For the first time in the history of SparkLight Digital, cash is not the primary constraint. For three years you were stuck in a walled garden, toiling hard to eke out a tiny harvest. Suddenly a door swung wide open, revealing a vista of new opportunity.

But what now?

It’s the end of May. The move to the new Class B office space just off Mathilda Avenue in Sunnyvale went well. You procured and installed phones, internet connectivity, and furniture. The brown carpet is a bit threadbare, but it’s a entirely serviceable space. On relocation day, all fifteen of you shuttle cars and vans back and forth between Fieldstone Ford and the new office until everyone is situated. With over 9,000 square feet, you have the capacity for about 50 employees.

A day later, with Vijaya in charge of the office, you pick up Joe at his home at 7:00 AM and drive north on Highway 280, then west on 92 over the coastal hills. You and Joe decided to spend a couple of days together in a rented AirBnB house north of Half Moon Bay. It’s time to consider your top priorities — and what they mean for the design of your organization.

You dive in with abandon. Within two hours, flipchart pages litter the walls. Your first step is to rewrite your mission and vision statements. The mission is tighter now: “To deliver transparent, data-driven, omnichannel communications between car owners and car dealers that simplifies engagement, speeds conviction, and enhances delight.” So is the vision: “To become the leading omnichannel auto dealer CRM in North America and Europe through superior transparency, simplicity, and comprehensiveness.”

To test whether the vision is realistic, “December _____” is scribbled onto the top of five wall-posted flip chart sheets. Each shows a year, starting with five years out and working backward to this current year. On each sheet, for each year, you and Joe work together to jot down a feasible portrayal of the market (customers/competitors/market dynamics), your product (key features/value drivers), and the company (revenues/funding/number of employees). It’s a speculative exercise, but it lays down breadcrumbs that mark a path from the end-state vision back to today. The result is a daunting year-by-year portrait of leapfrog steps. You can wrap your head around what it’s going to take, but just barely.

Also in the room is a large whiteboard displaying a list of all 27 dealer customers. Beside each name is a box colored green, yellow, or red. Most of the boxes are green, though two are yellow, and three are red. Beside these yellows and reds, you note the remedial actions necessary to make the customer happy.

Hand to chin, you think for a moment, and then begin.

“So I think we can conclude that we’re in pretty decent shape at this moment with regards to our 1.0 launch. Early feedback from our customers is positive, though they are all chomping at the bit for more features. Most customers look stable. The reds and yellows have solvable issues. Bill is fully capable of working with these five customers to get them straightened out. That means we are free to focus on our two major mid-term priorities: product roadmap and sales.”

“So let’s look at product first. How do you see it, Joe?”

Joe begins.

“We spent so much time fixing the bugs with Phase One; we didn’t even start Phase Two yet. We are a solid two months behind our original schedule. The good news is that we’re finally digging out. With some reassignments and the new planned engineering hires, we can get underway, if we nail down the scope. The focus of Phase Two is analytics and dashboards — this continues to be the priority, right?”

You respond immediately.

“I talked with all our customers, and they all answer ‘yes.’ With our current limited dashboard capability, they feel like they’re flying blind. On the one hand, as you know, the custom SQL queries we ran show that since launch the car buyer purchase cycle shortened at most dealerships, and conversion rates from lead to sale are higher. Anecdotal feedback from dealer sales reps and managers is all positive.”

“But the dealer principals don’t have enough visibility into their sales pipelines. They feel like they don’t have the data to manage their people properly. Most Internet sales directors and GMs are frustrated about that, even though they acknowledge that since converting to SparkAction CRM, their overall monthly sales are up.”

You and Joe double-click on the details of Phase Two — the resources required and the monthly milestones you want to achieve. The most important outcome is to build both single-store and multi-store dealer group dashboard views. Hierarchical prospect pipeline views, rolling up from rep to store to multi-store, are critical if you wish to sell to dealer groups.

On the top of a flip chart sheet, you write a short one-sentence summary of the strategic imperative for the product: “Launch Phase Two in August.” Right below that, on the left and the right of the sheet, you list two projects — a Data Layer Project and a User Interface Project. Under each of these, you identify a team leader and team members, then major milestones and timelines.

In the afternoon, you and Joe approach the sales scaling problem the same way. Up until now, the entirety of your revenue engine was you. It’s time to hire a proper head of sales, update the pitch deck and demo meeting plan, install Salesforce CRM, and begin to build out a dealer prospect list. You need to create a set of email nurture campaigns, plus hire a couple of account executives and sales development reps.

You and Joe debate what’s doable over the next six months, and render it into a one-sentence strategic imperative: “Hire VP Sales, Implement Tools, and Launch First Sales Pod by September.” Underneath on the flip chart, you list the crucial dates and milestones for each imperative.

