Once you have passed Minimum Viable Product and are closing in on Minimum Viable Repeatability, you enter the realm of early-stage VC investing. As you scale through the next three value inflection points — Minimum Viable Traction, Minimum Viable Scaling and Minimum Viable Expansion — venture capital continues to be one of your primary funding options.

CEOs often fail to do sufficient research and end up approaching VCs who are not appropriate fits. Curate your target list so that you only approach investors who are aligned on investment stage, geography, fund size, and domain.

Remember, it’s the partner that matters most — not so much the firm. Individual VC partners often hold unique investment preferences. In a single VC firm, one partner may focus on technical infrastructure, while another may focus on B2C marketplaces, and a third on B2B vertical SaaS applications. You can figure out a partner’s domain preferences by looking at the boards she sits on. Once you have determined the target partner who seems like the best fit, find someone who can introduce you. The ideal referrer is the CEO of one of your target’s current or former portfolio companies.

Some VCs are early-stage investors — seed and A round. Some call themselves growth stage VCs — focusing on the B round and beyond. Then there are late-stage VCs — writing big checks to companies that are headed towards IPO. A new and increasingly important VC option is corporate venture. Corporate VCs have grown significantly in impact over the past 10 years. They participate across the spectrum, from early to growth to late stage. If you know a VC’s fund size, you can estimate its average check size. Divide the fund size by the average number of companies per fund (twenty-five is a good estimate), and then by 2 (to account for reserves). If the resulting amount is in the ballpark of your target for your lead investor, then the firm is a check size fit.

Private VC funds are made up of investments from limited partners (LPs): high net worth individuals, pensions, endowments, sovereign funds and family funds. These LPs put their money to work in VC firms led by investors they believe in — based on a track record and investment thesis. LPs invest fund by fund. Funds tend to have about a ten year life, with an initial investment period of 2–4 years. If the firm hasn’t raised a new fund in more than four years it is likely not to have much new capital left to invest. So you should clarify the status of the next fund, to confirm the firm will be sustaining. LPs expect the investments to begin liquidating between six to eight years after investment, hopefully with large capital gains.

