“It is said that if you know your enemies and know yourself, you will not be imperiled in a hundred battles; if you do not know your enemies but do know yourself, you will win one and lose one; if you do not know your enemies nor yourself, you will be imperiled in every single battle.”

— Sun Tsu, The Art of War

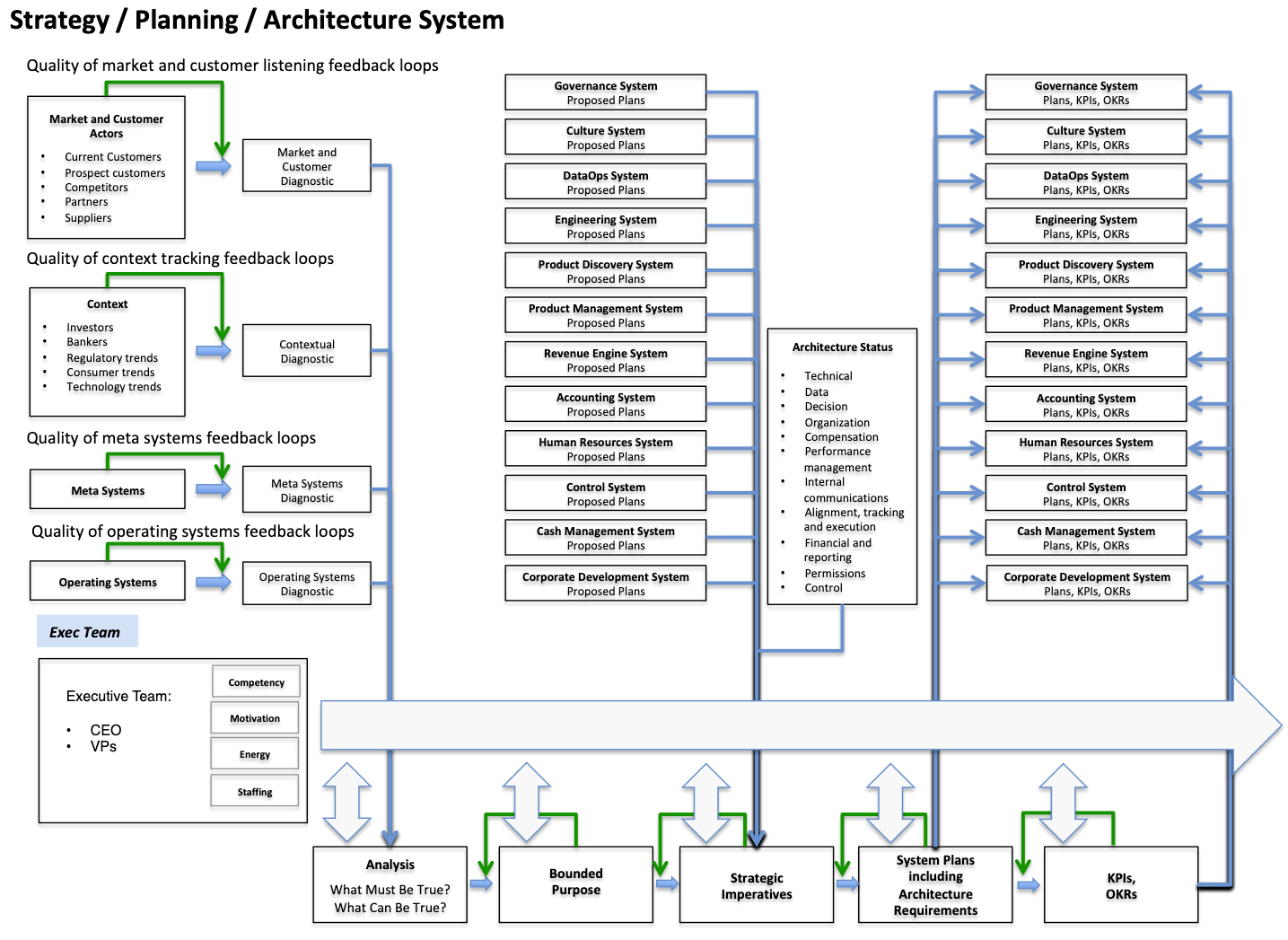

The strategy / planning / architecture system is a meta system.

Strategy is your response to the position you occupy in the ecosystem. Like a game of hearts, you seek to create out of the hand you’ve been dealt the best possible outcome, given your assessment of the strength of the hands of your competitors. You draw upon data. You seek to understand the market, current and targeted customers, the broader context of trends that could spark opportunities and threats, and your own capabilities. As you plot your growth path, you ponder the complex web of interconnections in your enterprise and the ecosystem. The better you do this, the more likely you will be to set sound strategy.

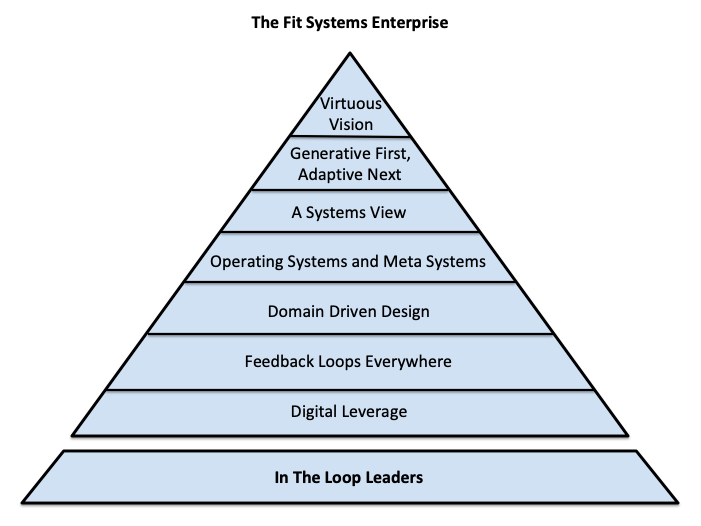

The strategy / planning / architecture system is doing its job when it helps you advance your vision and mission. You are best able to do so if you become a fit systems enterprise. This requires you and fellow senior executives to be In The Loop leaders — ethically grounded, digitally literate systems thinkers. It requires that you design the organization and company systems based on right principles. These are expressed in the eight key attributes of the fit systems enterprise:

Consider the degree to which your senior leadership team has embraced the way of the fit systems enterprise. This is a gating factor in the health of your strategy / planning / architecture system.

