Expansion is explosive.

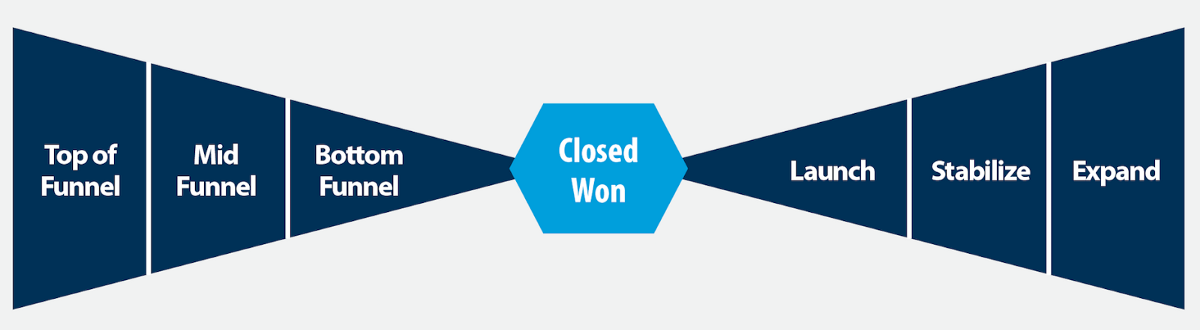

This chapter concerns the Expand domain of the Bow Tie:

Consider the happy customer. Once upon a time, this prospect knew nothing about your company or product. First, you had to create awareness. Second, you had to create relevancy — we called that vision lock (“I get what you do, and why it’s relevant for me.”). Third, you started leading your prospect on the journey towards conviction lock (“I’m convinced, sign me up.”). Time was your enemy, so you focused on speed to “aha.” Finally, you focused on speed to trust until the eureka moment when you held in your hand (or saw on your platform) a Closed Won deal.

Soon enough, your customer is launched, stabilized, and beginning to derive sustaining value from your product. She has reached the advocacy lock stage (“I’m a raving fan.”). Great work!

Now, your customer is poised for expansion.

Companies of every business model, from Very Low to Very High LTV, can design for the Expansion domain of the Bow Tie. For a media company, expansion involves increasing page views per visit and visits per month per visitor. For a marketplace company, it’s about increasing the number and size of transactions per month per customer. B2B SaaS companies seek to increase users and usage levels and expand products. Most businesses can leverage expansion to drive growth.

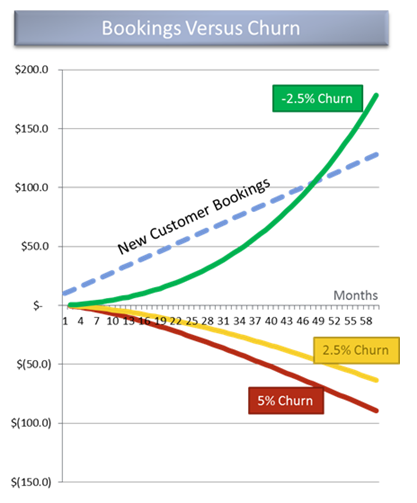

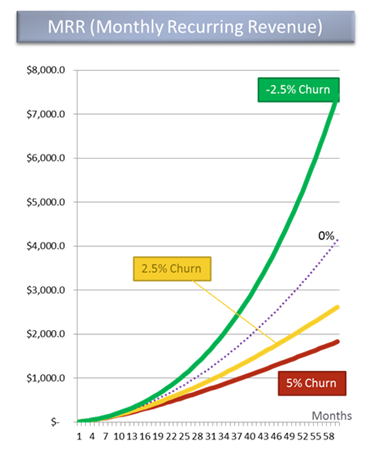

Expansion is your secret scaling weapon. The math of your business explodes if your expansion efforts yield the outcome of negative dollar churn.

SaaS expert David Skok, General Partner at Matrix Partners and author of the popular blog forentrepreneurs.com, modeled MRR (Monthly Recurring Revenue) at zero, and bookings from new customers at $10k in the first month, increasing by $2k every month after that. Here’s what it looks like at different levels of churn. In the first graph, net bookings grow with negative churn. In the second graph, revenue increases dramatically faster with negative churn:¹

