entrepreneur, you will need to evaluate services on a program by program basis to find the program that is right for you. Here is the list of services you may find:

- Access to funding (may be a direct investment by the incubator or accelerator, pitch events, demo days or networking contacts)

- Workspace (may be free or not)

- Business mentorship (may be structured or unstructured)

- Access to customers/markets (the workspace may include corporate partner teams, allowing direct collaboration; or access to markets and customers via mentor introductions)

- Access to enabling technologies and services (there may be financial, legal and technical support to stand up your company)

Accelerator investments (for that matter, angel and seed investment in general) are most likely to be structured as SAFE investments or convertible notes, with a discount to the next round and / or a cap to ensure a defined percentage in the company is achieved at the time of a priced round. A SAFE (Simple Agreement for Future Equity) is an agreement that provides for the conversion of the investment into preferred shares at the point the company raises equity financing with a priced round. A SAFE is not a debt instrument, so it is simpler than a convertible note — but both instruments enable the investor and entrepreneur to defer the pricing of the round until a later, probably larger institutional investment. The investor gains a conversion advantage via a valuation cap, a discount to the next round, or both. The convertible note bears a nominal interest rate, but its purpose is to allow conversion into a priced round, just as is true with the SAFE.

Here are some of the top accelerators, with the number of investments since inception in parentheses:

- Y Combinator (1,662)

- 500 Startups (1,640)

- Plug and Play (673)

- StartX / Stanford (190

- AngelPad (160)

- Boost VC (149)

- SkyDeck / Berkeley (141)

- MedTech Innovator (134)

- Indie Bio (130)

- Alchemist Accelerator (130)

- Google Launchpad Accelerator (110)

- IdeaLab (86)

- Acceleprise (85)⁴

Crowdfunding

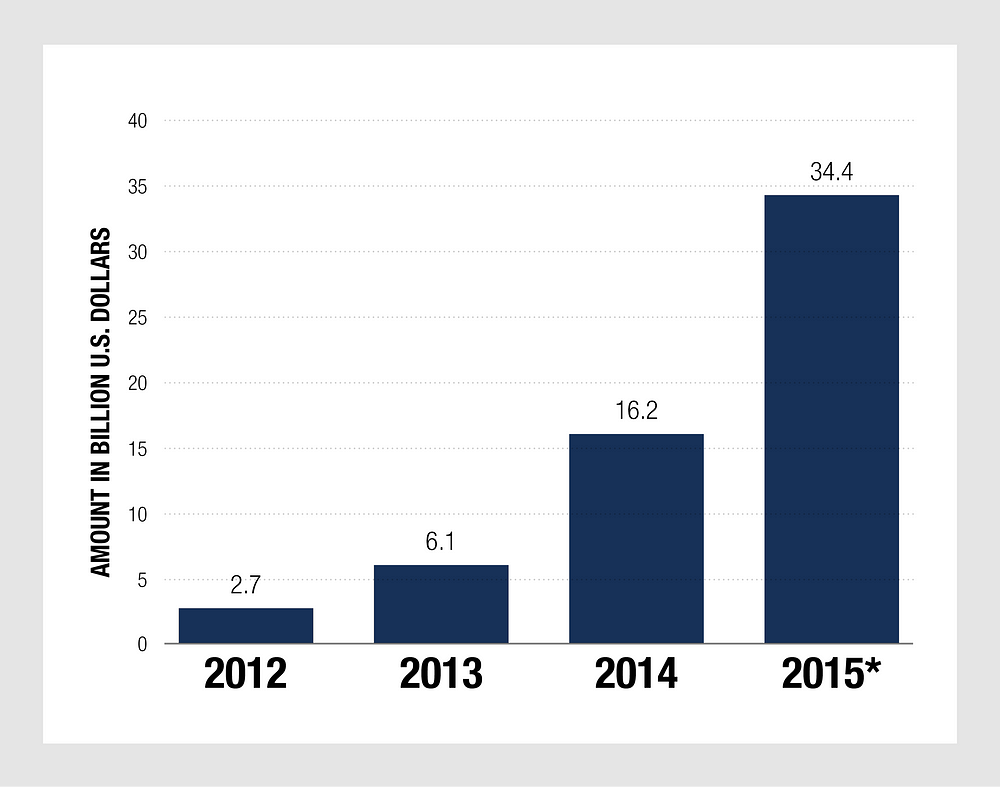

It is estimated that in 2015, $34B in crowdfunding occurred worldwide. Crowdfunding is a big tent that includes equity and non-equity funding, for businesses as well as for personal projects. Its popularity is growing rapidly.