Throughout this book I have emphasized the importance of self-organized teams. Self-organization is indeed a key attribute of the fit systems enterprise. Within their domains of responsibility and assigned purpose, self-organized teams can and should set their own strategies and plans. And yes, enterprise strategy is informed by these — as well as by feedback flowing in from outside the enterprise, across the enterprise and above the executive team (the board). Sources of feedback are many, but the CEO and top team must bear the burden of devising enterprise strategy.

Strategy starts with a virtuous vision. Vision paints a picture of your aspirational future. Mission is what you do, for whom, and why. There are only three times when vision and mission should be updated: at the beginning of your company, once you have achieved product / market fit, and at a major pivot point — where a change in the core assumptions of your business is required.

Vision and mission set the boundaries of strategy. Your mission-driven enterprise lives inside a dynamic ecosystem. In the ecosystem, many things are in motion:

- Customer needs

- Competitor actions

- Supplier supply

- Investor trends

- Consumer trends

- Technology developments

- Regulations

- Economic conditions

It is the job of the strategy / planning / architecture system to assess these ecosystem dynamics, assess current enterprise capabilities, define a purpose (bounded in time), and chart the path forward.

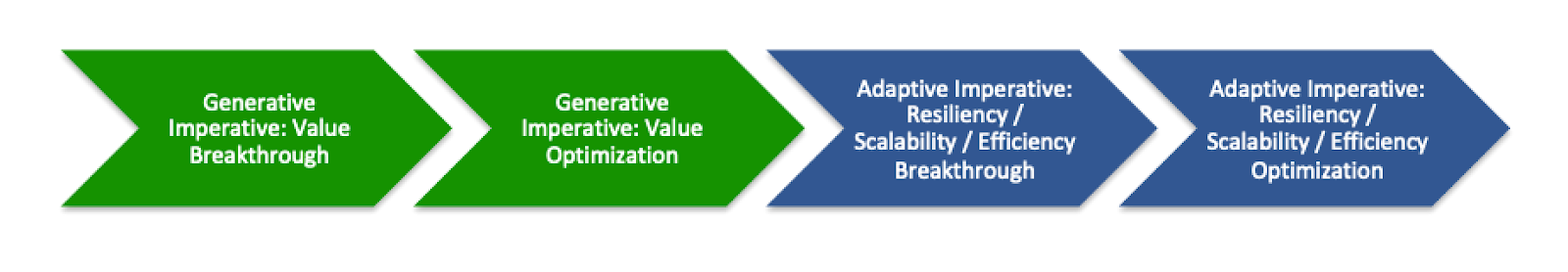

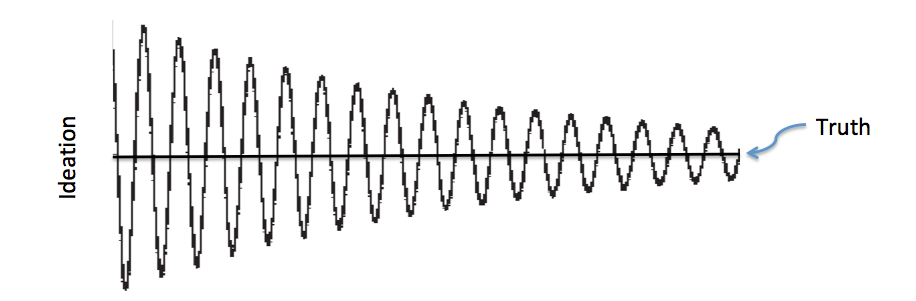

The path must always begin by advancing your generative imperatives. It then turns to the pursuit of your adaptive imperatives. Both of these move forward through breakthroughs and optimizations, like this:

Sound strategy inspires investor belief. Investors seek the best return on cash invested. If your company is burning cash on the path towards cash flow positive, then strategy is a critical component in attracting new investor cash. If your company is private and profitable, sound strategy gives your existing investors the confidence to stay on the growth path versus seeking a quick exit. And if your company is public and profitable, sound strategy propels your stock price and increases your capacity to control your future.

So how do you create sound strategy?

In strategy development, “Must Be True” and “Can Be True” must converge. The two are brought together by “How To Make It True” (strategy).

Your “Must Be Trues” are the things that must happen to achieve a value inflection point that inspires investors. Chapter 6 presented the continuum of company growth stages, defined by investable value inflection points:

What’s your next value inflection point? Your targeted value inflection point represents a significant progress milestone in the advance of your generative and adaptive imperatives. “Must Be Trues” are expressed as strategic imperatives — first the generative ones, and then the adaptive.

You need “Must Be Trues” that “Can Be True.” These two states exist in creative tension with each other. Every strategic imperative must pass the “Can Be True” test. A strategic imperative “Can Be True” when it works within the constraints imposed by the ecosystem and internal capabilities.

“How to Make it True” is strategy — your creative resolution of the conflict between strategic imperatives and constraints.

Ascertaining The State of the Ecosystem

You can’t pursue your generative imperatives unless you understand ecosystem dynamics. Ecosystem dynamics include customer needs, competitor actions, supplier factors, investor trends, consumer trends, technology developments, regulatory changes and economic conditions.

To understand ecosystem dynamics, you need market and customer listening capabilities. What is the status of your market and customer listening architecture? To assess your customer-perceived awareness and value compared to competitors, it needs to be well designed. Do you have a mix of sensors and feedback loops in place? For a B2B SaaS business, such feedback loops would include:

- Capture of prospect and customer feedback from sales reps and customer success reps

- Conversion rate data

- Product engagement data

- Expansion rate

- Logo retention rate

- NPS score

- Competitor customer satisfaction assessments

- Competitor brand awareness and brand equity assessments

- Feature comparisons

- Price sensitivity analysis

- “Prospects who didn’t buy” survey

- Social media sentiment analysis / trending of your products and competitor products

- Market share analysis

This latticework of market and customer feedback loops will help you clarify your value position relative to competitors. This is the first important thing in strategy development.

