Performance is powered by people.

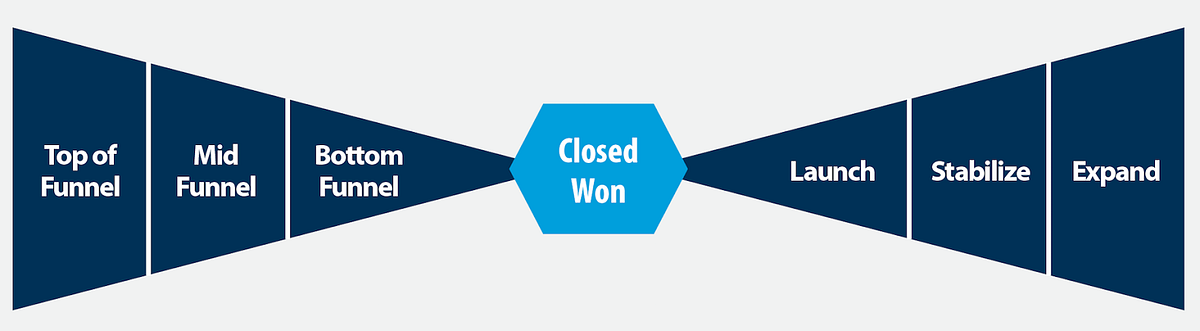

Your revenue engine is a whole system comprised of all actions that occur across the Bow Tie (see image, below). As CEO, it’s your mission to scale and run the revenue engine — and the people within it — so that you achieve optimal performance.

To do this, four aspects must be synchronized: data structure, workflows, tools, and people. To acquire and retain customers, data passes along workflows via tools, augmented by people. Wherever a machine can do the job, it should. Wherever human action is required, your job is to ensure each person’s work is executed efficiently and effectively within established workflows.

In previous chapters we have discussed how to develop a tight segmentation scheme. We’ve reviewed how to achieve smart pricing and packaging, a well-honed channel architecture, intelligent information architecture, an optimized tools stack, and a tightly defined messaging schema.

In this chapter, we will focus on organization design. This draws upon all that’s been covered in prior chapters. With data structure, workflows, and tools figured out, you are ready to address organization design.

In your design, the data structure, workflow, and tools come first, and people next — not the other way around.

Organizations are best designed bottom-up, flat, and cross-functional. In support of your workflows, you hire to solve capacity constraints without getting too far ahead of them. Three key factors impact the design and scale of your organization:

- Business model

- Proof of product / market fit

- Workflow maturity

Business Model Variations

Under the Very Low LTV business model (under $500), the entire Bow Tie journey is fully automated. The product drives the journey, so your product and engineering teams are very much a part of your revenue engine organization design. The org chart also includes the growth marketers, product marketers, and possibly brand marketers necessary to achieve broad reach, engagement, and nurture. Given the data volume (millions of prospects), a data scientist may play a prominent role.

If you operate within a Low LTV ($501 — $10,000) business model, yours is a high velocity leads based approach. With hundreds of thousands of prospects, data science remains relevant here. You may have a call center in place, populated with reps who provide order fulfillment (this becomes economically viable as your LTV approaches $10,000).

With a Mid LTV ($10,001 — $100,000) business model, some account based tactics begin to make sense, but you still must ensure a highly efficient sales development team. Your account exec team is likely inside sales-based. Integrations are highly efficient, with launch teams leveraging tools and automated processes to execute. The customer success team has a high customer-to-CSM ratio (100:1 or greater).

High LTV ($100,001 — $500,000) and Very High LTV ($500,001+) business models enable you to adopt a full-fledged account based approach where sales development reps (SDRs) work with inside and field based account executives (AEs) to drive multi-touch engagement throughout a complex, many-to-many, multiple-point sales process. You seek engagement with the right people in the right companies. In this model, content may be highly customized by prospect, which then requires dedicated product marketing support. Sales engineers are deeply engaged in the sales process. Launch teams have the engineering and technical support competencies to execute highly customized integrations. Customer success teams serve customers with a low customer-to-CSM ratio, and provide support to multiple points of contact inside each account. With very high LTV business models, each account may even have a fully dedicated account manager. Sometimes, that account manager is physically located right inside the customer’s own office.

