An investor must consider two key factors when assessing an investment: opportunity and traction. Opportunity points to the company’s potential; it includes the team, the product vision, the competitive advantage thesis, the market opportunity thesis, the business model, and the go to market strategy. Traction, on the other hand, demonstrates what has already been accomplished. Traction is measured by the achievement of value inflection points. These value inflection points are traction milestones. Once achieved, they drive up the value of your company and alter the investor classes that will consider funding you.

It is very important to understand the next value inflection point you must hit to prove traction. Investors buy stories. You need both a traction story and an opportunity story for your story to be compelling and for your company to be fundable.

VCs usually define the funding continuum one of two ways:

- “Angel / Seed / Early Stage / Growth Stage / Late Stage”

- “Angel / Seed / A round / B round / C round / D+ round”

Neither is helpful. The first is too broad: it doesn’t tell you what progress your company must demonstrate at each step. And the second paradigm signals nothing at all about company progress. An artificial intelligence company operating with complex data sets might have received a B round before its first dollar of revenue, while a B2B SaaS company might already have hit $1M in revenue run rate by the time it takes its seed investment.

Value inflection points, on the other hand, are specific. They define what “must be true” for a company to possess a strong traction story. Here are the value inflection points:

- Minimum Viable Category — high-level company vision and choice of product category

- Initial Product Release — release of the alpha product

- Minimum Viable Product — release of the product that delivers enough value to capture early adopter customers

- Minimum Viable Repeatability — proof that your product can be sold with repeatability

- Minimum Viable Traction — proof that you can sustain repeatable sales performance as you begin to scale

- Minimum Viable Scaling — proof that low existing customer churn, increased spending per existing customer and accelerating new customer acquisition have combined to sustain high rates of year over year revenue growth

- Minimum Viable Expansion — proof of success in expanding into new product lines, new geography and / or new verticals and markets, resulting in continued high rates of year over year revenue growth

- Minimum Viable IPO Path — Revenue growth and workflow efficiencies have accelerated, yielding growing profitability, with predictable revenue and profit growth in a large market

- IPO — Revenue growth, profitability, predictability and opportunity have combined to merit a compelling initial public offering

- Hot Public Company — Company has continued to expand and diversify in a fast-growing market while securing more and more workflow efficiencies, creating a revenue and a profit powerhouse and a hot stock

Measuring progress according to Value Inflection Points places the focus where it should be: on the accomplishments you must achieve to have a justifiable ask (in other words, to merit funding). Once CEOs understand these milestones, they can mobilize their companies to achieve them.

In the value inflection points summarized above, the first five were initially articulated by Bruce Cleveland, Managing Partner at Wildcat Ventures. Cleveland and the team at Wildcat created the Traction Gap Framework, a new way to conceive of the funding continuum, and the Traction Gap Institute, dedicated to promulgating this new paradigm. Cleveland is one of the founding executives at Siebel Systems and an early investor in Marketo (IPO in 2013; acquired by Vista Equity Partners in 2016 for $1.8B).

Anchored by these five value inflection points, the Traction Gap Framework puts the focus on company outcomes. Because Wildcat Ventures invests in companies that are moving from Minimum Viable Repeatability (MVR) to Minimum Viable Traction (MVT), the Traction Gap Framework ends at MVT. It is spot on as far as it goes. But we believe that to complete the funding continuum, five additional stages (noted above) must be added.