The next step is to look at context. In the crush of daily work, it is easy to ignore contextual changes that could impact strategy. Are there new opportunities and threats in the economy, funding environment or regulatory environment? How do emerging technologies (such as 3D printing, Internet of Things, blockchain, fast data infrastructure, AI, machine learning, deep learning, etc.) change the game? How will consumer trends (privacy concerns, the gig economy, etc.) impact your strategy? Are any regulatory issues emerging? Can the market be defined differently to create competitive advantage? What alternative business models could alter the value calculus?

As you review incoming signals, no one trend or data point is likely to be definitive. But taken together, patterns, problems and ideas will emerge.

Market / customer listening and context tracking don’t just happen. They require architecture, design and implementation. They take capital and human resources. The implementation of this listening architecture is key to a healthy strategy, planning and architecture system. In an early stage company, they start as simple sensing mechanisms. They grow in richness and diversity as your company heads towards enterprise scale.

These signals inform your generative imperatives. At the highest level of abstraction, the generative imperative is to:

- Know the needs of your “ideal customer profile” (ICP)

- Create new value for your ICP through product development

- Properly communicate your value to existing and prospective customers

- Mobilize teams to connect with prospects, convert them into customers, retain them and expand them

Once you understand product and brand strength relative to competitors, you can calculate the gap between current and desired state. This knowledge informs generative strategy in the following areas:

- Segmentation

- Product discovery system priorities

- Product management system priorities

- Value proposition

- Competitive positioning

- Brand identity architecture

- Marketing, sales and customer success team goals and resources

Depending on the degree of change required, generative strategy may require breakthroughs or optimizations.

Breakthroughs are big initiatives; they are achieved through projects. For a big initiative, you mobilize a project team dedicated to the task. Projects usually are bounded in time. One example of a breakthrough team would be a product discovery team working towards a big product breakthrough. Other examples would be project teams mobilized to redesign the segmentation scheme, or value proposition, or brand identity architecture, or to negotiate a major strategic partnership, or significantly increase the size of marketing, sales and customer success teams.

Optimizations are more incremental, and more ongoing. One example of generative optimization would be the continuous improvement work of a cross-functional, self-organized team working within the product management system. Another is the iterative work of product and engineering teams optimizing the website visit-to-trial conversion rate. Other examples would be incremental changes to value proposition, competitive positioning and brand identity architecture, executed by the teams assigned to these domains of responsibility.

Ascertaining the Status of Enterprise Systems

What is the health of your operating systems and meta systems? A healthy enterprise system has a clear purpose. Its people, workflows, technology and money flows are deployed to pursue that purpose. This purpose is in alignment with the bounded purpose of the enterprise. The system exhibits signs of maturity: rich feedback loops deliver data as to the status of key stocks; self-organized teams are using this data to continuously improve; and processes are becoming more automated and efficient.

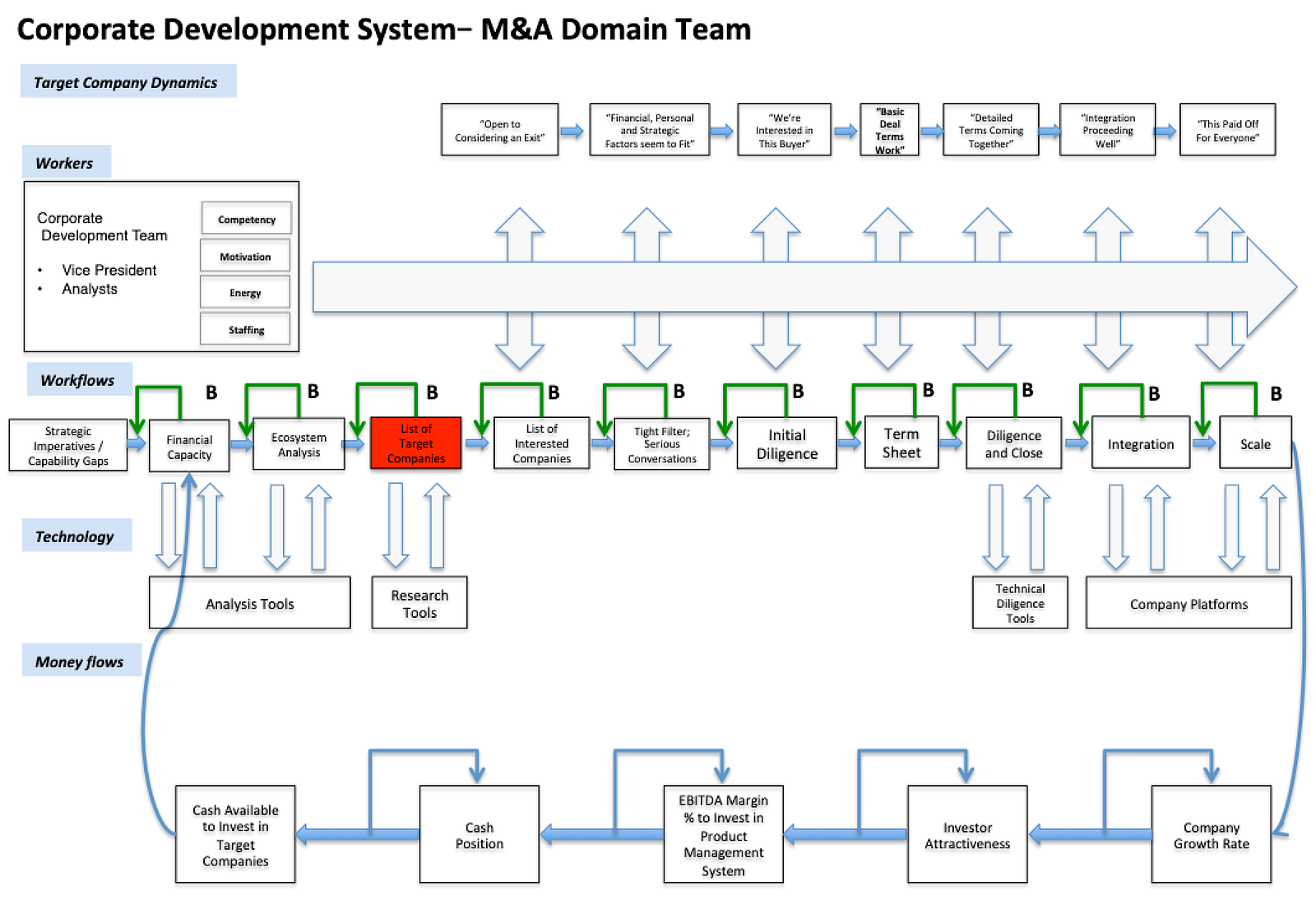

Strategy can’t be devised without understanding the status of your systems. To create clarity, it is helpful to draw system maps. You can then visually review each component, assessing its current state. You could even add metrics into the stocks in the system map. The picture becomes rich when paired with time graphs that show each stock’s performance over time.