Proof of Product / Market Fit

A general principle of organization design is that teams remain small until there is proof of product / market fit. If you can’t sell your product or keep customers, it makes no sense to scale. Before you expand, fix the product first and prove it with sales growth and customer retention at steadily improving levels of efficiency. You don’t need perfect sales efficiency before you scale; however, you do want validation of product / market fit. Once you have traction (as shown by customer acquisition efficiency and retention), then it is time to build out your teams.

Workflow Maturity

Aggressive scaling of your sales team should not occur until you are approaching an LTV / CAC ratio of 3 or better. As noted above, product / market fit is one reason for falling short of this threshold — but it’s not the only possibility. It could also be due to workflow inefficiencies.

Before scaling your team, elevate workflows to an acceptable level of performance. It makes no sense to hire into a broken workflow.

Since workflow optimization is an important precursor to aggressive scaling, let’s take a moment and dig deeper. The Carnegie Mellon Capability Maturity Model¹ (see Chapter 2 — Revenue Engine Maturity) identifies five levels of workflow maturity:

- Chaotic: workflows unpredictable, poorly controlled and reactive

- Project Centric: broken workflows fixed one at a time; often reactive

- Whole System: workflows linked end to end; proactive approach

- Quantitative: workflows measured and controlled

- Continuous improvement: teams optimize the whole system via ongoing, data driven fine-tuning

To achieve “level 5 maturity,” your team must demonstrate that it consistently measures and seeks to improve the capacity, speed, and conversion performance at every bottleneck in every workflow across the whole system. If you are performing at level 5, your team methodically and consistently identifies the most significant bottleneck. It mobilizes an attack on that bottleneck until it is no longer the biggest bottleneck. At that point, the new “biggest bottleneck” is attacked and defeated. In level 5 companies, the workflow improvement cycle operates continuously.

The capacity of the whole system is the capacity of its bottlenecks.² An hour lost at one bottleneck is an hour lost throughout the whole system. So the key to workflow optimization is to continuously attack the bottlenecks. The first priority is always the biggest bottleneck.