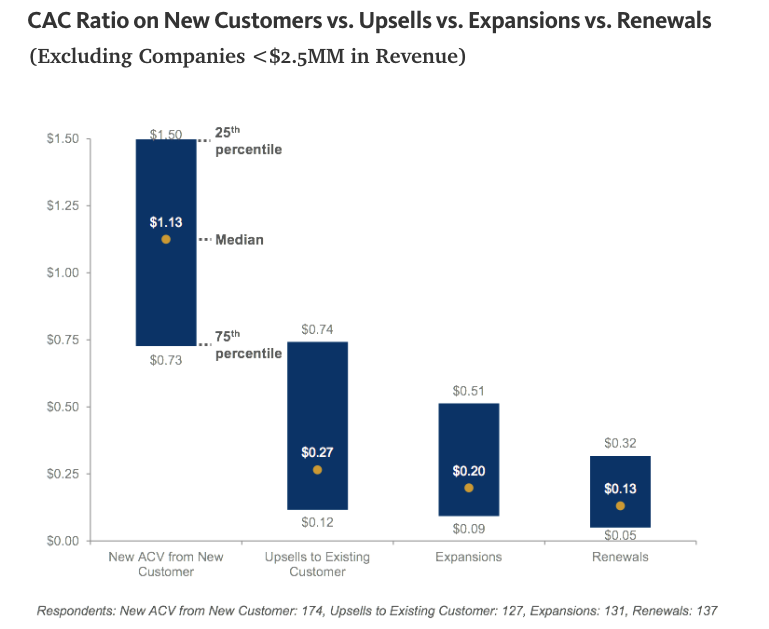

Based on data from the “2016 Pacific Crest Saas Survey,”² Skok reported that to acquire an incremental $1 in ACV from a new customer, it costs $1.13. However, an upsell dollar from an existing customer costs just $0.27. Moreover, an expansion dollar costs $0.20, and a renewal dollar costs even less — $0.13.

Given the substantially lower CAC associated with renewals and upsells, negative churn transforms your LTV / CAC ratio. So how do you get there?

A successful expansion strategy requires that you:

- Deliver a product with superior sustaining value

- Price for expansion

- Expand the product line

- Execute smart expansion programs and plays

- Incentivize for expansion

Superior Product

No expansion strategy can succeed unless the product delivers superior value. As discussed in Chapter 8 — Product, your product needs to genuinely connect to the needs of the customer in order to win in the marketplace. This is true for a media website, a marketplace company, a B2C e-commerce site, a B2B SMB SaaS company, or an enterprise software company. Expansion starts with the value your product delivers to your customers.

Price for Expansion

You expansion strategy informs pricing and packaging decisions. At its essence, pricing is the quantification of your leverage in your relationship with your customer. You have created value, and through pricing, you capture back some of that value. The more value you create, the more leverage you have.

Cash up front

If you are a SaaS business, the best practice is to offer annual or multi-year contracts and receive cash up front (see Chapter 9 — Pricing and Packaging).

Cash up front significantly reduces the amount of funding required to scale. Cash up front also locks the customer in for the 12 months.

Of course, the cash up front approach results in the customer receiving another big bill at renewal time. Depending on your leverage, you may be able to capture an increase, or you’ll renew at the same price, or you may require a discount. If your leverage is low, you may be forced to go to month-to-month billing as well.

So a smart pricing plan builds on a realistic understanding of your leverage and structures the renewal offer (cash up front or not; price up, same, or down) accordingly.

Automatic Surcharges

For expansion optimization, the automatic surcharge is a powerful pricing lever. Mobile companies employ this strategy to great effect. In a SaaS offer, pricing is usually based on a use threshold: either # of users or # or quantity used. If the customer buys “up to” a monthly threshold level, then you can bill for surcharges.

For example, you sell an annual contract for $200K, receiving the cash up front. The contract enables the company to use up to 10,000 “widgets” (processing power, queries, leads, etc.) a month for 12 months. In any month where the widget use exceeds 10,000, there is a $5 per widget charge. In February, if the company uses 14,000 widgets, the customer is sent a surcharge bill for $20,000.

Multi-Year Deal

The multi-year deal locks in the expansion, especially if the cash is up front. To calculate the percent discount you might be willing to offer the customer for a multi-year deal, consider the logo (accounts) churn rate you might otherwise experience and the time value of money. Discounts of 5% to 10% may be fully justified by the math of your business in return for a cash-up-front, multi-year deal.

Expand the Product Line

Of course, product line expansion opens the door to cross sells. If you can create products that expand upon your core product to create new tiers of value for customers, then you can diversify your package bundles, and you’ll create cross-sell potential.

The secret to successful product line expansion starts with value and relevancy. Because your customer has already bought your core product, you know a lot about her or his needs. You understand not just the pain points you already solve, but also the nearby pain points you do not yet solve. If your product extensions tackle these next pain points, and if those pain points are significant enough, you have a viable cross-sell product.