Take, for instance, the Corporate Development System. One of your strategic imperatives might be to regain competitive advantage through acquisitions of targeted companies. But perhaps you have determined that your analytical capabilities on the corporate development team are inadequate. You fear you have not been targeting the right companies for acquisition because you are not using the right target company filters. You could expose the problem on a system map, like this:

The system map exposes the problem the corporate development strategy must solve. In this example, the system plan would include a plan to expand the list of targeted companies.

Adaptive imperatives are as much a part of strategy as generative imperatives. As you scale, you need to improve enterprise resiliency, increase scaling capacity and become more efficient (in that order). Adaptive imperatives are also expressed in terms of breakthroughs and optimizations. Enterprise strategy identifies which systems and architectures will be targeted for significant improvement.

To uplift the maturity of enterprise systems, changes to enterprise architectures are often required. Enterprise architectures are both targets for improvement and, given their current state, constraints on the degree of change that is possible. Enterprise architectures work within and across enterprise systems to enable outcomes. Improving architecture improves outcomes. We will come back to enterprise architectures at the end of the chapter.

Determining your “Must Be Trues”

Because Must Be Trues test the boundaries of change, as you seek to identify them it is helpful to adopt the investor’s point of view. Investors place their money in companies they conclude offer the greatest upside potential with the lowest downside risk, given their chosen investment class.

In order to forecast, an investor first looks backward. She assesses the progress the company has made — its growth rate and historical performance versus projections. She then assesses strategies and plans. She asks, “does this company see a crack in the ecosystem that can be profitably exploited?” Then she asks, “does this company have a compelling plan to exploit the crack?” Then she asks, “if this plan were to come true, would it result in a significant positive inflection in company value?” Finally, she asks “how confident am I that this team can make this plan come true?”

A “Must Be True” is the next spot you want to land — a value inflection point. It is often expressed within a bounded period of time. In its earliest stages, a company may need to prove it can secure twenty paying customers before pursuing its Series A investment. That’s a Must Be True. Since cash is limited, the company also may need to raise at least a $6M “A” round within eight months. That’s also a Must Be True.

A public company might express its Must Be Trues in terms of digital transformation progress, with specific milestones of achievement in terms of the percent of the monolith that has been migrated into microservices. Here too, the top team will apply a time frame to the Must Be True that reflects new investment requirements and current investor tolerance.

Determining your “Can Be Trues”

Within your chosen timeframe, you must deal with constraints. They are external and internal. The heart of innovation is to challenge constraints, but they do exist. In the strategic imperatives that drive your strategy, it’s OK to push up against the boundaries of constraint. But you can’t cross them. Each strategic imperative must pass the “Can Be True” test.

Let’s first consider external constraints.

For instance, in determining your expansion strategy you assess your position relative to competitors. Where is your competitor strongest? That’s a constraint. To mobilize a frontal assault on a strong competitor’s ideal customer profile or core value proposition would be foolish. Rather, you will define a target segment that is less well served, one where your value attributes (existing and developable) can be accentuated.

It’s the same idea when you pursue investors. You assess your progress in light of investor expectations (a constraint). You look at the list of target investors and review their past investments. You make an educated guess as to which investors are an ideal fit, and how much these investors might be willing to invest (another constraint). It makes no sense to ask for more than that; an investor would back away from a deal if he felt it was beyond his investment comfort zone. These are examples of external “can be true” assessments.

A primary internal constraint is human capacity. People drive change. Most projects go through eight stages:

- Envision

- Design

- Architect

- Build

- Implement

- Stabilize

- Optimize

- Scale

A project team requires people that have the competencyto perform each of these steps. These people must also have availability, motivation and energy. These four stocks are key limiting factors in the pace of change. Too often, senior executives under-appreciate the degree to which simple human capacity is a constraint on change.

In the fit systems enterprise, redundant capacity is built into both management and front line staffing levels. With autonomous, self-organized cross-functional teams working throughout the enterprise, what is the role of management, anyway? In no small part, managers exist to drive change — to improve the systems within which they work. Staffing levels should be set accordingly. At least twenty percent of management time and five percent of frontline employee time should be set aside to advance change initiatives.

Your plans “can be true” if they are achievable, given your human capacity constraints.

Other internal constraints include the limitations of current technology, or culture, or financial capacity. Well designed strategies and plans factor in these constraints.

Bounded Purpose

Bounded purpose unifies the Can Be Trues and the Must Be Trues together into an enterprise-wide purpose statement that is bounded in time — a “bounded purpose.” An enterprise’s bounded purpose is of supreme importance. It is the organizing focus of strategy.

How does bounded purpose emerge?

