Smart segmentation sparks scaling.

You have a product. It makes the unworkable workable; the unavoidable and urgent easier. On some dimension of personal or corporate need (status, affiliation, safety, ease of use, cost, speed, etc.), your product wins big. Segmentation can only emerge from this: the solid foundation of a compelling product. Without it, you have nothing. Once you’ve nailed basic product / market fit, however, proper segmentation is the lift-off point for all future company growth.

Who is your customer? This is the question that customer segmentation answers.

Segmentation is a data driven filtering exercise. Your segmentation scheme divides the market into buckets, and then clarifies which buckets matter most. From your top priority buckets (segments) emerges your Ideal Customer Profile (ICP). Here we find the ideal buyers’ and users’ personas, tasks, expectations and pain points as they pertain to your product.

Let’s begin with a segmentation example that underscores its power. Zuora is the leading subscription management platform for B2B and B2C companies. It supports recurring revenue billing, multi-channel commerce, global payments, and workflow analytics. The company has raised over $200M in venture funding and is fast growing, with 600 employees serving customers worldwide. Tien Tzuo, founder and CEO, has developed a comprehensive, multi-layer segmentation scheme.

Working bottom-up from a detailed understanding of product use case scenarios, the company has defined three high-level segments: B2B subscription companies, B2C subscription companies, and companies in transformation. The latter segment is populated by companies that are innovating their business models. Each of these three major segments has been further sub-segmented by industry, company size and geography.

The segmentation scheme has been leveraged to clarify brand, tighten messaging, and focus the sales organization. The top-level Zuora brand is distilled into one word: “Freedom.” This cascades into three segment-specific brands. For B2B, it’s “Freedom to Grow.” For B2C, it’s “Freedom to Experiment.” And for companies in transformation, it’s “Freedom to Reinvent.”

The sales organization itself is organized into three tiers, based on company size. B2B, B2C, and companies in transformation are all served by the same sales teams within a size-based tier, but messaging is customized to these different audiences, based on their unique buyer and user personas.

Segmentation has also sharpened product road map decision making. By understanding the unique unmet product needs in each segment, smart decisions have been made to prioritize development.

That’s the power of doing it right. Smart customer segmentation:

- Anchors your brand strategy

- Sharpens pricing

- Drives product roadmap prioritization

- Lasers in messaging

- Superpowers lead generation

- Tightens sales workflow

So why do so few tech startup CEOs get it right?

Too often, CEOs either don’t segment at all, or they approach the task with a top-down, “gut instinct” approach. Lacking the time or money for extensive research, the next best thing, many CEOs conclude, is essentially an educated guess. But there’s a sweet spot that stands between “expensive, time-consuming research projects” and “winging it.”

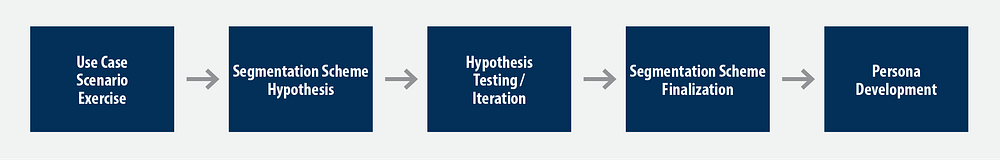

This middle way involves the following:

Use Case Scenario Exercise

The Use Case Scenario Exercise is the key to this “middle way.” It leverages the existing domain knowledge of your team so that you only need to focus on researching the things you don’t already know.

To complete the Use Case Scenario exercise, you need to start by coming up with at least 50 different use case scenarios for your product. This ensures you work from the atomic level on up towards a segmentation scheme, versus top down. The 50 use case scenarios are your “raw material” that will eventually yield 1–3 top priority segments. To come up with this number of use case scenarios, or permutations, the first question you will face is, “what segmentation dimensions matter most?” At this stage, you should cast a wide net. You’ll narrow later. Here are some dimensions to consider:

B2B:

- Size of company (revenue / employees / market cap / Alexa ranking / etc.)