The High LTV Business Model at Scale

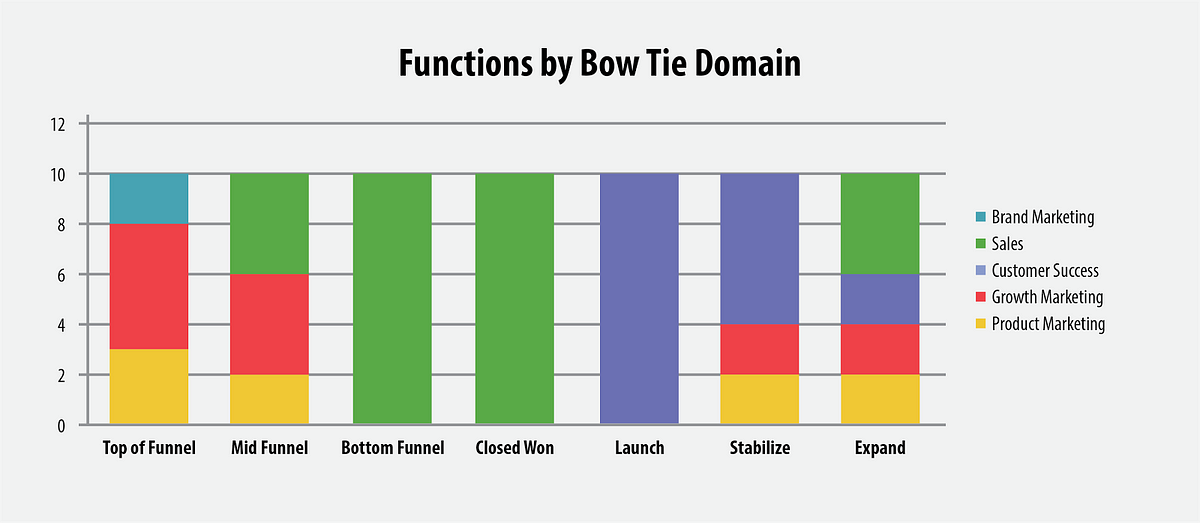

For the purpose of this chapter, let’s choose the High LTV business model. Within this business model, the marketing functions bear some resemblance to Low and Very Low LTV business models. Similarly, the sales development, sales, and customer success functions are relevant to the Mid and Very High LTV business models. The information and data noted here is drawn from research into the practices of CEO Quest member companies, and discussions with numerous marketing and sales experts.

Here is an overview of the functions, as they operate at each Bow Tie domain:

Marketing

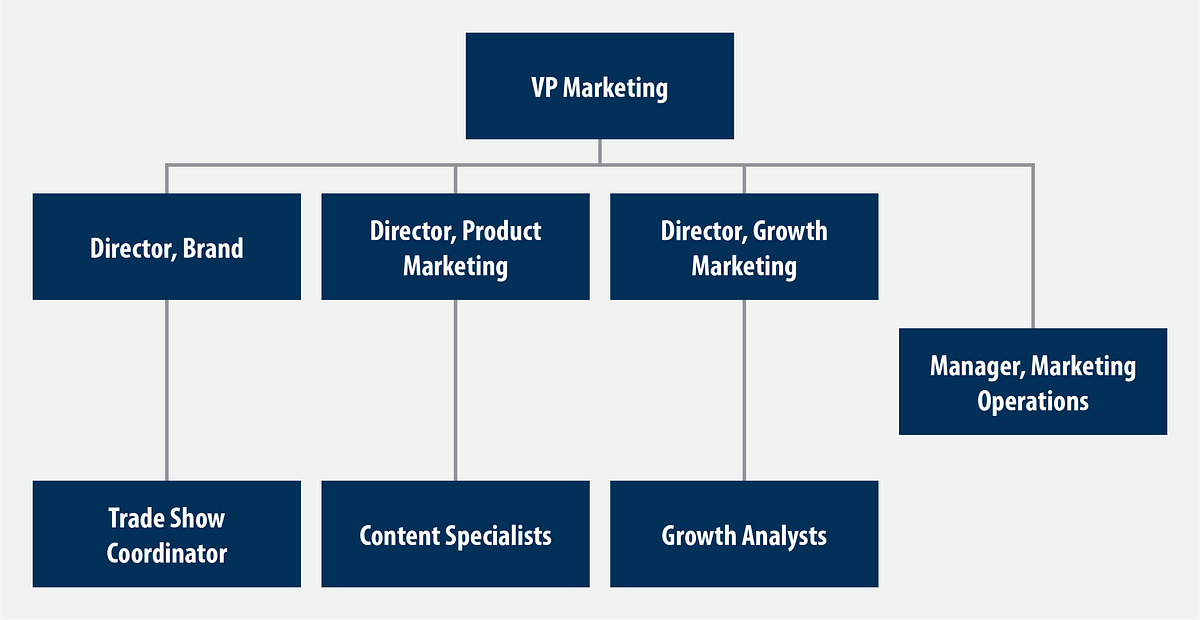

At scale, a High LTV business model company is likely to execute a steady stream of product marketing content, a rolling drumbeat of growth marketing campaigns, and, periodically, extensive brand marketing campaigns. At scale, the team that executes this work might contain the following roles:

- VP marketing (to define brand identity; marketing strategy and execution; team leadership)

- Director, brand (to build brand equity; fidelity to brand identity; execute brand campaigns)

- Director, product marketing (to lead execution of all content)

- Director, growth marketing (to lead execution of all demand gen and nurture campaigns)

- Marketing operations manager (to manage data / tools)

- Trade show coordinator

- Content specialists (to write, create, and post content)

- Growth analysts (to conduct campaign analysis)

- Growth campaign specialists (to execute campaigns)

The brand, product marketing, and growth marketing playbooks guide the marketing team in their pursuit of reach, engagement, and conversion objectives.