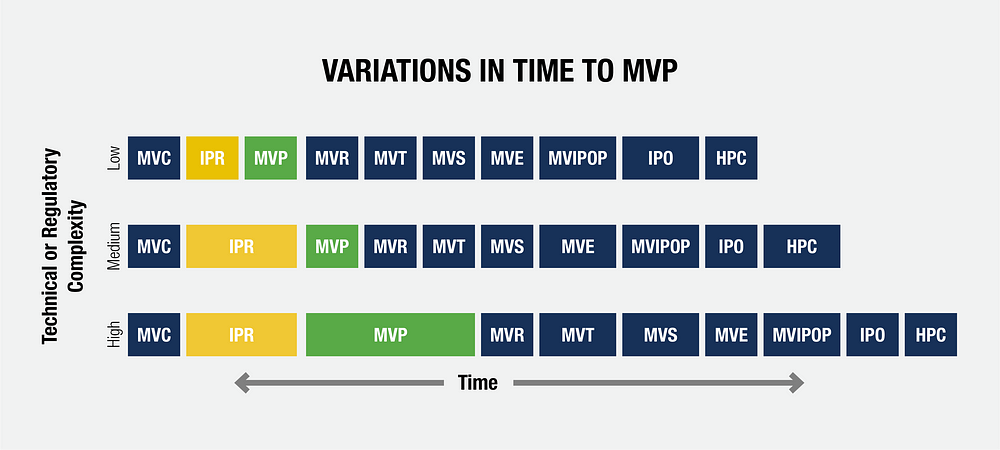

Different types of startups take different amounts of time to reach key value inflection points, such as Minimum Viable Product. Let’s assume three groups of founders launch three startups on exactly the same day. Let’s also assume that all three startups have chosen the right concept, and will ultimately build a highly successful product without significant pivots along the way.

One startup is a social media company targeting pre-teens, with extensive photo and text sharing capabilities in a mobile-centric design. The next is a B2B SaaS workflow solution, which ingests data from legacy systems and generates outputs that create workflow efficiencies. The third is a B2B IaaS (infrastructure as a service) platform, with a highly technical innovation depending on artificial intelligence.

Assuming that the concept itself resonates for the chosen market, the first company will reach the Minimum Viable Product first. The second company will reach it second, and the third company will reach it much later. The difference in time could be significant — many months, or even years.

To be useful, these value inflection points must be defined with clarity and specificity. Any objective observer should be able to assess the facts about a company and have no doubt as to which value inflection point the company has achieved. A value inflection point marks achievements in four domains: Product, Revenue Engine, Workflows, and People.