- Product usage profiles

- Buyer or User profiles

- Product demand indicators

- Technology maturity

- Legacy technology

- Manufacturer / vendor affiliation

- Geography

B2C:

- Gender

- Age

- Income

- Psychographic profiles

- Product usage profiles

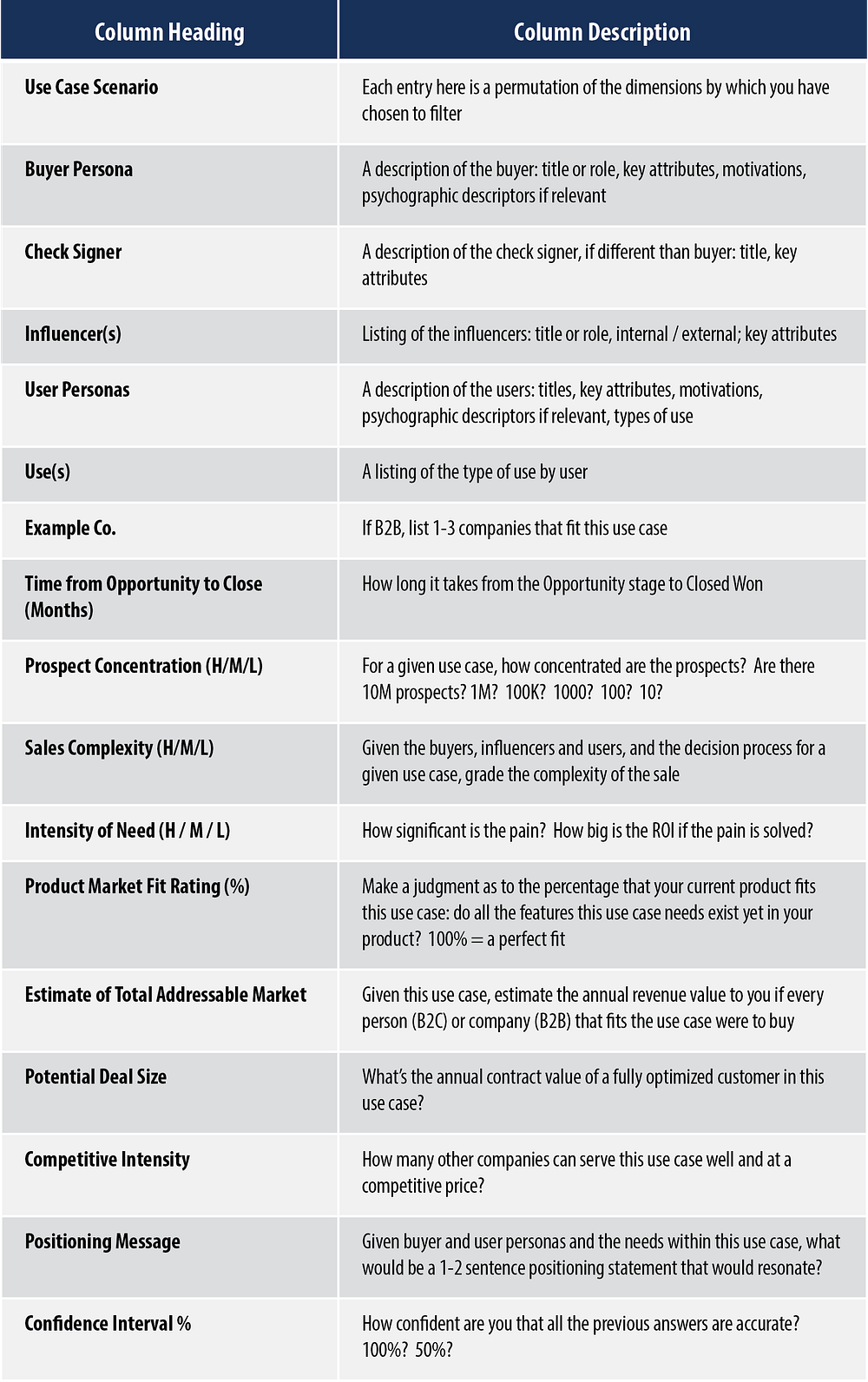

Once you have come up with at least 50 permutations, create the following columns in Excel or a Google Sheet:

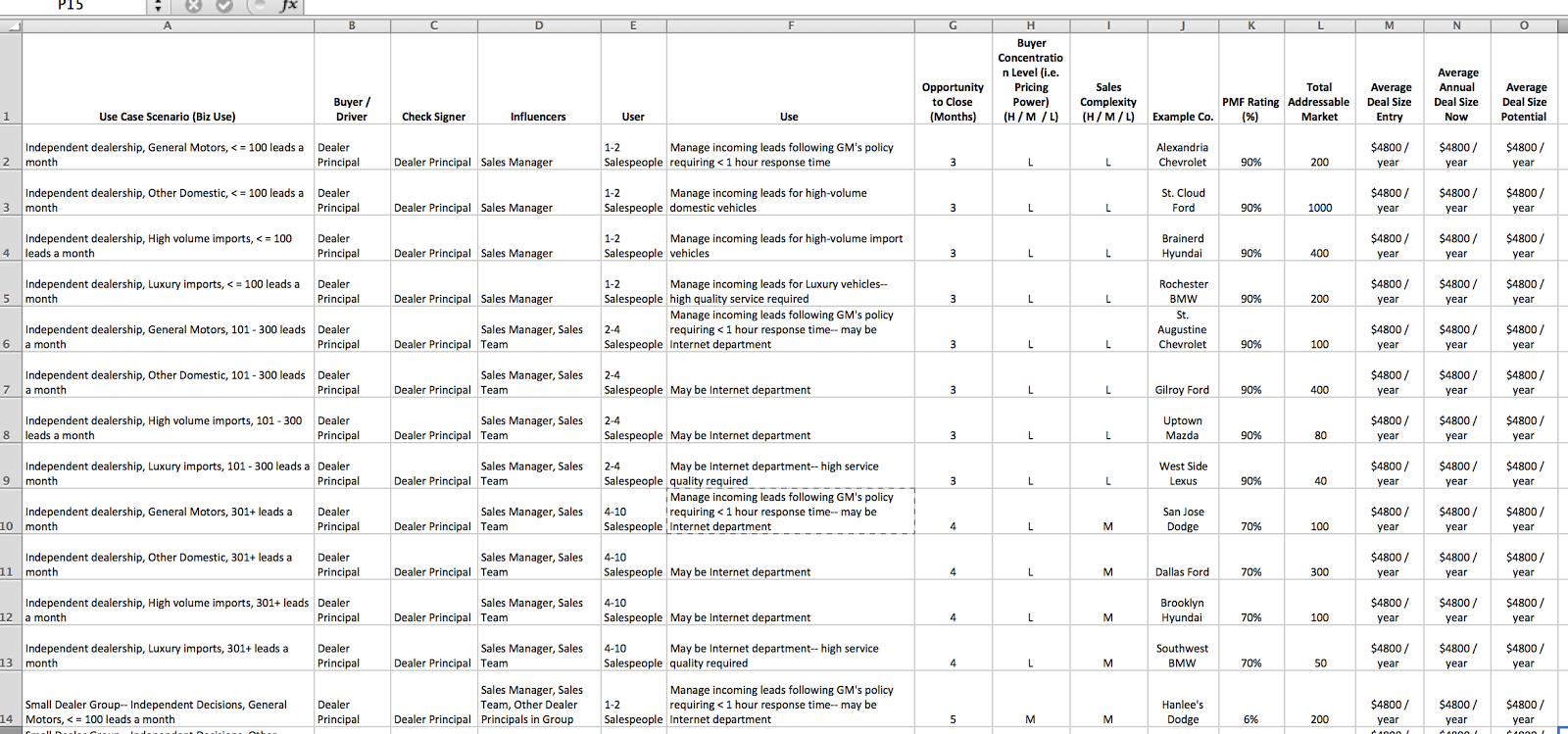

A completed Use Case Scenario Exercise (in this case, for a CRM solution for auto dealers) might look something like this:

As you execute this task you’ll be forced to think more about your customer and your market. This may cause you to change the dimensions themselves, and iterate the exercise a couple of times. That’s good! It means you’re really thinking it through. It also probably means you’re listening closely to your customers and prospects.

Salespeople should be asked to fill out the Use Case Scenario exercise. Top salespeople have good instincts; tap into that.

Once you’re done, you might feel that many answers aren’t much more than a “gut-level guess.” For some questions, such as your estimate of Total Addressable Market, that’s OK. If you understand your chosen domain, your guess is probably close enough. For other questions, such as Buyer Persona, a guess isn’t good enough: research will be required.

Once you’ve completed the Use Case Scenario exercise, check the Confidence Interval % for each scenario. Any row showing a confidence interval of less than 90% requires further research. Note that you’re only conducting research on things you know you don’t know. That’s much more efficient than the kind of comprehensive research project a bigger company might do. If you’re B2B, pick up the phone and call people who fit the use case for which you need more data. Have a good conversation with 20 or more people, so you have enough pattern recognition to gain confidence that you understand the use case. For B2C, you may need to conduct a shopping mall survey or “person on the street” interviews.

