Entrepreneurship is woven into the fabric of America. 30 million small businesses operate in the US.¹ Each year, about 800,000 startups join their ranks.² Every month, 300 of every 100,000 adults start a new business.³ For the past forty years, this small business activity has been the growth engine of the US economy, responsible for almost all net new job creation.⁴

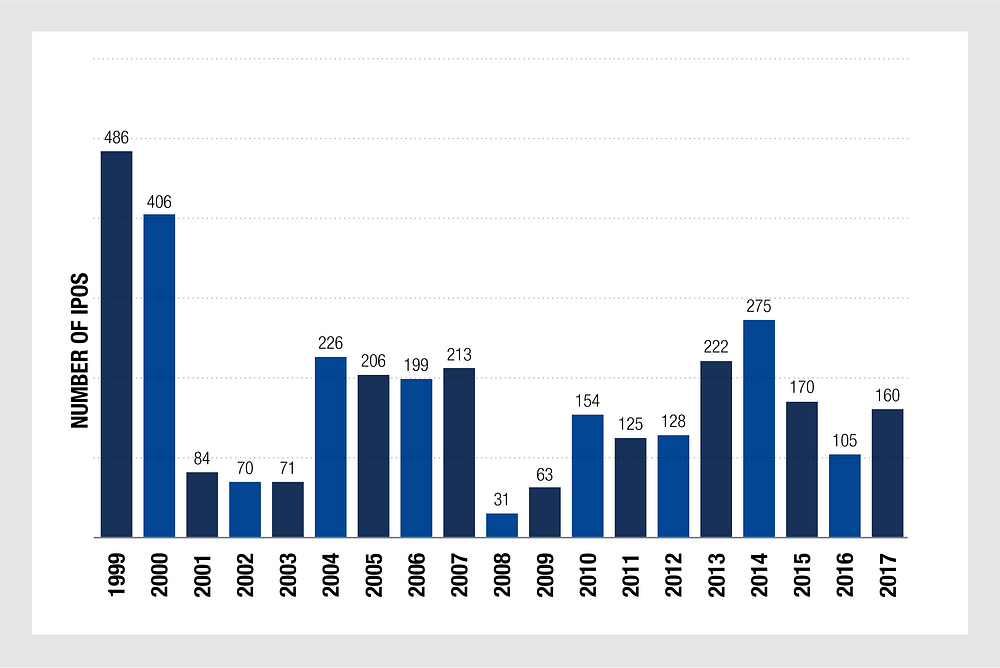

And yet, almost as many businesses fail every year as are started. Of all new businesses, only 1% employ fifty or more people after ten years in operation.⁵ This percentage has declined fairly steadily since 1990. Less than 0.1% of all US businesses employ more than 500 people.⁶ The number of public companies in the US was down to 4,333 by mid-2016 — a 46% drop from twenty years ago.⁷ And in 2017, just 160 companies went IPO — down 42% from three years ago.⁸

Why have so many new businesses stayed small or failed? What factors have constricted their growth? Why have so few scaled into large companies, and even fewer gone public?

Company building is a science. As CEO, the people you hire, the markets you choose, the products you build, the systems you design, the revenue generation practices you pursue and the funding path you follow all contribute to your growth trajectory. Not every company will go IPO, but armed with knowledge of the science of company building, a disciplined CEO can build a company that achieves greater success at every stage. The best CEOs will lead their companies towards impressive exits. A select few will break through and take their companies public.

Technology companies have a unique path to scale. Because of their potential for outsized growth, tech companies have access to capital not available to other types of companies. In this book, our focus is on tech companies. As tech CEOs scale their companies and introduce their technologies to more and more customers, they disrupt and change the world. But achieving success is hard. If you are a tech company CEO, you know well that the scaling of your company is a ragged jog through a vicious gauntlet. The marketplace is unforgiving. Failure nips at your heels. Only the strongest get funded; only the strongest survive.

Before an investor takes a deep look at your company, she will first take a deep look into your background (and into your soul). What makes you, the tech company CEO, fundable?

When I started Digital Air Strike, my cofounder and I each put in $100K of our own money. Five months later, just before that money ran out, I raised a $900K seed round. Then, as our bank balance fell perilously low, we raised an $8M A round. After that, there were a couple more funding events — one of which powered an acquisition. One thing was common across every one of these funding events: they were all really hard. Investors were hard to reach. Once reached, most wouldn’t take a meeting. Once we met, all were skeptical. After the meetings, most said no. Only a few — the bare minimum, actually — said yes. Even after wereceived a term sheet, every step until the close of funding was difficult. Every time.