In the base / bonus mix, on-target earnings (OTE) skew heavily towards base. Bonuses often tie to reach and conversion objectives, and occasionally in larger companies to brand awareness and brand equity measures.

Sales

Sales Engineers:

Sales engineers provide technical guidance to prospects during the sales process, both for new accounts and for expansion sales. They have the deep technical competencies necessary to clarify all key integration challenges, and how those will be addressed within an account’s technical environment.

Sales engineer total compensation can range from $140,000 to $175,000 or more, usually with 15% to 25% of compensation at risk.

The at risk component is usually paid out based on achieving new sales and expansion sales objectives.

Sales Operations:

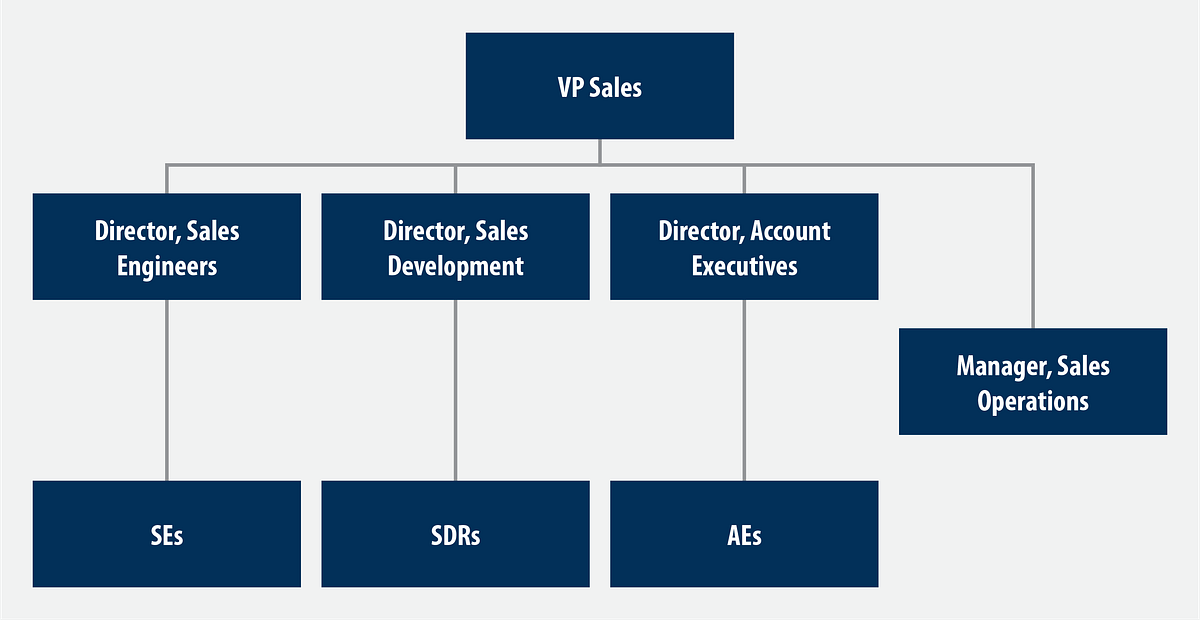

Sales operations maintains workflow and data integrity in the sales process. Data hygiene (lists, de-duping, etc.), tools management (Salesforce, InsideView, Engagio, etc.), territory management, quota management, and commissions calculations are usually the responsibility of a sales operations manager or director. This position usually reports to the VP sales.

Sales Development:

The sales development role is vital. Sales development reps (SDRs) are assigned to account executives (AEs), perhaps at a ratio of two or three SDRs to 1 AE. The objective is to fill up each AE’s calendar with active accounts that are labeled new or in-process Opportunities. SDRs certainly have accountability to the AE they support. But so as to ensure efficiency and consistency in the execution of the sales development role, there is likely to be a sales development director that reports directly to the VP sales or the VP marketing.

Most SDRs are compensated on the number of sales accepted leads (SALs) they generate and the percent of those that are converted into Opportunities.