Segmentation Scheme Hypothesis

Once you have completed this exercise, identify all the use case scenarios that exhibit:

- A large total addressable market

- High product / market fit

- High intensity of need

- Low to moderate competitive intensity

Depending on your business, you might also place weight on other factors, such as:

- Technology maturity

- Manufacturer / vendor affiliation

- Time from Opportunity to Close

- Potential deal size

Review all the use case scenarios that match your chosen filters. Perhaps you have 15. Is there a way to naturally group them into 3–5 segments? You are looking for common dimensions that create a rational basis for grouping. Within these, is there an obvious prioritization into your 1–3 top priority segments? As mentioned previously, Zuora did just this. The company selected three top priority segments: B2B subscription, B2C subscription, and companies in transformation.

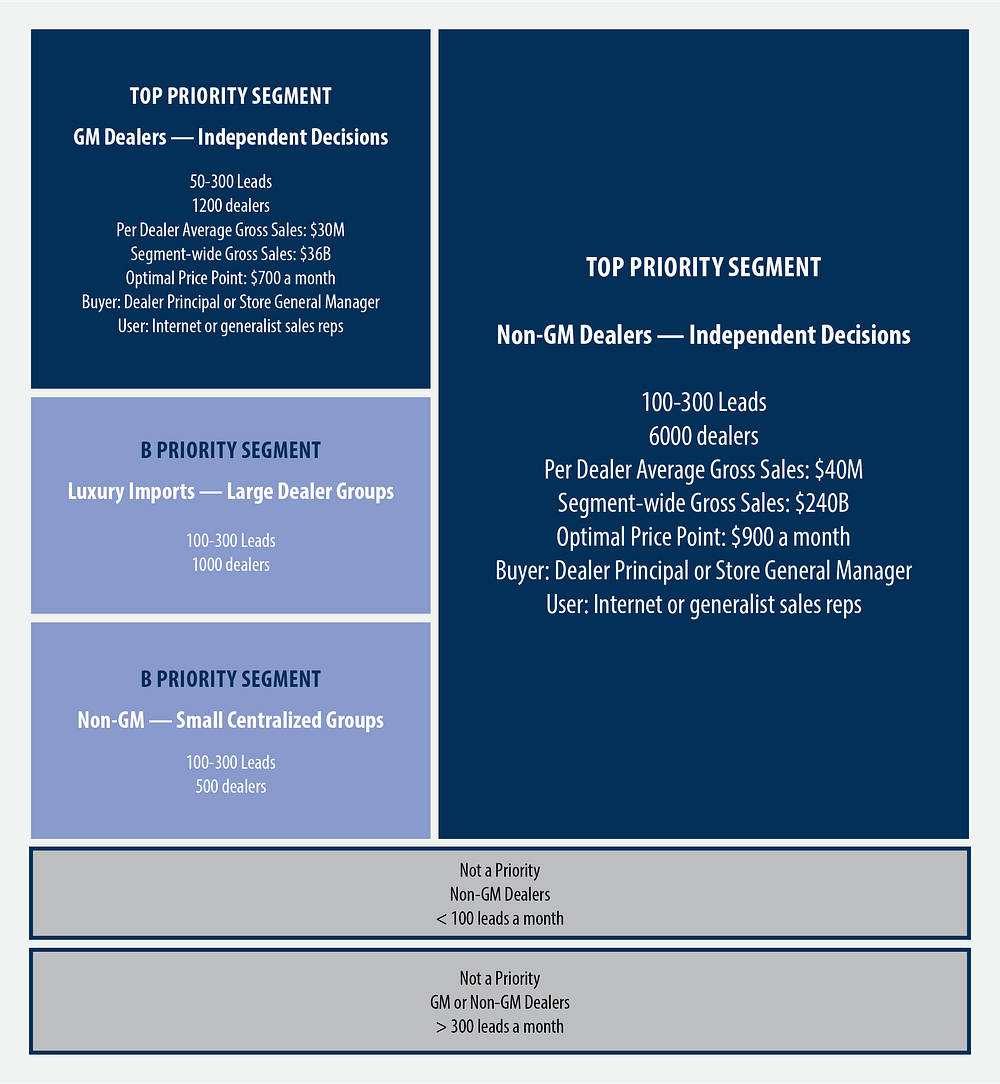

Let’s consider the example of an auto industry CRM product. Let’s assume this product is targeted to car dealerships with internet incoming lead activity up to 300 leads a month. The following factors are considered primary for the purpose of segment prioritization:

- Manufacturer affiliation

- General Motors (GM) affiliated dealers receive an incentive from GM to use a CRM system that is GM certified; this one is

- Luxury import dealers have unique needs that are especially well served by this CRM

- For those stores that are in dealer groups:

- Independent (store level) buying decisions are better than centralized (dealer group level)

- Number of internet leads per store

- 100–300 leads is best

- Total addressable market

- The larger the better, all else being equal

This leads to a prioritization of two “Top Priority” segments, two “B Priority” segments and two “not now” segments. Box sizes reflect differences in the total addressable market.