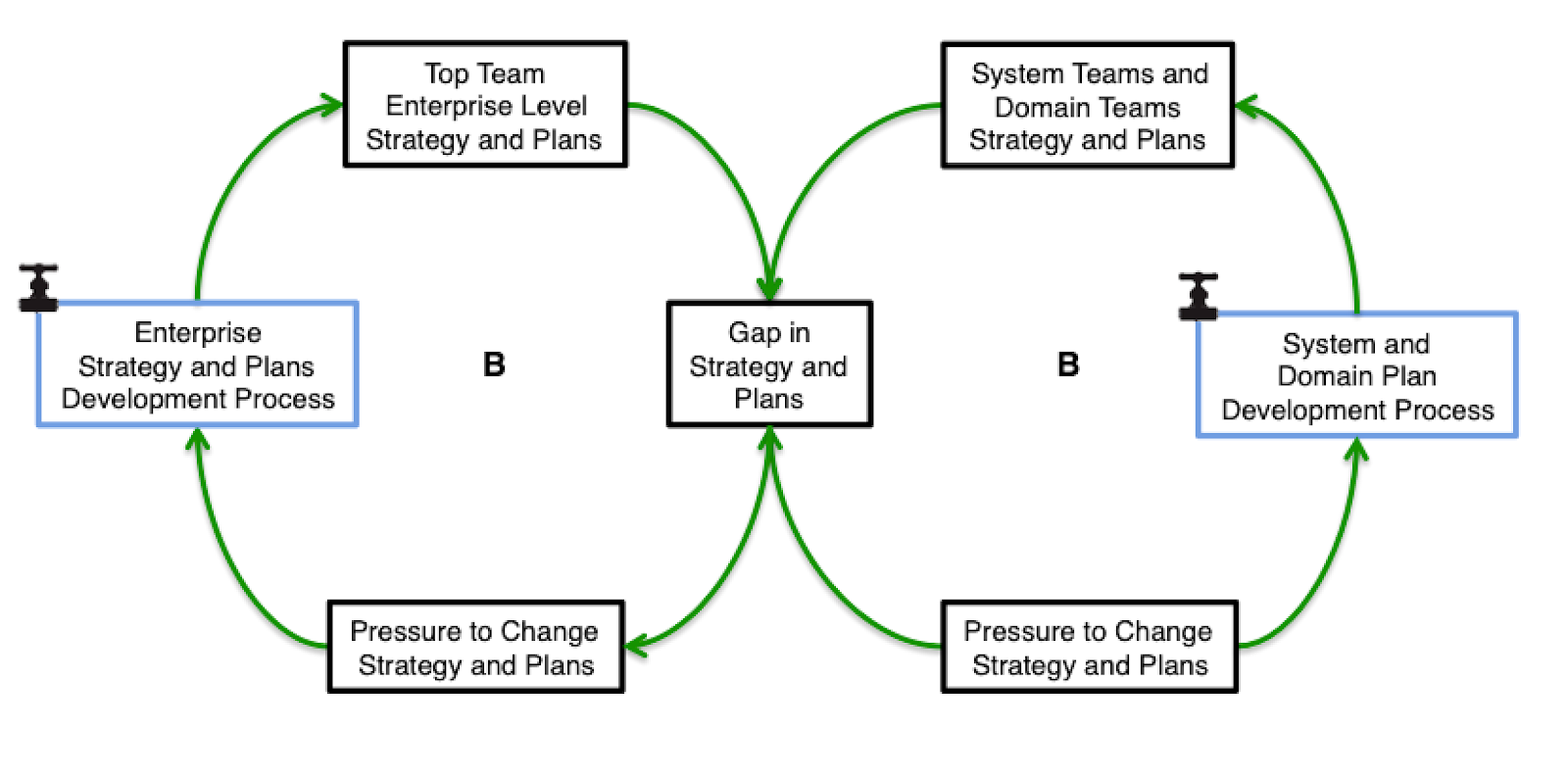

It emerges through the strategic planning process. Strategic planning occurs in an iterative balancing feedback loop, with top-down and bottoms-up plans interacting with each other as follows:

Much of the frustration executives experience with the strategic planning process emanates from a desire to make it linear. But it never is, and it shouldn’t be. The value of the process is in the iterations — as different data points emerge from outside and within, as “Must Be Trues” confront “Can Be Trues,” as teams and systems float their plans and as diverse stakeholders bring their agendas to the table.

For instance, the first draft of strategies may be initiated at the top of the enterprise. But meanwhile, teams inside the operating systems are also developing strategies and plans (such as a revenue engine system plan coordinated by marketing, sales and customer success teams). These top-down and bottom-up inputs need to be reconciled. As they are reconciled, all three (bounded purpose, strategies and plans) evolve.

The reconciliation process is invariably messy, with high variation at the beginning. This variation forces debates and tradeoffs. But in the fit systems enterprise the process lurches relentlessly down a narrowing path (usually over a period of several weeks):

Eventually, the gap between top down and bottom up, and between bounded purpose, strategy and plans, narrows away.

For the early stage startup, the bounded purpose might be: “We will acquire and retain twenty happy customers, and raise a $6M A round by June 2019.”

A public company may define its bounded purpose as follows: “We will drive efficiencies in the core business that yield 15% year over year savings-driven EBITDA growth by December 2021. Despite an expected decline in revenue from our legacy products, another 15 points of EBITDA growth will come from the rapid revenue expansion of products less than five years old, more than overcoming legacy product revenue decline. EBITDA from new products will comprise 20% of total EBITDA by December 2021.”

Strategy and Plans: The “How to Make It True”

A strategy identifies a required change in state, and describes how that change will be brought about. For each strategic imperative there is a strategy, and each strategy has one or a few supporting plans. Since systems drive outputs, strategy reveals itself in system plans.

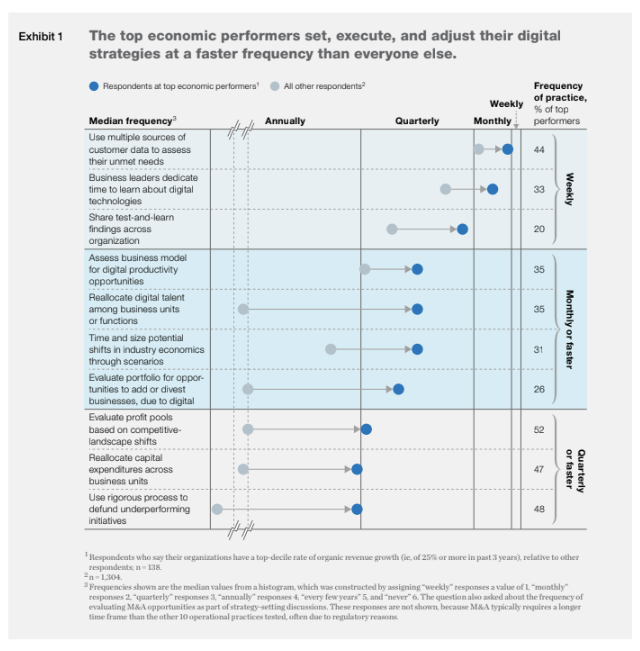

In a white paper on digital strategy, McKinsey noted that top economic performers exhibit greater agility in creating, adjusting and executing strategy than peers:

Source: Bughin, Jacques, Catlin, Tanguy, & LaBerge, Laura. “A Winning Operating Model for Digital Strategy”. McKinsey & Company, January 2019.¹

A plan is well designed when it has identified all components of the system that must change, and for each of these components has identified five things:

- The limiting factor that stands in the way of the required change

- The action that has been devised to attack the limiting factor

- The expected time lag between intervention and result, given the nature of the action

- The case for change: its expected impact in relationship to its cost, time and effort

- The degree of confidence leadership has that the action will prove successful

If the way forward to solve a limiting factor is not clear, this implies a lower degree of confidence in the action. In such situations, small-scale experimentation is best. A/B testing, hypothesis testing and rapid prototyping are examples. Where there is high confidence that an action will achieve its desired result, or when the change is mission critical and urgent, the plan will propose full-scale execution with less experimentation.

The strategy specifies how company assets (such as people, technology, brand equity and money) will be deployed to drive the change. Plans provide further details, often including a high level project plan with sequencing and dependencies.

The job of the strategic planning process is to devise strategies that meet the strategic imperatives, supported by plans that are light, but are well thought through. In the fit systems enterprise, executives understand that strategies must be fairly stable, but plans continuously evolve. Don’t let the planning process fall into the waterfall trap, where there is so much upfront work that the result becomes a rigid, unchangeable contract. On the other hand, be comprehensive enough to take into account the integrated nature of things and the lag between cause and effect.

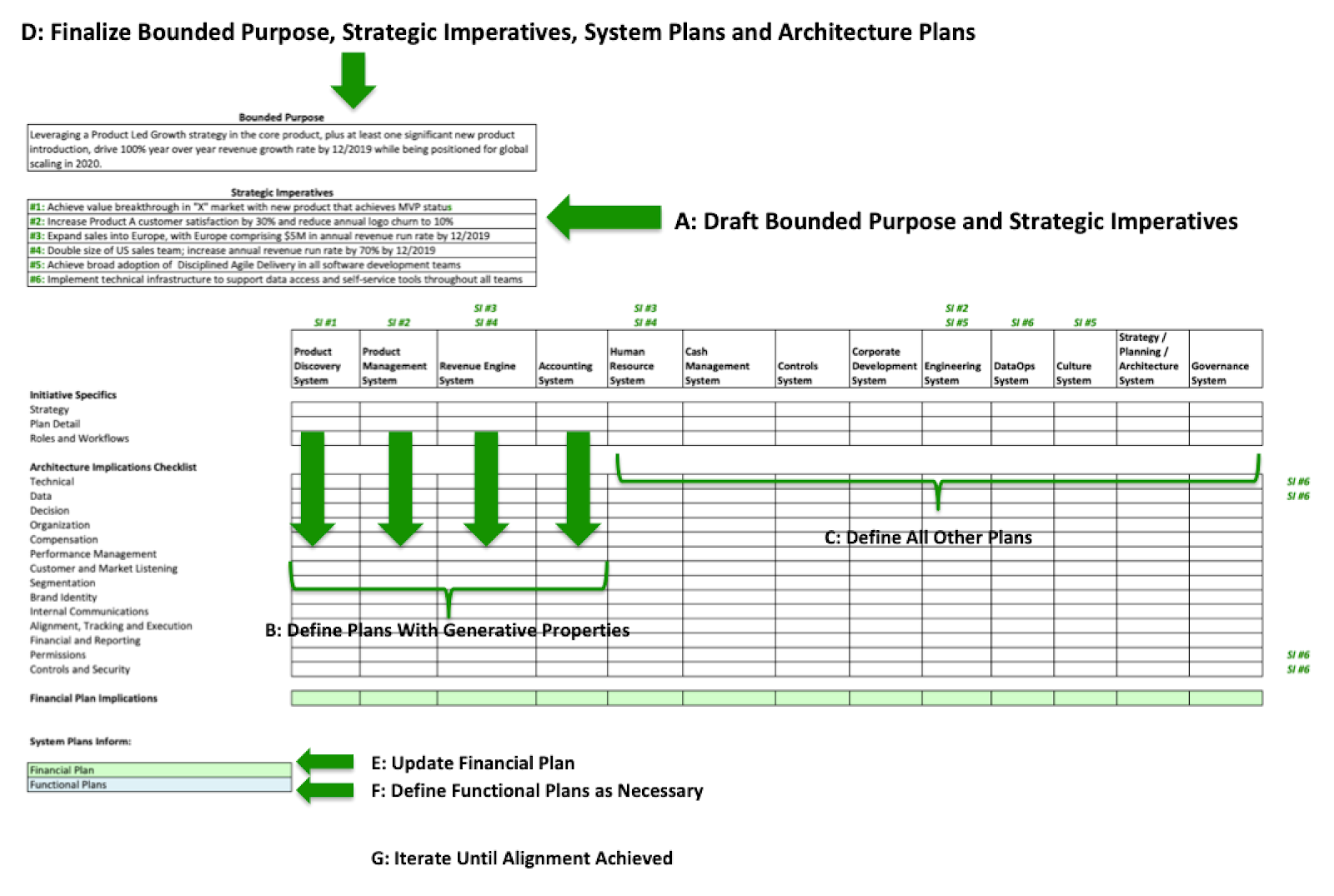

Too often, enterprise plans fall short. Key interdependencies are missed. To mitigate this risk, it is best to go through eight sequential steps. These steps may feel cumbersome. But if you don’t complete them up front, you are likely to find the consequences much more cumbersome later.

Remember that at every step, the key is to keep it well thought through, but light. A plan should be one to two pages, not thirty. You will find that each step in the sequence may force you to iterate on the previous steps. Roll with it — iteration makes strategies and plans better.