Was I fundable? Yes, I was — by the skin of my teeth. We had enough of a story and a strong enough team to convince just enough investors that our company was worthy of investment. I have no doubt each investor in Digital Air Strike took a close, critical look at me, the CEO. Each had to make a judgment: would I be able to lead this company to an exciting exit?

Investment is about confidence. An entrepreneur is fundable when she can create confidence in the hearts and minds of investors. At every company stage, domain expertise is important. But that’s just the beginning.

In the early stage, the company’s choice of market, product vision and go-to-market plan are all just theories. Nothing has been proven yet. You have a concept and a category. You might have an initial product release, or even a Minimum Viable Product, but you have not yet proven a repeatable sales model. At this stage, it’s all about the team, especially the CEO. The investor knows that your initial choice of market, your initial vision for the product, and your planned scaling path will all change radically, so she can’t invest in that. All she can invest in is you.

What exactly does the early stage investor look for in you, the entrepreneur?

Grit, determination and persistence matter. Ben Horowitz, in his book The Hard Thing About Hard Things, said:

“Great CEOs face the pain. They deal with the sleepless nights, the cold sweats, and what my friend the great Alfred Chuang (the legendary cofounder and CEO of BEA Systems) calls ‘the torture’. Whenever I meet a successful CEO, I ask them how they did it…. The great CEOs tend to be remarkably consistent in their answers. They all say, ‘I didn’t quit.’” ⁹

Vision, confidence and passion matter. Jeffrey Bussgang, author of the book Mastering the VC Game: A Venture Capital Insider Reveals How to Get From Start-up to IPO On Your Own Terms, observed:

“As I listened to pitch after pitch and watched as some venture-backed startups took off and others didn’t, I became much more aware that the successful entrepreneur is built, in fact has to be built, in ways that are fundamentally different from other business people… The most important of these [characteristics of the successful entrepreneur] are a certain kind of visionary optimism; tremendous confidence in oneself that can inspire confidence in others; huge passion for an idea or phenomenon that drives them forward; and a desire to change the game, so much so that it changes the world.” ¹⁰

Adaptability matters. Jessica Livingston, in her book Founders at Work, said:

“…founders need to be adaptable… People think startups grow out of some brilliant initial idea like a plant from a seed. But almost all the founders I interviewed changed their ideas as they developed them. PayPal started out writing encryption software, Excite started as a database search company, and Flickr grew out of an online game….” ¹¹

Intelligence, toughness, capacity to convince, task relevant fit, and special superpowers matter. In February, 2014, Rob Go, Partner at Nextview Ventures, wrote a blog identifying four attributes of a successful founder:

“1. Smart and Tough…Not all awesome founders are necessarily genius-level smart. Nor are all founders UFC-level tough. But there is a baseline that is certainly well above the top 5% of humans on both…

2. Convincing…. Not all founders are evangelistic, charismatic or the greatest salespeople. But almost all are able to be convincing in their own way.

3. Superlative. I’ve found that awesome founders tend to be really really great at something. No one can be amazing at everything, but I’ve seen the most success with founders that show superlative traits. I’m always excited when I hear the word ‘best’ in reference calls…

4. Fitting for the task at hand…. Many founders have multiple strong attributes, but great founders are great in the context of the task at hand.” ¹²

As the testimony noted above underscores, early stage investors want to see intelligence, vision, passion, confidence, never-quit perseverance, good fit with the task at hand, and adaptability.