La Costanera is the Peruvian restaurant just up the road. The food is outstanding. After a cocktail, your first course is creamy Kabocha squash soup, yucca balls in mustard sauce on the side. A tangy, consummately prepared dish of ceviche follows. As you enjoy each exquisite bite, you sip your Pisco Sour — that perfect Peruvian national drink, a concoction of Peruvian pisco, lime juice, syrup, egg white, ice, and Angostura bitters. You and Joe turn reluctantly back to the topic at hand while the sun slowly pours golden into the ocean.

It’s time to discuss organization design. You’ve never had a proper executive group with specific functional roles and responsibilities. Your growing company requires that you begin to be more formal about role specialization and hierarchy. As important as this is, it’s touchy. You both know that no matter what you decide — however you match names and roles — not everyone will be happy. By the time you drive back to the house on the cliff, though, you made the tough choices.

On the second day of your retreat, you and Joe collaborate to update the financial plan, identifying every expense and its timing, every sales hire, and every material assumption — from churn to sales ramp to sales hire failure rate. As you consider pricing and average contract value, you factor in the timing of Phase Two and Phase Three product launches. Working bottom up, you validate your monthly sales projections. The result is sobering. You realize you need to schedule a board meeting: the year-end revenue projection must come down considerably. The board won’t like that at all.

. . .

Decisions, decisions.

Every CEO must periodically make significant adjustments to organization design. Such modifications ensure full alignment with current needs and strategic direction. Changes to organization design are always a risk/reward calculus. On the one hand, you want your organization to align with the continually evolving reality of your market position and strategic imperatives. But on the other hand, a substantial organization change introduces disruption. New peer group relationships break down existing ones. Reshuffled teams and workflow groups and the introduction of new superior-subordinate relationships may wreak havoc for a time. Months of work may be required to correctly implement, stabilize, and optimize a new organization design.

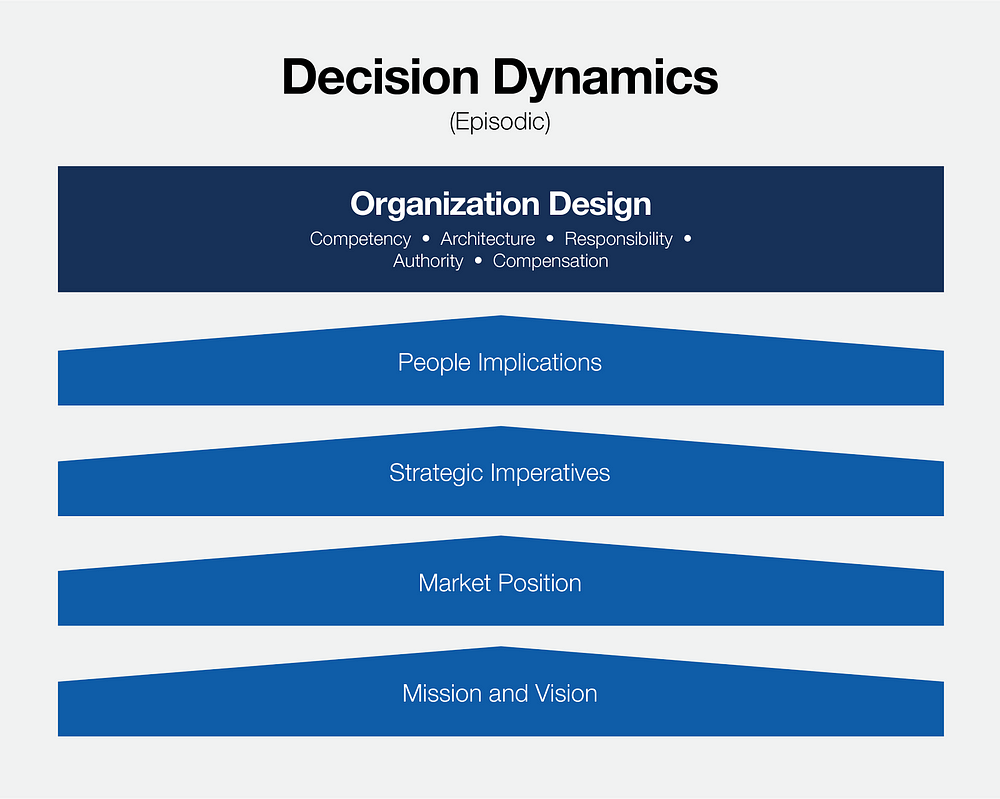

There is a natural decision sequence to determine required changes, depicted in the Decision Dynamics image, above.

Mission and Vision

You start at the bottom of the image and confirm that your currently articulated mission and vision remain valid. Mission and vision evolve as you scale. In the beginning, it’s a guess. With time, your guesses become more educated. Eventually, you begin to understand your real place in the ecosystem — both today and in the future. These insights help you update and refine mission and vision.