Execute Smart Expansion Programs and Plays

Product marketing, growth marketing, sales, and customer success functions all have a role in expansion programs. Product marketers produce the compelling content:

- Thought leadership content, reminding customers of the strategic rationale for your products and services

- Core product best practice videos

- Core product Q&A

- Cross-sell product feature / benefit videos for website and email campaigns

- Renewal, upsell, and cross-sell pitch presentations and collateral

Growth marketers execute the nurture campaigns and webinars to current customers. The nurture campaigns are versioned for different use cases (e.g., low levels of use, some users not using the system, under-utilization of certain features, to name a few). For instance, if it’s an under-utilization case, an email campaign might include a link to a video showing how to use a key feature currently not utilized by the customer.

Customer success managers (CSMs) maintain the health of the customer, using data to engage intelligently and efficiently.

Moreover, sales (AEs) will act on tips from the CSM, alerts, and thoughtfully defined workflows to initiate sales engagement and move the customer towards a renewal, upsell, or cross-sell.

Renewal

A smart renewal program starts with data. Is the customer healthy, as measured by the activity and outcome numbers? Is the customer happy, as shown by NPS score and CSM feedback? The faster you act on data to care for and nurture the customer, the better positioned you are for renewal.

Regardless of customer health, if your business model supports a dedicated CSM, your customer should receive a full business review meeting six months ahead of the renewal date. This meeting should include the CSM and the AE responsible for renewal and up-sell / cross-sell. The following preparation is required:

- Review activity and outcome metrics trends / data

- Review customer notes / cases

- Review customer satisfaction measures

- CSM and sales exec discuss the buyer and user personas

- A documented meeting plan (introduction, data review, key value points, questions, next steps / commitments)

After the meeting, the CSM should execute on any commitments made and closely track ongoing health indicators. A second business review meeting should then be held three months before renewal, again with both the CSM and the AE. In this second meeting, the AE reminds the customer of the upcoming renewal date and probes as to the level of satisfaction and readiness to renew on existing terms.

Then a month before renewal the AE holds the renewal meeting, with the objective to gain an online signature by the end of the meeting if possible (or a clear finalization / signature path defined with dates, if necessary).

Up-sell and Cross-Sell

As is true with all expansion activity, accurate data is required to execute up-sells and cross-sells successfully. By knowing the health of a customer on the core product, you can infer the customer’s openness to expansion through up-sell, cross-sell, or both.

The data will surely lead you to up-sell opportunities. However, depending on the nature of your add-on product, there may be core product utilization data that will also directly point to the relevancy of the add-on for a given customer.

With the data in hand, it’s all about workflows. These “propensity to buy” indicators must be built into alerts, and the alerts built into workflows. The role of the CSM as a trusted advisor means that it is usually best practice to separate this role from direct selling. However, the CSM should certainly alert the AE to initiate a sales action when the opportunity emerges.

Ultimately, CSMs and AEs need to act quickly and decisively on “buy signal” alerts, coordinating the customer interventions that yield an up-sell or cross-sell agreement.

Incentivize for Expansion

Two actors must execute their roles successfully to ensure optimized selling in pursuit of expansion: the CSM and the AE.

CSMs are incentivized significantly for retention. Consider additional kickers for average customer satisfaction scores above a certain threshold. It’s also important to have a kicker for successful up-sells and cross-sells. This will encourage CSMs to probe for the opportunity and to alert AEs of buy signals.

For the AE, the “2015 Pacific Crest SaaS Survey” indicates that median commission rates on renewals were 2% of ACV. For up-sells, it’s 8%, and for multi-year deals, 32% of companies included an additional percent-of-ACV commission past the first year. Meanwhile, for 26% of the others, the multi-year deal was rewarded with a nominal kicker.

The point is that incentives motivate. Point your dollars where you want action.

Summary

In summary, expansion is the most cost-efficient way to grow revenue. Customer spending has the potential to increase by 400% or more in one year if the product delivers sufficient value and the expansion strategy is conceived and executed well.

A surprising number of companies under-invest in expansion. Don’t do that. Be the CEO that gives expansion the focus it so rightly deserves.

Expand like fireworks.

. . .

If you would like more CEO insights into scaling your revenue engine and building a high-growth tech company, please visit us at CEOQuest.com, and follow us on LinkedIn, Twitter, Facebook, and YouTube.

. . .

Notes:

- David Skok. “Unlocking the Path to Negative Churn.” Blog post. forEntrepreneurs.com. n.d.

- David Skok. “2016 Pacific Crest SaaS Survey — Part 1.” Blog post. forEntrepreneurs.com. 2016.