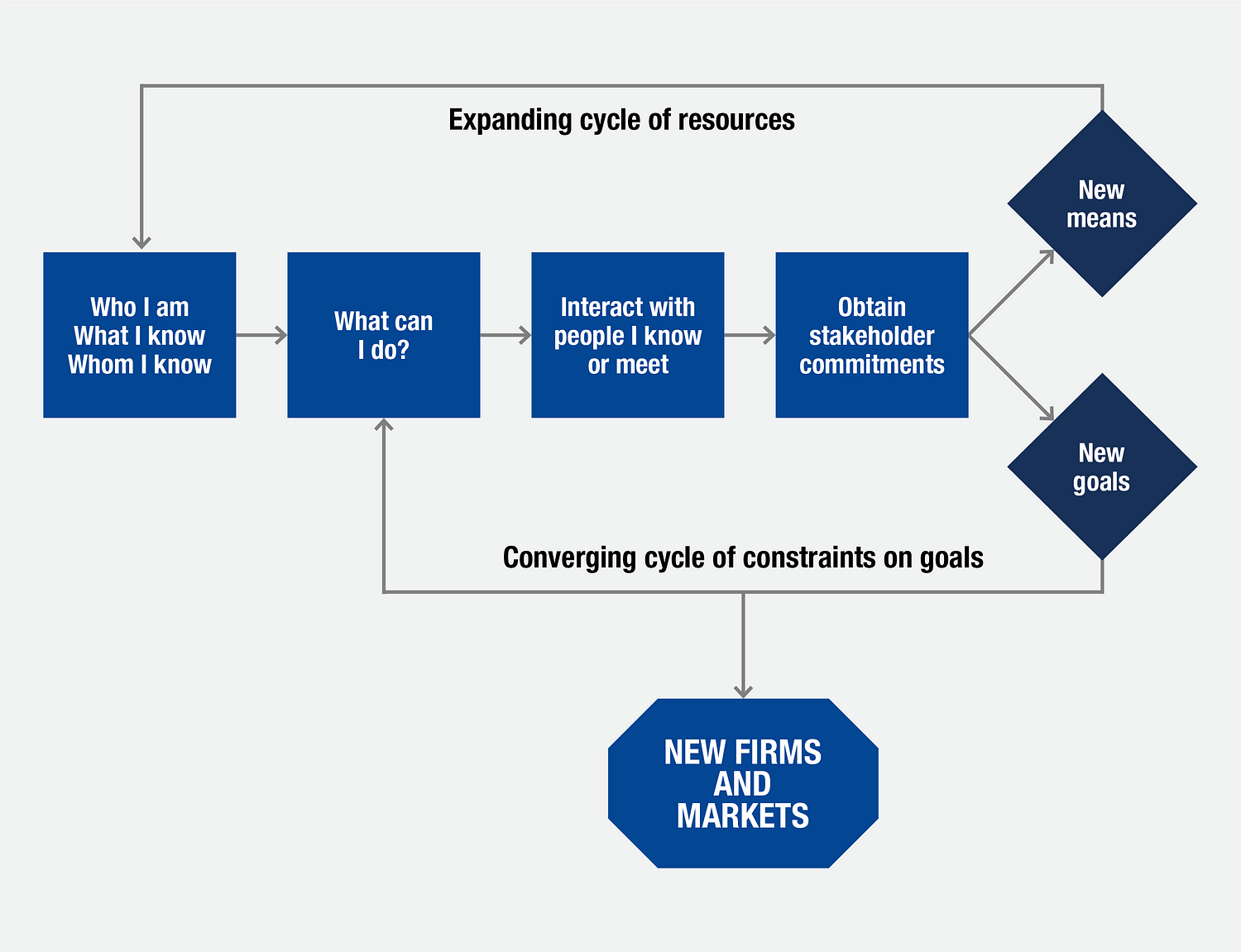

The perspectives of Horowitz, Bussgang, Livingston and Go anecdotally affirm the prevailing research. In the late nineties, Saras Sarasvathy, associate professor at the University of Virginia, published her first research into the reasoning of expert entrepreneurs. Since then, a large body of academic research has built up in the area now known as effectuation research (check out effectuation.org). In her wide-ranging interviews with founders of companies valued from $200M — $6.5B, Sarasvathy found that expert entrepreneurs exhibited a distinctive approach to decision making. Specifically, these entrepreneurs exhibit five key reasoning attributes:

Start with Means

- Who we are

- What we know

- Who we know

- What we have

Manage Within Affordable Loss

- Primary focus on limiting risk

- Manage investment based on amount that can be affordably lost

- Less focus on potential upside

Build Partnerships

- Attract partners early and often

- Co-create the future with every partner

- Partners bring new knowledge, contacts and money to the enterprise

Leverage Contingencies

- What can we learn from everything we do

- How do failures inform us

- Build / Measure / Learn

Control, don’t Predict

- Don’t spend time trying to predict the future

- Control the accessible levers

- Learn and adjust

These attributes are exhibited through a decision flow that continuously iterates as an opportunity is identified, refined and built into a company. It works like this:

Sarasvathy referred to this entrepreneurial decision methodology as “effectual reasoning,” which is differentiated from “causal reasoning.” In causal reasoning, both the goal and the means are a given.¹³ The decision maker seeks to identify the optimal path towards the goal. But with effectual reasoning, you, the entrepreneur, begin only with means: who you are, who you know, what you know, and what you have. Given these means, you then consider all the possible goals these means might be applied towards. You then reach out to the people you know, seeking to determine which conceivable goals might be most viable. Out of these conversations, partnerships emerge. In turn, these partnerships shape the goals. From these co-creation partnerships, markets are chosen, products are built, and businesses scaled.