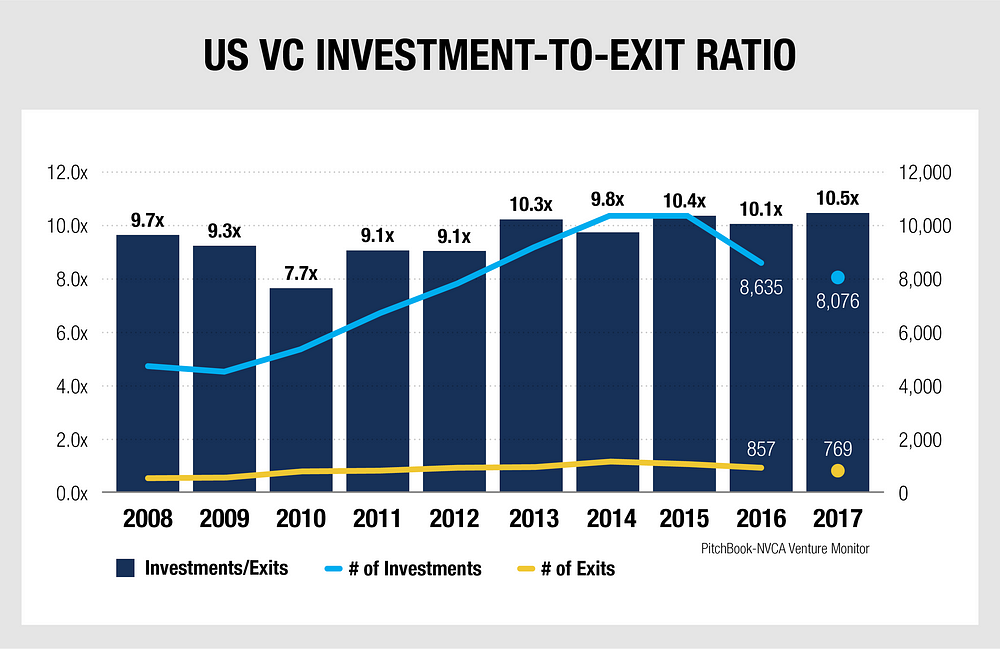

An emerging challenge for VC funds is the elusive exit. VCs need the exit to create liquidity for their LP investors, but companies are staying private longer — the median time to exit is now a record 5.6 years. There were 769 exits in 2017, down every year since 2014, which boasted 1,065 exits. In the US, the investment-to-exit ratio is the highest in a decade:¹

The problem is exacerbated by the fact that VCs don’t generally like to hold investments in companies that span multiple funds. Doing so can complicate fiduciary responsibilities, especially when some but not all LPs participate in both funds. To solve for this problem, when an investment is made from a fund, the firm will usually hold additional capital in dedicated reserve — expecting that this money will eventually be needed for a follow-on investments in the company. But sometimes the reserve amount proves insufficient for the company’s capital requirements.

So what are the attributes of a highly successful VC Steve Schlafman, partner at Primary Venture Partners, identifies the following attributes:

- Curiosity — thirst for knowledge and learning

- Expertise — business, engineering and / or product chops developed through experience

- Passion — genuinely excited by new ideas, innovation, and entrepreneurship.

- Focus — ability to drown out noise and spend time on what matters

- Network — authentically develop and maintain relationships at scale

- Sales — ability to sell and build consensus internally and externally

- Emotional intelligence — empathize and assess motivations, desires, needs, and intangibles

- Conviction — ability to maintain excitement in the face of opposition and skepticism²

Jason Green, founder and general partner of Emergence Capital, adds patience to the list. “The best VCs are in it to create big wins over a longer time horizon and have the patience to see that success through,” he says.

VC firms and the partners that work for them make most of their money from the carry (they can also make money from management fees, usually structured as a small percentage of the overall invested capital in the fund). When an investment has its liquidity event, the capital that was invested by LPs is returned to these LPs first. Then the profit on the investment is split. The “carry” — usually in the 20% to 30% range — goes to the VC firm to share amongst its partners based on pre-arranged formulas. The rest of the profit goes back to the LPs.

These dynamics can have interesting implications for startups and the CEOs who lead them. If your company needs to pivot, you may find yourself fighting with a VC whose investment thesis doesn’t align with your new business model. That VC could be reacting to pressure from his firm’s LPs or other partners, who don’t like your pivot for the same reason.

Perhaps your VC board member has begun to push hard for you to sell. Why? Is that because of an objective risk / reward and market timing assessment? Or is it because of pressures inside the VC’s fund that are unrelated to your company? For instance, LPs in an older fund might seek liquidity, and could pressure the VC you work with to close out all investment positions. Similarly, when follow-on investments are required, VCs at the end of fund life might find it hard to join the round.

It’s important to understand these dynamics when you are seeking funding, so that you can properly evaluate which funds might be most attractive.