- Draft the bounded purpose and strategic imperatives (both generative and adaptive)

- Build the strategies and plans that address generative imperatives first (specifically, these are the plans for product discovery system, product management system, revenue engine system and corporate development system)

- Identify any architectural implications of these plans

- Develop the plans for all remaining systems

- Think through architectural implications of all strategies, and make sure they are addressed in the appropriate system plans

- Finalize bounded purpose, strategic imperatives and system plans

- Finalize financial plan

- Develop summary functional plans (if necessary)

Most companies start strategic planning with functional plans. But this is backwards. Functions don’t create business outcomes, systems do. Of all operating systems, the ones with generative properties (product discovery, product management, revenue engine and corporate development) are most important. That’s why you start with these plans. It makes no sense for the HR system’s plan to be developed before the revenue engine system’s plan. The following spreadsheet may be helpful in understanding this process:

As you can see, the system plans must identify any impacts they have on enterprise architectures. Once the generative plans and their architectural implications are clarified, the plans for the other systems can be developed — accounting, HR, cash management, control, engineering, DataOps, culture and governance. Updates to architecture can be built into the plans for their appropriate system — engineering for technical enterprise systems architecture, DataOps for data architecture, Governance for top executive organization architecture, each operating system for lower-level organization architecture, HR system for compensation and performance management, revenue engine for customer and market listening, and so forth.

A plan should have just enough detail to provide basic direction, to identify dependencies and to address basic sequencing issues. Plans will evolve as teams engage the work — a core principle of agile. In the fit systems enterprise, strategic planning and execution follow agile principles.

A key artifact of the strategic planning process is the financial plan. All other plans eventually flow into it. The financial plan operates as a forcing function. Preparing the financial plan forces leaders to predict cause, effect, and delays. It shows how money will be spent in enterprise systems. It shows how money will flow back into the enterprise through revenue. You have to explicitly define the linkage between spending and revenue. In a well designed financial plan, you see both monthly GAAP financials (P&L, balance sheet and cash flow) and monthly operational metrics for the coming year (quarterly for the subsequent two or three years). It includes a headcount schedule, a booking and revenue schedule, the expense budgets for every department and a table of key assumptions.

One assumptions table with all major assumptions in it makes it easy to conduct sensitivity analysis.

The financial plan is an artifact of the cash management system.

Once these system plans are done, if further functional clarity is required you can complete functional plans.

These plans will go through many iterations. By this means, flaws in the plans are discovered and ironed out, and the competing interests and expectations of various stakeholders (board, management, employees, partners and customers) are brought into balance.

Forest for the Trees

The detailed, iterative planning process noted above increases the likelihood that your plans will be well thought through. But the process carries with it a risk. By its nature, planning will place leaders amongst the trees. In the identification of the myriad actions for each plan, and the multiple plans for each strategic imperative, there is a risk that you either miss transformational levers entirely, or that you include them as “one of many.”

A company I coach had done an excellent job of completing the strategic planning process as described here. But it was only during a day-long board / executive team retreat that some critical revenue levers were identified, some with a bigger impact than all the actions that had been called out in the plan.

To defeat the “forest for the trees” risk, it’s important for executives to take some time in the strategic planning process to climb out of the trees and get to the mountain top, where the view is different. Once you are in a reflective state, ask yourself some simple questions. Here are examples:

- What impossible things would transform our enterprise if they were possible?

- What are our biggest blind spots?

- Who is looking at our market and customer needs in an entirely different way?

- What technology changes impact us the most?

- Knowing what you know, if you were handed $30M to start a startup to compete against us, what product would you build?

- How could we increase the conversion percentage in the prospect funnel by 50%?

- What could we do with $100M in cash?

- How could we cut expenses by 30% over two years while growing by 40% over that time?

- How should we balance now, near and far?

The creative process is non-linear. But when highly competent leaders take time to ponder in a reflective state, breakthroughs emerge — often in flashes of “Eureka” insight. In your strategic planning process, make room for the pondering.

Alignment, Tracking and Execution Architecture

The board plays an important role in the strategic planning process. A board’s role is to challenge and stress-test strategy and plans. In most companies, the board approves the annual financial plan, which encapsulates the investments and expected returns tied to the strategies and plans. An effective board will push hard to discover flaws in the plan, and to challenge executive teams to higher levels of stretch than teams might be comfortable with if left on their own. This “stretching” is healthy. Just as muscles build through tiny stress failures in muscle tissue, so does executive team competency. The secret alchemy is never to stretch so far as to cost yourself executive team belief.

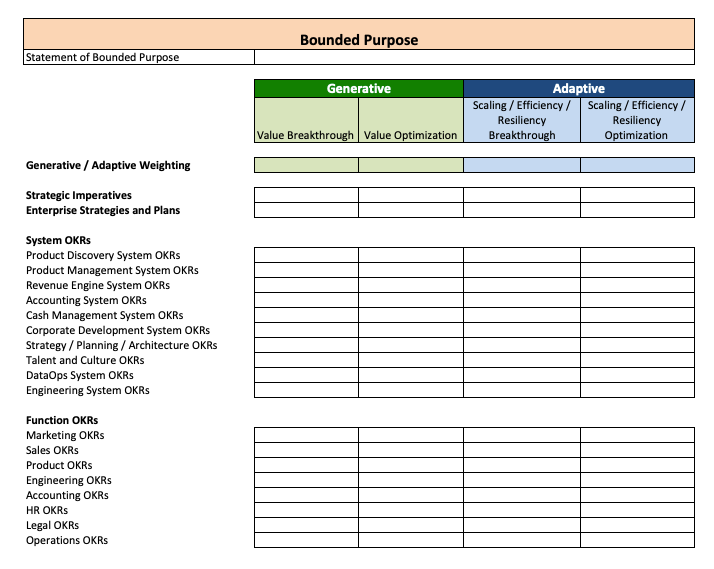

Ultimately, strategies and plans settle. Purpose and direction cascade from top to bottom and across systems and functions. Expectations are set for each person, domain, system and function. This is the alignment process. This is done through OKRs (Objectives and Key Results) and KPIs (Key Performance Indicators).

OKRs identify objectives and intended results. KPIs keep track of the stocks that matter most, at the enterprise level, the system level, the team level and the individual level. Dashboards show trending of KPIs.

Here’s an example of an OKR for the revenue engine system. The Objective summarizes the strategic goal, and the Key Result states in SMART terms (specific, measurable, actionable, results-based and time-bound) what you want to accomplish:

Objective:

Launch and expand sales in Europe, establishing a sales hub based in Geneva and mobilizing to achieve revenue objectives as defined in the financial plan.