SDRs make substantially less than AEs — often half or even one-third the amount. In Silicon Valley, the on-target earning level might be from $60,000 to $100,000 or more.

Elsewhere, it may be closer to $50,000. A 60:40 base-to-bonus split is common for this role.

SDR enablement is of primary importance. The enablement tool of choice is the sales development playbook. The SDR role is especially important in the early part of the orchestration sequence. There are touch points that must be executed in the proper order, with the right content, including calls that follow specific scripts. SDRs are measured on the number of emails sent and the number of calls made per day. SDRs must be held to clear performance requirements. Best practice is to seek steady, positive movements towards minimum requirements over the first three months of employment. If performance stalls below the minimum threshold, quick action should be taken.

In an inside sales model, it’s ideal for SDRs to be situated in close proximity to the AEs they support. But for a company based in a high-cost region (such as Silicon Valley or New York City), a key issue will be whether to scale the SDR / AE pods at headquarters or to find a remote location in a lower-cost market (e.g., Omaha, Phoenix, Boise).

Presence at headquarters is a strong positive in ensuring alignment and cultural connectivity, but the economics drive many companies to the remote model.

Without question, the first two to three SDR / AE pods should be at headquarters. Don’t scale and don’t move remote until you settle into a steady pattern of solid sales performance.

If you do choose the remote office approach, invest time, planning, and money into doing it right. When FiveStars built its Denver office, one of its co-founders, CTO Matt Doka, moved there for six months. He made sure the FiveStars culture was firmly established and that expected performance thresholds were met before he moved back home.

Account Executives:

The AE role is vital in the Bottom Funnel domain. AEs must have the skills and experience to move an SAL and its associated account through the four “opportunity” stages: discover, prove, propose and close. For most High LTV business models, AEs also are responsible for renewal and expansion sales. Each stage requires a combination of sales experience, market knowledge, and enablement in the details of the ICP and buyer / user personas. The account executive playbook provides details on the messaging and the plays that AEs must use to execute their roles effectively.

To optimize AE efficiency and impact, territory rules must be established. If it’s an inside sales model, how many prospect accounts will you assign? How many customer accounts? If you have a field sales model, how do you define territory boundaries? Are they geographic? If so, how do you deal with accounts that have assets in multiple geographic territories? What are your reassignment rules when an AE exits the company? You must consider all of these factors when you determine AE territory management.

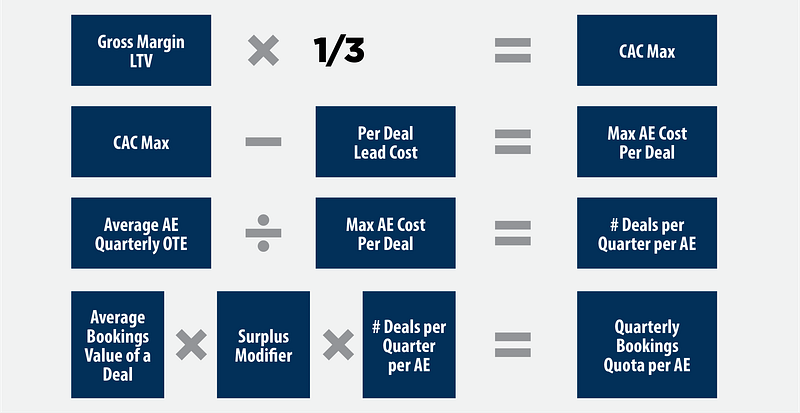

Quota setting is important as well. The following math exercise is one way to determine the AE quota for new customer acquisition:

- Determine the gross margin LTV of your average customer

- ⅓ of that number is the maximum you should spend on CAC (CAC Max)

- Calculate Per Deal Lead Cost: the total cost of all lead acquisition and lead qualifying activity (lead gen and sales development labor and nonlabor) in the previous quarter, divided by # of deals in the most recently completed quarter

- Subtract Lead Cost from the CAC Max to get the maximum possible AE Cost per Closed Won Deal per quarter