Total Crowdfunding Volume Worldwide from 2012–2015 (in billions of US $)⁵

The leading crowdfunding platforms include AngelList, Crowdfunder, EquityNet, Fundable, RocketHub, MicroVentures, PeerBackers and SeedInvest. The purpose of these platforms is to make it easier for accredited investors to evaluate investment opportunities, and for entrepreneurs to efficiently pitch to a large pool of investors.

Crowdfunding is all about momentum. For AngelList, syndicates drive the action. If a syndicate begins to attract investor commitments, this “social proof” is a big factor in sparking more deal heat. A proprietary algorithm identifies which startups are trending. If well-regarded investors have already committed to your deal, it can be relatively easy to get others to join the ride.

In 2016, 600 startups received investment via the AngelList platform. Since inception through 2017, 1900 startups have received $715M of funding via AngelList; these startups have subsequently received $6.6B in follow-on funding. Overall, investment performance has been strong. Syndicates launched in 2013 achieved 46% in unrealized returns by end of 2015, placing AngelList at the upper top quartile when compared to 2013 VC and PE funds.

It makes sense to put your profile on a crowdfunding platform if you have already secured the interest of a well known lead investor. Crowdfunding can often make sense to “top off” a round. For instance, if you have secured $400,000 in funding, you may be able to build a syndicate around a lead investor to secure another $200,000.

ICOs

A new and exotic form of crowdfunding has recently emerged — the Initial Coin Offering. The National Venture Capital Association estimates $4.2B in investments were made via ICOs in 2017. In an ICO, a company posts its plans on an ICO platform and seeks a specified amount of funding. The funding target must be met or exceeded by a specified date and time. In the funding event, the company receives bitcoins and investors receive tokens created specifically for the ICO. Ethereum, the smart contracts platform, raised $18M in bitcoins 2014. In return, investors received tokens called Ethers worth $0.40 per Ether. ICOs are unregulated, controversial and unproven. Our recommendation: don’t waste your time chasing an ICO.

Bitcoinist.com shows ICOs in progress. This one will close in 22 days, 8 hours, 5 minutes and 10 seconds:

ICO’s have emerged as a sexy new way to raise money. But experience so far has thrown cold water on the concept:

Recommendation: avoid the ICO funding path.

Micro VCs

Seed stage investments are usually made by funds. These funds are made up of limited partner investments — usually from high net worth individuals, pension funds, endowments, sovereign funds, and family funds.

There are times when the first seed investment runs low before a company is ready for an investment from an early stage VC. This may require a “bridge” — often called a “seed plus” round — where seed investors put in more money in order to help the company make it to the early stage VC’s “A” round. These bridge notes usually are structured as SAFEs or convertible notes with a steep discount or low cap, to reward the investor for the additional risk.

Khosla Ventures offers a large seed fund, separate from its main fund. Its description is instructive of the stage and required value inflection point:

In 2014, CB Insights ranked 106 seed stage investors. For the tech CEO seeking a seed-stage investment, this list is worth perusing. In 2014, the top 10 most active firms (excluding accelerators and angel groups) were:

- SV Angel

- Andreesen Horowitz

- Foundry Group

- Lerer Hippeau Ventures

- BoxGroup

- New Enterprise Associates

- Data Collective

- Khosla Ventures

- First Round Capital

- VegasTech Fund

- RRE Ventures⁶

In summary, if you’re the CEO of a company on the journey from Minimum Viable Category to Minimum Viable Product, count on fundraising to consume fully half or more of your time. As you pursue angel and seed funding, an “all of the above” approach works best: pursue angels, angel groups, crowdfunding platforms, accelerators, micro VCs, and other seed stage investors. Only by an all-out “all of the above” blitz can you activate the Metcalfe’s Law network effects that are so necessary to close your funding round.

. . .

Notes

1. “Member Directory”, Angel Capital Association, https://www.angelcapitalassociation.org/directory/.

2. “Global Accelerator | Report 2015”, Gust & Funacity, http://gust.com/global-accelerator-report-2015/

3. Ibid.

4. “Investors”, Crunchbase, 2018, https://www.crunchbase.com/search/principal.investors

5. “Total Crowdfunding Volume Worldwide from 2012–2015 (in billions of US $) | Statistic”, Statista, 2018, https://www.statista.com/outlook/335/100/crowdfunding/worldwide.

6. Venture Capital, “The 106 Most Active Seed Venture Capital Firms”, CB Insights, 2015, https://www.cbinsights.com/research/active-seed-venture-capital-firms-2014/.

. . .

To view all chapters go here.

If you would like more CEO insights into scaling your revenue engine and building a high-growth tech company, please visit us at CEOQuest.com, and follow us on LinkedIn, Twitter, and YouTube.