Key Result #1:

Open sales office with capacity for sixty salespeople in Geneva by June 2019.

Key Result #2:

Nine sales pods (each with one AE and two SDRs) are hired and in the new office by June 2019.

Key Result #3:

Bookings for European companies will be $2M by Q3 2019, and $4M by Q4 2019.

OKRs link to enterprise bounded purpose, strategic imperatives, and the various strategies and plans. They cascade throughout the enterprise, like this:

Once again, system OKRs come first. These OKRs are assigned to the teams (cross-functional or otherwise) that work within each system. Where appropriate, you may need to add additional functional OKRs. OKRs set a standard against which performance can be measured. The performance expectations can be tracked via KPIs. OKRs and KPIs should be updated quarterly. In the data driven enterprise teams have timely access to performance data. Using that data, teams and managers can assess progress towards goals and make necessary adjustments.

The Enterprise Architectures

As a company scales, its structures and processes can crack under the weight of growth. To counteract this, leaders in the fit systems enterprise continuously improve architectural design.

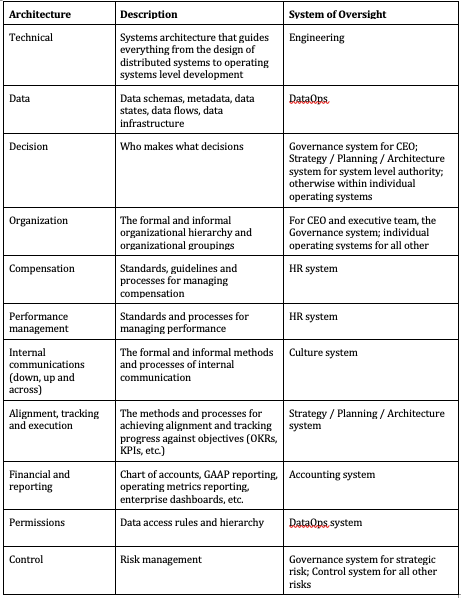

Here are some important enterprise architectures and their corresponding descriptions and systems of oversight:

The goals of these enterprise architectures are derived through the strategic planning process. The systems of oversight execute those goals through the architectural designs themselves.

Strategy, Technical Systems and Teams

In a technology company, strategy impacts technical systems and the teams that build them. A key strategic decision is to define the top priority problem domains for which technical development is required, and to define the business outcomes you seek. For instance, if a key problem domain is the customer onboarding process, your business outcome goal might be to reduce the customer launch time from six weeks to one week.

It is often the case that one customer segment requires different features than another. When a targeted segment is missing key features, that is a problem domain. In fact, any targeted segment is a problem domain, in the sense that a tech company seeks to continuously optimize that segment’s customer experience.

If you have the financial capacity, it is best to assign separate cross-functional, self-organized teams to your top priority problem domains. If the boundary of the team (in an organizational sense) matches the boundary of the problem domain, you increase the team’s autonomy. Some of these domains (such as target segments) will be standing teams, persisting over the long term. Others will be spun up as project teams.

It makes sense for the sales and marketing organization structure to be organized in the same way — with teams assigned to targeted customer segments (problem domains). This simplifies collaboration between non-technical and technical teams.

In a technology company, the technical team is the voice of final authority on product change priorities, but inputs from marketing and sales are important contributors to these decisions.

Enterprise Distributed Systems Architecture

At enterprise scale, the number of technical systems proliferates. As important as it is that domain teams develop architecture to meet the needs of their assigned domain, that alone is insufficient. In a large enterprise it becomes increasingly important to architect the interactions between distributed systems throughout the enterprise. This requires an infrastructure chassis to be built under all technical systems in the business.

The structural design of the distributed system is defined within the Strategy, Planning and Architecture system. The engineering system mobilizes implementation of this design in software. The resulting software joins together the technical systems sitting inside individual enterprise systems (product discovery, product management, accounting, revenue engine and so forth).

The Cadence of Strategic Planning

While ecosystem and enterprise data-gathering occurs all the time, strategic planning is episodic. For companies who have passed the Minimum Viable Traction stage, the formal strategic planning process usually occurs twice a year. Often an executive team retreat is the venue for consolidation of strategy and plans and creating alignment.

The word “retreat” fits its metaphysical purpose — a retreat from day-to-day business, so as to contemplate the future. The mid-year retreat is often dedicated defining the bounded purpose and strategic imperatives. The end-of-year retreat is usually focused on finalizing strategies, plans, roles, responsibilities and the financial plan.

Preparation is the key to a successful retreat. Preparatory work often begins two to three months in advance. During the preparatory phase, all ecosystem and enterprise system data is gathered and reviewed. All stakeholders submit inputs. Executives engage each other in debates. Planning begins. As a general rule, retreats are most successful when roughly seventy percent of the work has been done by the time the retreat begins.

Between retreats, executive teams engage in quarterly business reviews and weekly progress reviews to keep on track. These reviews become feedback loops that inform strategic planning.

Here is the system map for the strategy, planning and architecture system:

Summary

The strategy / planning / architecture system is a company’s “brain.” It is the job of this system to clarify direction, identify roles and responsibilities, and cascade them throughout the enterprise. Great strategy depends on market and customer listening, context tracking and a deep understanding of the current state of all enterprise systems. This will enable you to determine “Must Be Trues” that “Can Be True,” with sound strategies for each — “How To Make It True.” If you can set smart direction, gain top team alignment and cascade roles and responsibilities so that everyone is working together to get it done, you will be on your way.

As Sun Tsu said, “if you know your enemies and know yourself, you will not be imperiled in a hundred battles.”

You’re the CEO. Go make it so.

To view all chapters go here.

If you would like more CEO insights into scaling your revenue engine and building a high-growth tech company, please visit us at CEOQuest.com, and follow us on LinkedIn, Twitter, and YouTube.

Notes

- Bughin, Jacques, Catlin, Tanguy, & LaBerge, Laura. “A Winning Operating Model for Digital Strategy”. McKinsey & Company, January 2019. https://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/a-winning-operating-model-for-digital-strategy