- Divide the quarterly OTE cost of an AE by the maximum AE Cost per Closed Won Deal to determine how many Closed Won Deals per quarter an AE must sell to achieve minimum positive ROI

- Multiply the minimum number of Closed Won Deals by the average bookings value per closed won deal to determine the minimum bookings quota per quarter

- Decide the “surplus modifier” you will add to the quota to take into account potential AE underperformance, and multiply the modifier by the minimum bookings quota per quarter (i.e. 5% would be 1.05)

AEs are usually compensated at a higher rate for initial customer acquisition bookings, often for the first year ACV. Renewals and expansion commitments are rewarded at a much lower rate, or may even be handled by the customer success team. Performance below quota should yield a rapidly declining rate of payout; it’s not uncommon for a 20% quota shortfall to yield a commission payout of $0. Performance above quota should yield accelerating payments.

AE on-target earnings vary widely depending on the complexity and length of sales cycle (OTE can range from $150,000 to $400,000 or more). The base-to-bonus ratio is usually around 50:50.

Customer Success

The customer success team is responsible for the launch and successful stabilization of the customer and either provides support for is fully responsible for expansion. At scale, the team may look something like this:

- VP customer success

- Director, launch team

- Director, customer success team

- Director, professional services team

- Launch managers

- Customer success managers (CSMs)

- Professional services managers (PSMs)

For a software company, a successful launch is both technical and human. “Technical launch” means the system is plugged in and works properly. “User launch” means the intended users are using the system above a defined minimum threshold of use. More specifically, the right number of users are using enough of the key features with high enough rates of utilization to validate that the customer is successfully up and running.

Launch teams must continuously attack bottlenecks and optimize the workflow so as to deliver a high quality new customer experience.

Team members are accountable for both speed of launch and new user health as measured by actual system use. Compensation plans may be designed accordingly. In these positions, a high base-to-bonus mix (80:20 or more) is common.

The customer success playbook is used to support new launch team member enablement.

You will need to decide how to assign accounts to customer success managers (CSMs). At scale, for most B2B SaaS businesses, the number can be high because human engagement is only required when a trigger indicates a problem such as a decline in usage. The customer success playbook includes plays for all the most common trigger events.

In some tech companies, professional services are an important revenue line item. Professional services managers possess strong technical skills and deep product knowledge and are usually compensated with a more significant at-risk component (such as 60:40 base to bonus) tied to revenue generation and customer satisfaction.

Revenue Engine Leadership Team

The VPs of marketing, sales, and customer success possess shared responsibility for performance of all tasks across the Bow Tie — all the way from the Top of Funnel domain to the Closed Won domain, and from the Closed Won domain to the Expand domain. Accountabilities must be clear, but functional dividing lines are less important than cross-functional dependencies. Day to day, the marketing team must generate “right person / right company” MQLs. The sales development team must turn them into SQLs that associate with target accounts. The AE team must convert these accounts into Closed Won stage deals. The launch team must launch the account, the CSMs must stabilize and optimize the account, and the CSMs and AEs must work together to expand the account. These actions require continuous collaboration. Collaboration is also required in the ongoing optimization and redesign of workflows.

If all functional leaders share the same terminology for stages in the prospect and customer journey, if your tools and systems are calibrated accordingly, if everyone uses the same data to assess the performance of the Bow Tie at every step, if bottlenecks are continuously attacked through collaboration at the leadership and frontline levels, and if performance is steadily improving, then leaders are doing their jobs.

In the next six chapters, we will march through the Top of Funnel, Mid Funnel, Bottom Funnel, Launch, Stabilize and finally, Expand domains — the Bow Tie journey itself.

Turn the ignition. It’s time for the engine to roar.

. . .

Notes

- Carnegie Mellon Univ. Software Engineering Inst. The Capability Maturity Model: Guidelines for Improving the Software Process (SEI). Addison-Wesley Professional, 1994. Print.

- Eli Goldratt & Jeff Cox. The Goal: A Process of Ongoing Improvement. North Rivers Press, January 1992. Print.