If you are an early stage investor, it’s important to invest in entrepreneurs who exhibit effectual reasoning skills. Like a jet ski, the early stage company has lots of speed and directional flexibility — but it is small. By starting with means and then flexibly searching for the right goals, the early stage entrepreneur brings the right mindset to customer discovery and early stage company building.

But as a business scales, its very success forces a change in CEO leadership attributes. With success, the jet ski slowly morphs into a ski boat. Then it becomes a cruise boat, then an ocean liner, and eventually a supertanker. As it does, it grows in substance and complexity. It gains mass but loses directional flexibility. Many component parts must all work together. There are now multiple organizational levels between captain and seaman. Investors understand that this requires a different set of leadership competencies.

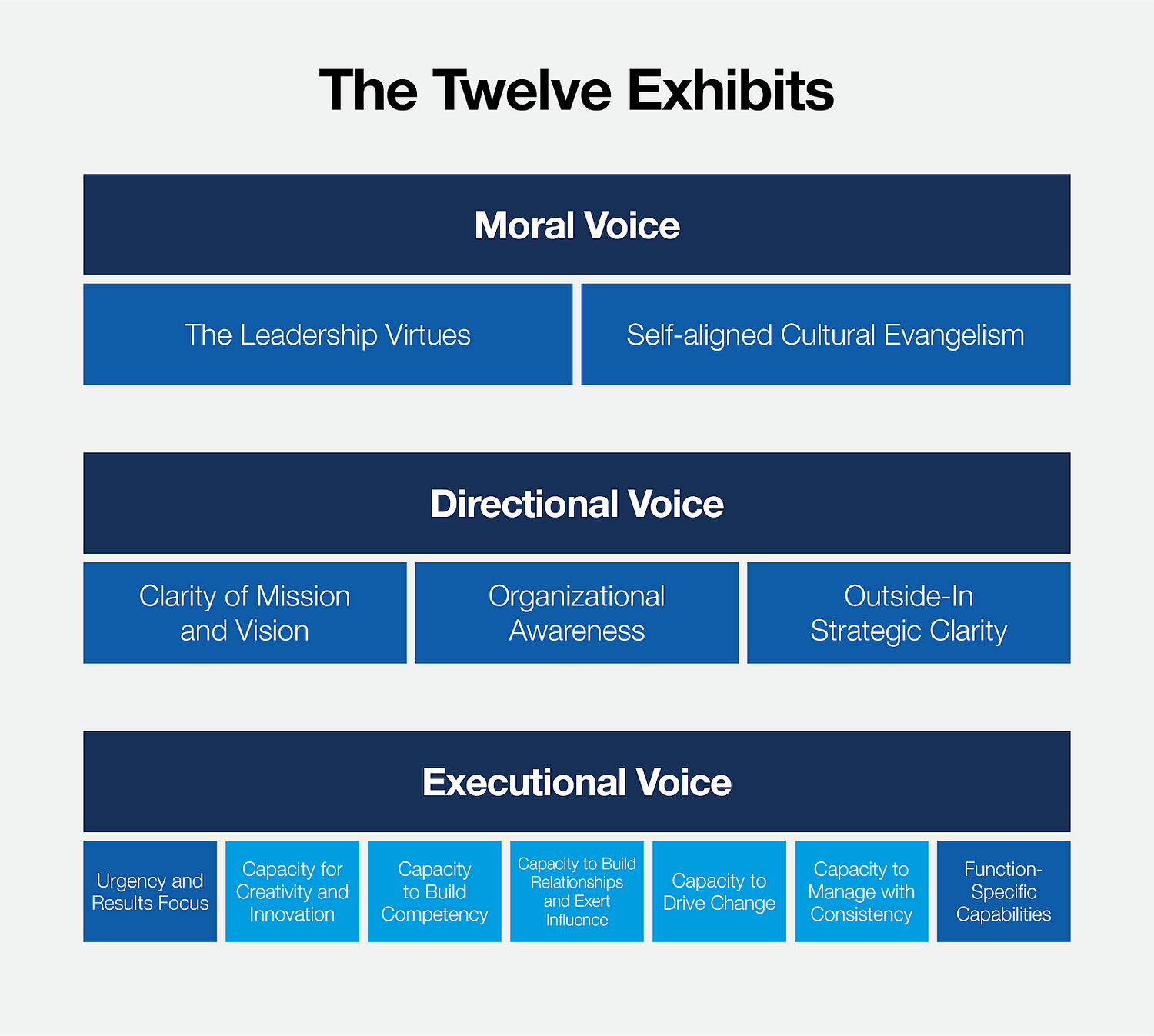

On the journey of company building, CEOs evoke three voices: a moral voice, a directional voice, and an executional voice. Within these three voices lie the most critical competencies of leadership. Investors will test you on all of them. In my book, People Design, the “Twelve Exhibits” summarized these competencies:

Your moral voice is important to leadership and should be important to any potential investor. The world is full of CEOs who have fallen short in moral voice, causing irreparable harm to company value. The moral voice starts with the six leadership virtues:

- Quality

- Caring

- Temperance

- Prudence

- Courage

- Justice

A CEO who exhibits a passion for quality in everything; who cares deeply about people — employees, customers and investors; who is temperate in nature and prudent in decision making; who is courageous in all things and seeks just outcomes for all stakeholders — this is a CEO who possesses the attributes an investor seeks.

More broadly, the Twelve Exhibits reveal the types of attributes any intelligent investor in a mid or later stage startup might seek in the company’s CEO and executive group. Of course, no leader has everything. You’ll note that the above framework shows some boxes in dark blue, and some in light blue. Strong CEOs exhibit strong competency in all the boxes shown in dark blue. The light blue boxes (under Executional Voice) are competencies the executive group as a whole must possess. Any given executive may not possess all of them, but all of them must be possessed somewhere in the executive group.