Market Position

Mission and vision guide you towards the future. But proper priorities emerge at least as much from an accurate understanding of your current market position. Nothing is more destructive to a company’s success than delusion. If your knowledge of market position isn’t deep and precisely accurate, you may identify the wrong strategic imperatives. Market position includes:

- Product/market fit

- Business model

- Competitive dynamics

- Degree of opportunity

First, ascertain product/market fit by answering two key questions.

- Can you economically sell your product?

- Once you sell the product, does your customer keep it and seek to buy more?

Conversion and churn metrics are the ultimate proof of product/market fit.

Second, your pricing, gross margin, and churn rate provide the necessary data to calculate average lifetime value. In a healthy business model, no more than one-third of your average lifetime value can be spent acquiring a new customer. What’s your LTV/CAC ratio? Unit economics is an essential indicator of market position.

Third, where are you relative to the competition? Is your source of competitive advantage so strong you are steadily gaining market share? Or are you in a dog fight? Or are you losing ground? Competitive dynamics are a critical factor in market position.

The fourth factor is the degree of opportunity. Is your market large or small? Are you the only entrant and your job is to evangelize a new way of doing things? Or are there many competitors and your mission is to establish a value superiority via feature or price advantage?

Your assessment of market position anchors all future decisions. To act with confidence, you need both data and an intimate, personal connection to the market.

Strategic Imperatives

Once you have market position clarity, you move on to determine your strategic imperatives. Especially in the areas of product, revenue engine, workflow optimization, and funding, what building blocks must you put in place in the next six to nine months?

People Implications

Each strategic imperative has people implications. Determine what they are. Do you have the right people? Do you have the people resources necessary to execute your strategy? What degree of organizational change do you need? What degree of collaboration? How does company stage impact what’s possible? Inform your thinking with multiple inputs from customers, the board, the executive group, management, and individual contributors. Be open to the influence of many voices, while keeping a focus on the strategic imperatives.

Organization Design

People implications will finally lead you to the doorstep of organization design. Competency, architecture, responsibility, authority, and compensation are the key consideration factors here. Compare the people you need to the people you have. Determine the necessary changes. Organize roles into a clear organization structure and place them into appropriate workflow groups. Define the interdependencies. Then assign specific responsibility for each role and delegate authority as necessary. Finally, ensure that compensation for each role is in alignment with intended incentives and priced to market.

With your design fully documented, devising the rollout plan is next. Starting at the top of the organization, create a packet for each employee including a job description, critical six-month objectives, and compensation. Then, develop talking points. Cascade your rollout throughout the organization in an orderly fashion, providing each superior with the packets and talking points necessary to convey clarity. Ensure that you give adequate time for your conversation with each employee.