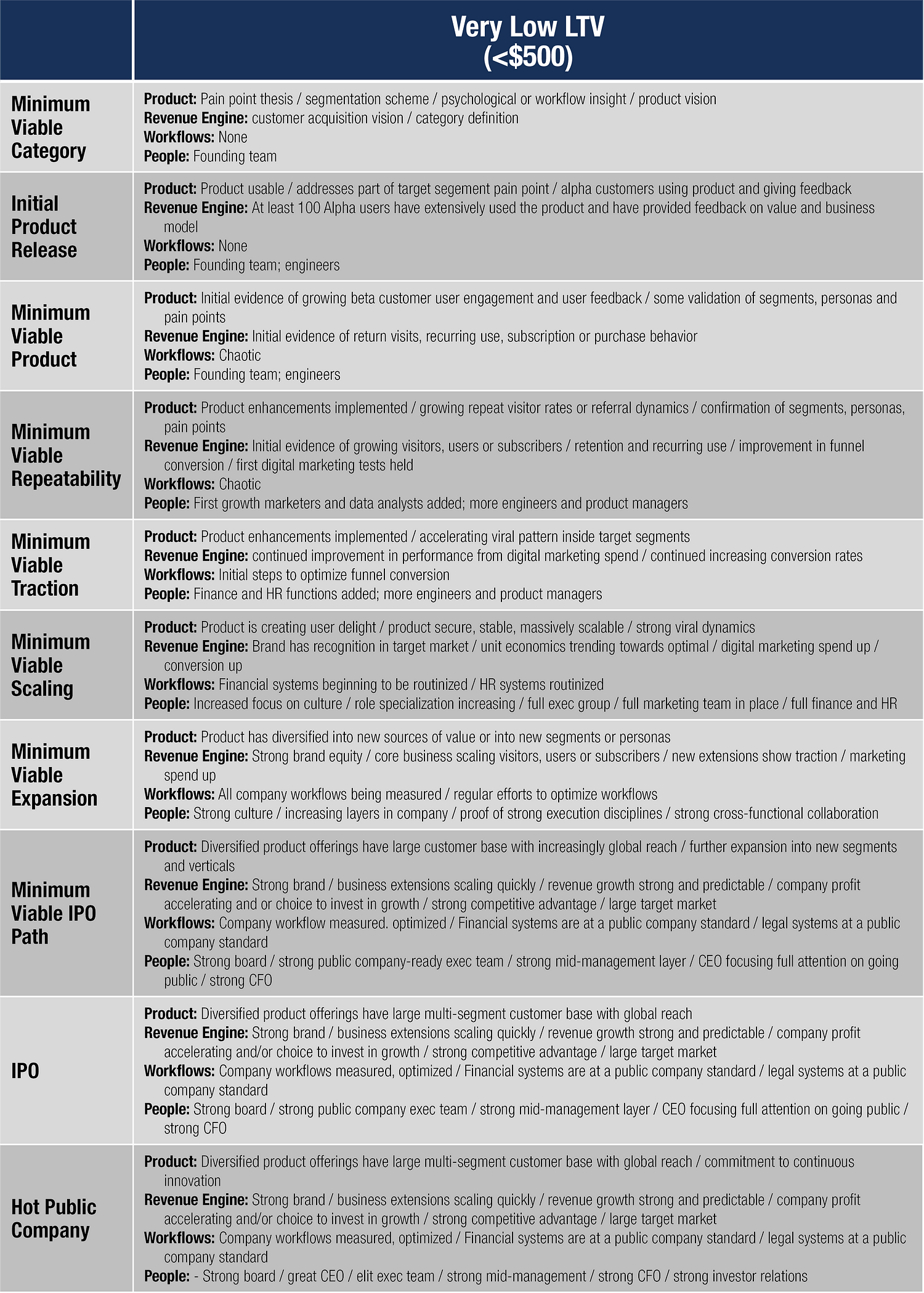

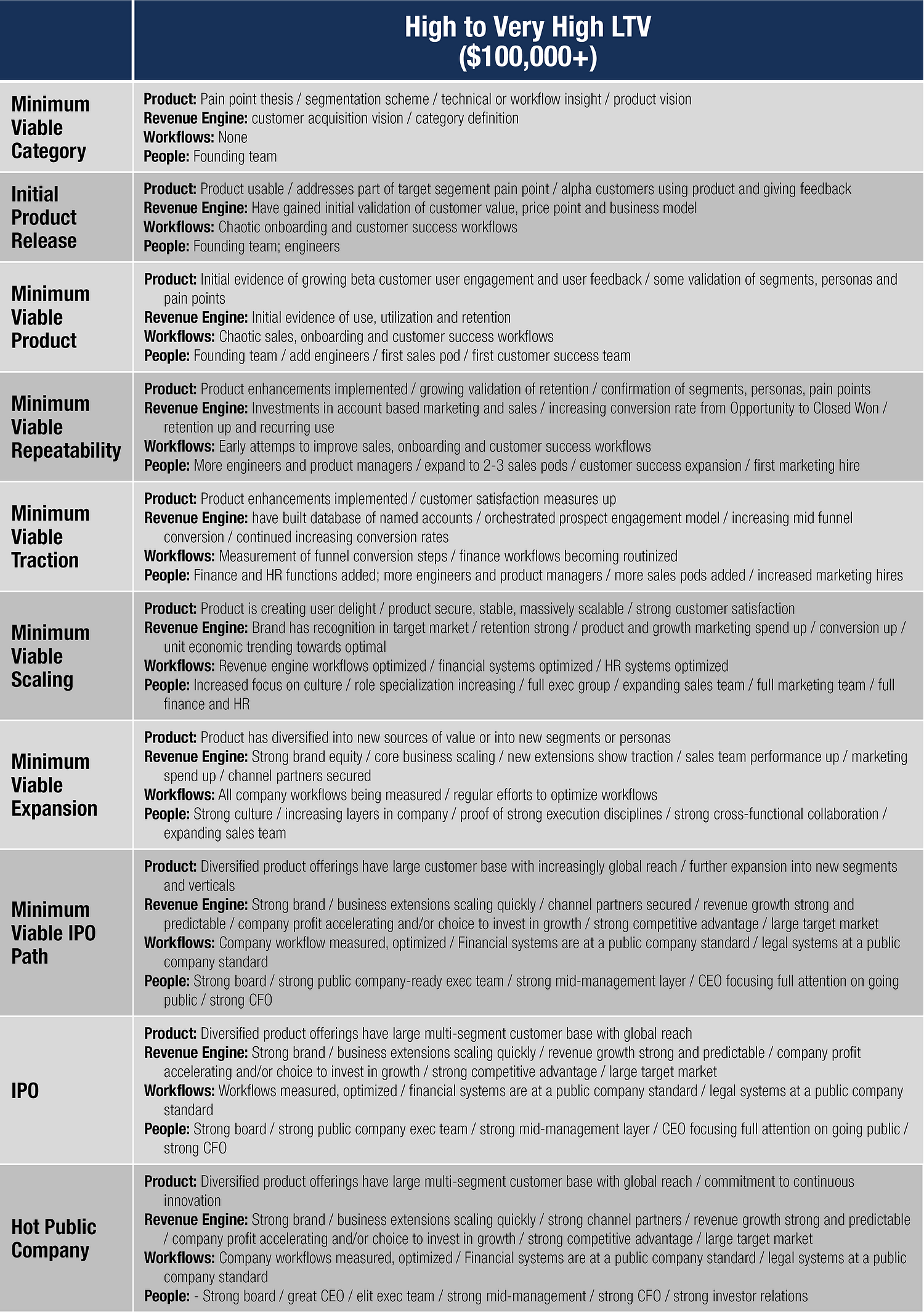

Value inflection point definitions differ by business model. A company selling a product that yields a lifetime value of under $500 must feature a completely digital revenue engine. There is not enough gross margin to justify human participation. This is called the “Very Low LTV” business model. On the other end of the continuum, companies with LTV over $100,000 pursue an account-based, human-centric sales process. These differences drive differences in the value inflection point definitions, as follows.

Very Low LTV

In this category, we find media companies (a media company might feature a consumer LTV of $0.05 or less), gaming companies, B2C and SMB marketplaces, B2C and SMB subscription sites and B2C and SMB ecommerce sites. Here are the value inflection point requirements:

Low to Mid LTV

Companies in this category include SMB and mid enterprise B2B SaaS, B2B marketplaces, B2B ecommerce, and B2B unit transaction businesses.

High to Very High LTV

Companies in this category include B2B enterprise SaaS and large unit transaction or licensing companies.

The value inflection points are milestones on your scaling road map. Which inflection point have you already achieved? What must be done to achieve the next one?

Most tech company CEOs are oblivious to these milestones. They initiate a funding process when cash begins to run short, and only realize too late the traction expectations of investors. Don’t do that. Especially in the early stages of your company, you must mobilize to achieve the next value inflection point, and begin your funding process well before cash runs short. As important as it is to have an opportunity story — to be able to signal a large market opportunity, a compelling product vision, sustainable competitive advantage, a workable business model, a smart go to market strategy, and a great team — it’s not enough. At every stage, the smart investor will require strong traction proof to make credible your opportunity claims.

Note:

We acknowledge the debt our funding continuum framework owes to the Traction Gap Framework. We should also note that CEO Quest is pleased to be a partner in the Traction Gap Institute alongside Wildcat Ventures, Geoffrey Moore’s Chasm Group, Velocity Group and others.

. . .

To view all chapters go here.

If you would like more CEO insights into scaling your revenue engine and building a high-growth tech company, please visit us at CEOQuest.com, and follow us on LinkedIn, Twitter, and YouTube.