If you are CEO of a tech company approaching the next funding event, take stock. How do you measure up? Are you working on yourself to develop the skills, knowledge and mindset to be a fundable entrepreneur? No matter the stage, it’s not enough just to have a hot idea — or even a company with traction. To maximize your likelihood of being funded, and certainly to maximize valuation and terms, you must be fundable.

. . .

Notes

1. “United States Small Business Profiles | The U.S. Small Business Administration | SBA.Gov”, Sba.Gov, 2017, https://www.sba.gov/sites/default/files/advocacy/All_States.pdf.

2. Ibid.

3. “Startup Activity”, Kauffman.Org, 2017, https://www.kauffman.org/kauffman-index/reporting/startup-activity.

4. (Ibid.)

5. “Growth Entrepreneurship”, Kauffman.Org, 2017, https://www.kauffman.org/kauffman-index/reporting/growth-entrepreneurship.

6. “United States Small Business Profiles | The U.S. Small Business Administration | SBA.Gov”, Sba.Gov, 2017, https://www.sba.gov/sites/default/files/advocacy/All_States.pdf.

7. Rayhanul Ibrahim, “The Number Of Publicly-Traded US Companies Is Down 46% In The Past Two Decades”, Finance.Yahoo.Com, 2016, https://finance.yahoo.com/news/jp-startup-public-companies-fewer-000000709.html.

8. “Number Of Ipos In The U.S. 1999–2017 | Statistic”, Statista, 2017, https://www.statista.com/statistics/270290/number-of-ipos-in-the-us-since-1999/.

9. Ben Horowitz, The Hard Thing about Hard Things (Ben Horowitz, The Hard Thing about Hard Things), 204.

10. Jeffrey Bussgang, Mastering The VC Game: A Venture Capital Insider Reveals How To Get From Start-Up To IPO On Your Own Terms (New York: Penguin Group, 2010), 13.

11. Jessica Livingston, Founders At Work: Stories Of Startups’ Early Days(Berkeley: APRESS, 2007), xiv.

12. Rob Go, “What Makes An Awesome Founder?”, ROBGO.ORG, 2014, https://robgo.org/2014/02/17/what-makes-an-awesome-founder/.

13. The Rector & Visitors of the University of Virginia, “Effectuation 3-Pager”, Effectuation.Org, 2011, http://www.effectuation.org/sites/default/files/documents/effectuation-3-pager.pdf.

. . .

To view all chapters go here.

If you would like more CEO insights into scaling your revenue engine and building a high-growth tech company, please visit us at CEOQuest.com, and follow us on LinkedIn, Twitter, and YouTube.