In a strong segmentation scheme, the following information should be known at the segment level:

B2B:

- Size of addressable market

- Company profile

- Product usage profiles

- Buyer and user personas

- Pricing demand curve (optimal price point)

B2C:

- Size of addressable market

- Buyer and user personas

- Product usage profiles

- Pricing demand curve

Hypothesis Testing / Iteration / Finalization

Since segmentation is key to everything — your product roadmap, pricing, channel choices, sales workflows, messaging — it’s important that you test your hypothesis. Go deeper into your top priority segments. Talk to more of the buyers, users and influencers about your product, and their needs. Pitch your product to them, and gauge their reaction on the following dimensions:

- Tasks, expectations and pain points

- Intensity of need / pain

- Degree of interest in your type of pain relief

- Price sensitivity

- Your prospect’s perspective on competitive alternatives

Prospect and customer feedback will deepen your understanding, and in all likelihood will cause you to iterate your segmentation scheme a couple of times. But soon you will vector in on a scheme that feels about right. While you will always be open to further iteration and optimization, you are ready to leverage your segment-level knowledge to make decisions.

Persona Development

With your top priority segments now clear, it’s time to glean maximum value out of them. This requires building out the buyer and user personas, including:

- Key attributes

- Title / Role

- Tasks

- Expectations

- Pain points

- Value received from your product

- Decision making process / steps

- Motivations

- Risk vs. reward

- Self-interest

- Psychographic patterns

- Buying profile (innovators / early adopters / early majority / late majority / laggards)

- Other generalizable personality tendencies

- Implications for messaging

- Based on key attributes, motivations, and psychographic patterns, what value statements uniquely resonate?

- Implications for prospect and customer journey

- What are the journey steps for your buyers and users, by segment?

- How does persona-specific messaging map to every decision step along the journey?

Ideal Customer Profile

Leveraging your analysis, it’s now simple to define your ICP. The ICP will guide your marketing and sales organizations, helping them focus on top prospects and filter out ones that are not on target.

The ICP is a tight description of your top priority segments that can be used by marketing and sales to guide prospect engagement.

B2B:

- Company attributes

- Buyer and user persona attributes

B2C:

- Buyer persona attributes

If you have a leads-based business model and you have sufficient lead volume, lead scoring tools can help you analytically refine your ICP by determining the correlation between company attributes and purchase behavior.

If you have an account-based business model, the use case scenarios exercise will help you analytically determine your ICP by assessing the sub-segments and specific accounts that exhibit the highest likelihood to buy now (as described in Vinod Khosla’s “Rifle Approach”1).

And if you have a B2B or B2C online fulfillment model, you can continuously test assumptions by varying top of funnel targeting and messaging, and testing alternative mid-funnel pathways to the sale.

Summary

A clear segmentation scheme helps you optimize:

Product Road Map

- Focus on development that addresses needs of top priority segments

Pricing

- Optimized for top priority segments, not “stuck in the middle”

Brand strategy

- Value Proposition

- Competitive Positioning

- Brand Identity

Messaging

- What resonates most to the segments that matter most

Lead Generation

- You thoroughly understand the prospect and customer journey

- Campaigns can be designed to match journey steps and optimized messaging

Sales and Customer Success Workflows

- Each step in the prospect and customer journey is a moment of truth

- Segmentation helps you determine at which steps human intervention makes sense, and ensure messaging is optimized

Channels

- Segment clarity creates channel clarity

- Prioritization of prospects within segments is now possible

This is hard, granular, iterative, analytical work. The move from segmentation hypotheses to settled scheme and actionable assumptions is hard-won. But if you put in the effort, the results are inevitable: increased sales acceleration, higher retention and happier customers.

Boom.

___________

1. Vinod Khosla, “Project Rifle: A Quantified Decision Making Framework,” Khoslaventures.com, March 1, 2010