Early Stage VC

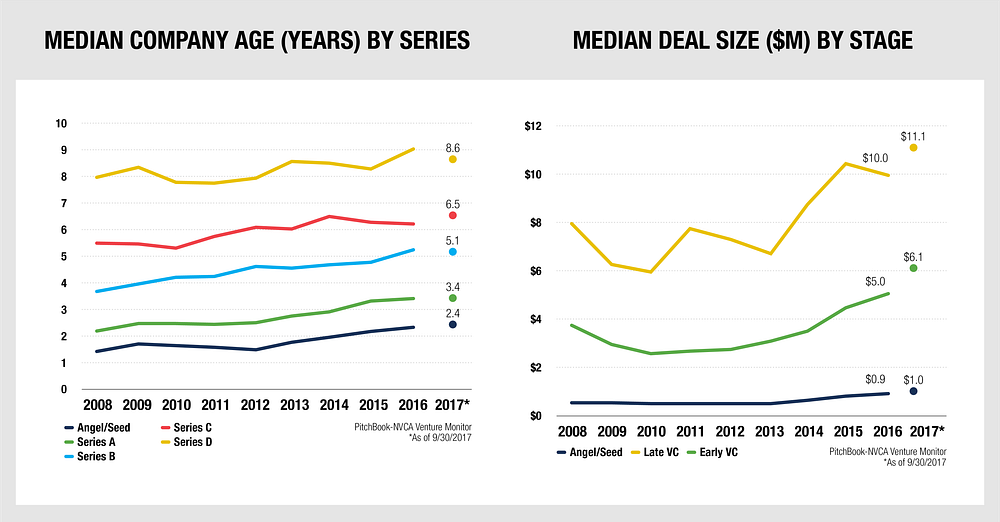

As data from the National Venture Capital Association shows, the median age of a company at the A round is about three years, and the median early stage VC investment is about $6M.³

NVCA identified the following early stage VCs as the top 10 most active in 2017 (not including angel groups, accelerators or corporate venture):

- New Enterprise Associates

- Kleiner Perkins Caufield and Byers

- True Ventures

- GV

- Khosla Ventures

- Lerer Hippeau

- Sequoia Capital

- ARCH Venture Partners

- Lux Capital

- Redpoint Ventures

Other prominent firms at this stage include Wildcat Ventures, Emergence Capital, Shasta Ventures, and Benhamou Ventures. For the full list of early stage VCs, see NVCA’s Q4 2017 Venture Monitor.⁴

Growth Stage VC

Once you have passed the Minimum Viable Scaling value inflection point, you are into the realm of growth stage investing. This is where successful companies secure their B, C and D rounds.

The National Venture Capital Association doesn’t differentiate between growth stage and late stage VC (both are referred to as late stage). I suspect that most of the sub $25M deals in the graphic below are growth stage investments.

Growth stage VC firms include:

- Accel

- Sequoia

- Kleiner Perkins Caufield & Byers

- Benchmark

- Lightspeed Ventures

- Emergence Capital Partners

- Greylock Partners

- New Enterprise Associates

- GGV Capital

- Norwest Venture Partners

- DFJ Growth

- Venrock

- Bessemer Venture Partners

- General Catalyst

- CRV

- Redpoint Ventures

- Khosla Ventures

- Shasta Ventures

Late Stage VC

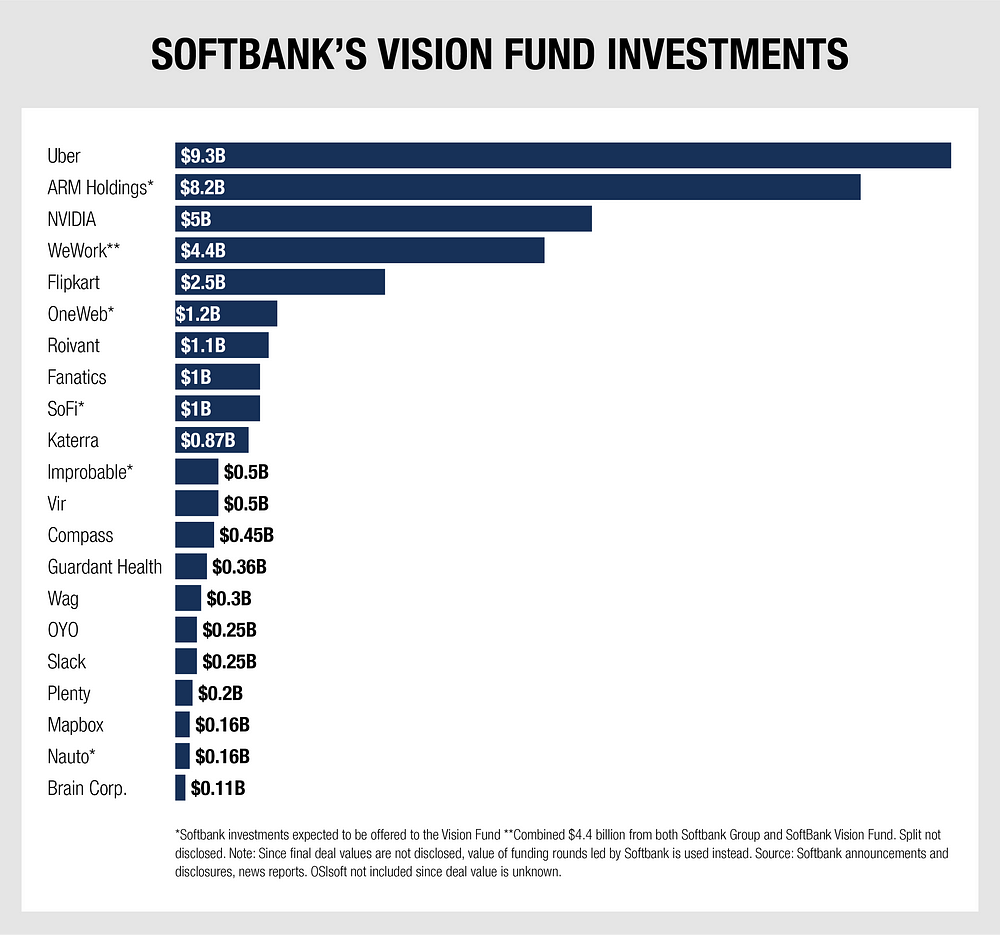

Late stage investment is the realm of very large check sizes — often over $50M. One fund that dominates this space is the Softbank Vision Fund, which boasts $98B in assets under management. Here are some of the largest investments by this fund alone:⁶

Investors at this stage include:

- Softbank Vision Fund

- Battery Ventures

- DAG Ventures

- Institutional Venture Partners

- Meritech Capital

- Technology Crossover Ventures

Corporate VC

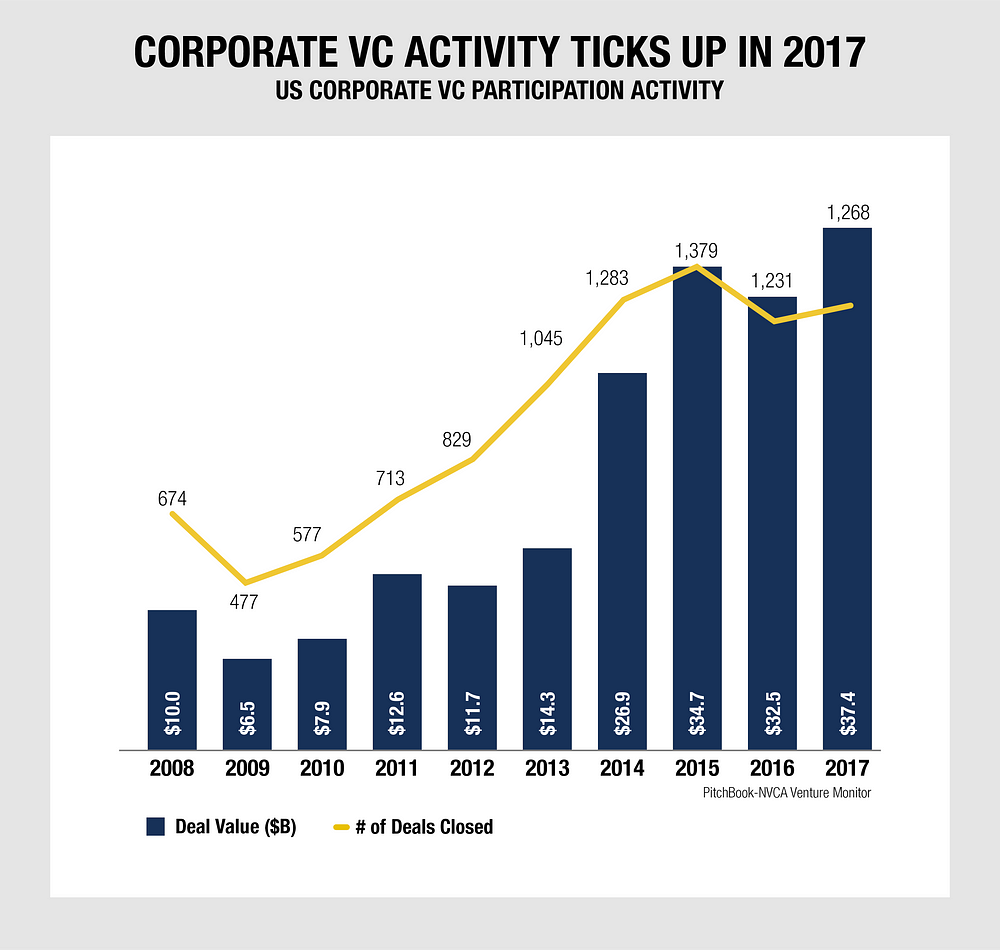

Corporate VC investors vary in their investment theses. Some invest at the early stage; others invest at the growth and late stages. Some require close coordination with and approval of enterprise business leaders; others have full independence and flexibility. Often corporate VCs invest with a potential future acquisition in mind. Overall, activity has grown briskly over the past ten years.

According to CB Insights, the top 10 corporate VC investors include:

- Intel Capital

- Google Ventures

- Salesforce Ventures

- Comcast Ventures

- Qualcomm Ventures

- Cisco Ventures

- GE Ventures

- Bloomberg Beta

- Samsung Ventures

- Microsoft Ventures⁸

More and more Fortune 2000 companies are creating corporate venture arms. These funds are considered a strategic asset, enabling corporations to keep a pulse on innovation, pick winners and eye potential acquisitions.

As you look to raise funding, consider how your company and its product impacts the F2000 enterprise. Which enterprises might find what you’re doing uniquely important and relevant, either as an opportunity or a threat? These are the companies most likely to consider an investment in you.

Summary

Venture capital is innovation’s propane. If you and your tech company are investment worthy and VC investment is your funding mechanism of choice, the door’s wide open for you. Prepare, choose your target VCs well, and then walk through that door and get it done.

Notes

1. PitchBook Data, Inc. and National Venture Capital Association, “Venture Monitor | 3Q 2017”, 2017, 21.

2. Steve Schlafman, “Decoding the Qualities of a Great VC”, Hackernoon,2017, https://hackernoon.com/decoding-the-qualities-of-a-great-vc-d02f2d4da4ae.

3. PitchBook Data, Inc. and National Venture Capital Association, “Venture Monitor | 3Q 2017”, 2017, 5.

4. PitchBook Data, Inc. and National Venture Capital Association, “Venture Monitor | 4Q 2017”, 2017, 32.

5. Ibid, 12.

6. Rani Molla, “Where SoftBank Has Invested Its $98 Billion Vision Fund | New Year, New Additions To Our Running Tally”, 2018, https://www.recode.net/2018/1/20/16912640/where-softbank-investment-98-billion-vision-fund.

7. PitchBook Data, Inc. and National Venture Capital Association, “Venture Monitor | 4Q 2017”, 2017, 18.

8. Corporate Venture Capital, “The Most Active Corporate VC Firms Globally”, CB Insights, 2018, https://www.cbinsights.com/research/corporate-venture-capital-active-2014/.

. . .

To view all chapters go here.

If you would like more CEO insights into scaling your revenue engine and building a high-growth tech company, please visit us at CEOQuest.com, and follow us on LinkedIn, Twitter, and YouTube.