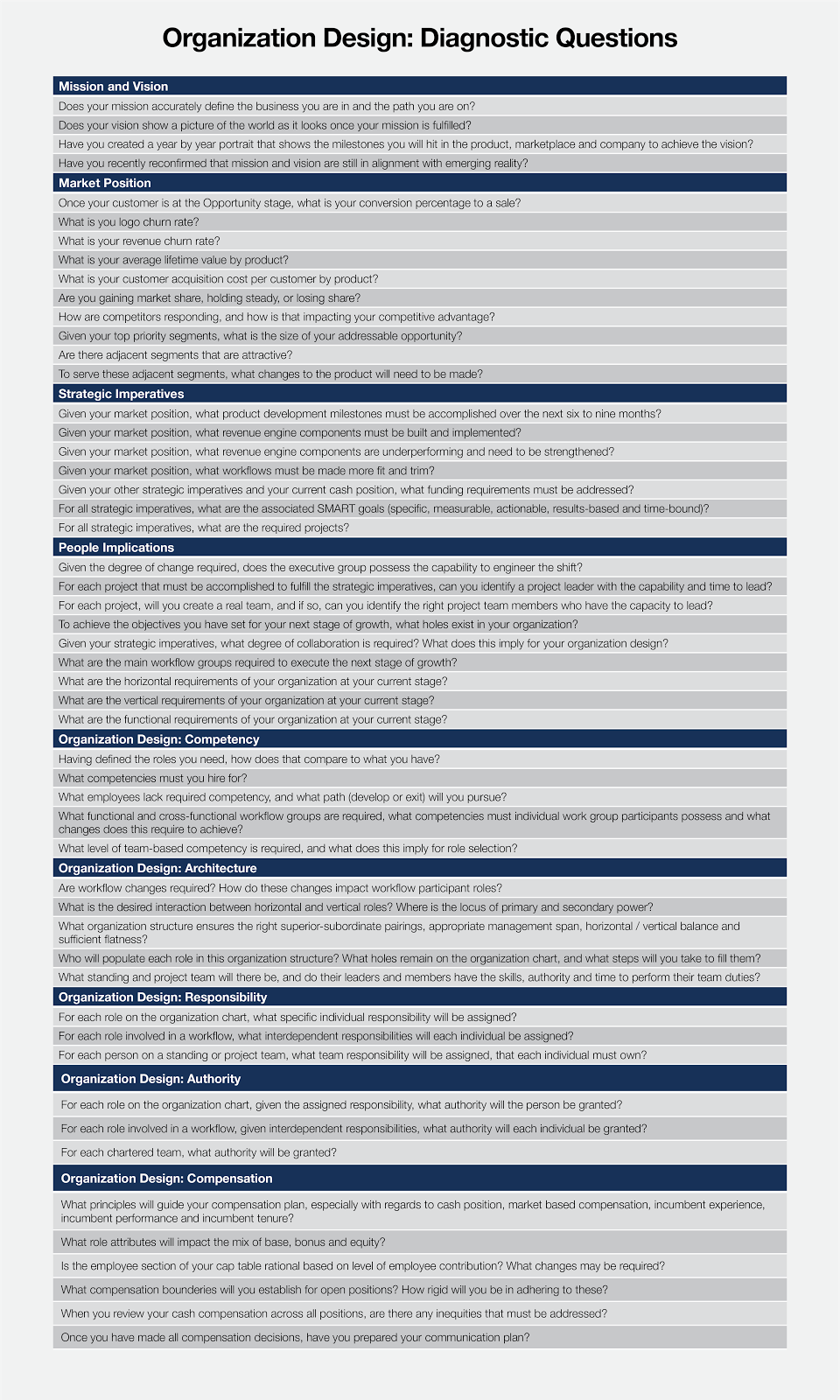

The following diagnostic questions guide decision dynamics:

In future chapters, we explore organization design in greater depth.

. . .

The toughest decision you faced was the VP Product role. Both Beatrice and Vijaya proved to be outstanding senior product managers. There is a saying that great design goes through three stages: from simplistic, to complex, to simple — and the journey to simple is hard. In the design of the user interface, Beatrice was a creative dynamo, and she created “simple.” The workflows and user interface design for both the mobile and desktop versions are masterful: easy to use but comprehensive. There can be no question that Beatrice’s obsessive perfectionism yielded a best-in-class product design.

But the VP Product role requires a combination of strategic competency, executional discipline, and interpersonal effectiveness. While a maestro on the first two, Beatrice shows some weaknesses in her collaboration skills. When she makes up her mind, she tends to defend her point of view fanatically. She is sometimes dismissive of the other’s perspectives. In the VP Product job, business trade-offs regularly need to be made between the ideal and the achievable. Beatrice’s perfectionist streak is a significant advantage, but in a more senior role could hamper her pragmatism. Meanwhile, Vijaya shows strengths in the strategy and execution domains — including advanced capabilities in thinking through the data layer, integrations, and the microservices design from the bottom of the stack to the top. She brings with that technical sophistication a more collaborative and pragmatic style to her leadership than Beatrice.

In the end, you decide.

Joe is now Co-Founder and VP Engineering. Vijaya gets the VP Product role. Bill’s title is VP Customer Success, at least for now. Having a technical lead in this function makes sense since Bill is good with customers and has the skills to design automation into the launch and customer maintenance workflows wherever possible. You decide to conduct a search for a VP Sales and a VP Marketing. The temp CFO service continues to manage Finance and HR for now.

Formal job descriptions emerge for each role, defining assigned responsibility and delegated authority. Each position includes a compensation plan. You bring prepared packets into every conversation. You meet face-to-face with all fifteen people in the company, going through their new role, reporting relationship, and expectations going forward.

Two conversations prove particularly difficult. Beatrice assumed she would be VP Product. She’s shocked. She comes close to quitting but after a series of discussions — including a breakthrough meeting with you and Vijaya — she grudgingly accepts her new reporting relationship. As to Farook, he expected a senior director title. One loud, salty exclamation made that abundantly clear. But he settles into the “senior architect” title, pleased with the size of his options grant.

With all organization changes announced, you turn to the VP Sales and VP Marketing searches. You also initiate a search for the nine other open positions you identified. So much to do and not a moment to lose.

You complete the new hires in two months. Victor, the new VP Sales, is sharp and in the zone. He begins by architecting and implementing the information infrastructure in Salesforce. He wastes no time in preparing to hire the first sales pod. Serena, newly appointed as VP Marketing, is a beacon of optimism and a dynamo of creative energy. Half of your office is full. It sounds like a beehive. Last time you heard this buzz, your company was spinning out of control. Now it’s different. Workflows are still shaky, and everything is nascent, but this time the chaos feels purposeful.

. . .

Please visit us at CEOQuest.com to see how we are helping tech CEOs of growth-stage companies achieve eight-figure exit value ($10m+).