The bottom line is the bottom line. Deal or no deal?

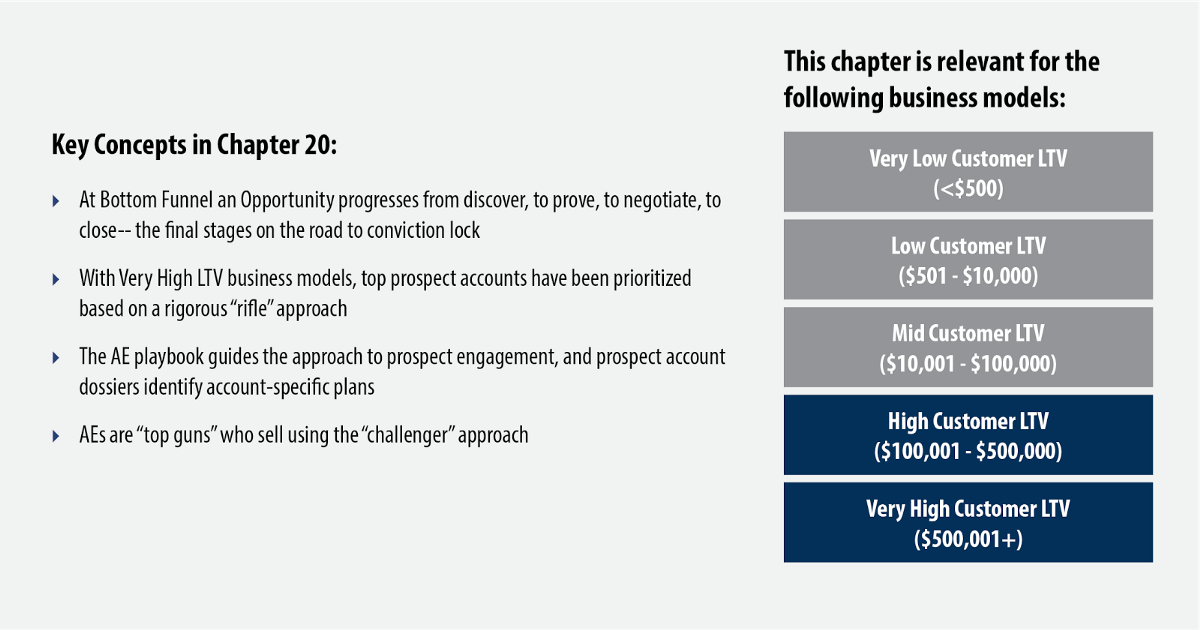

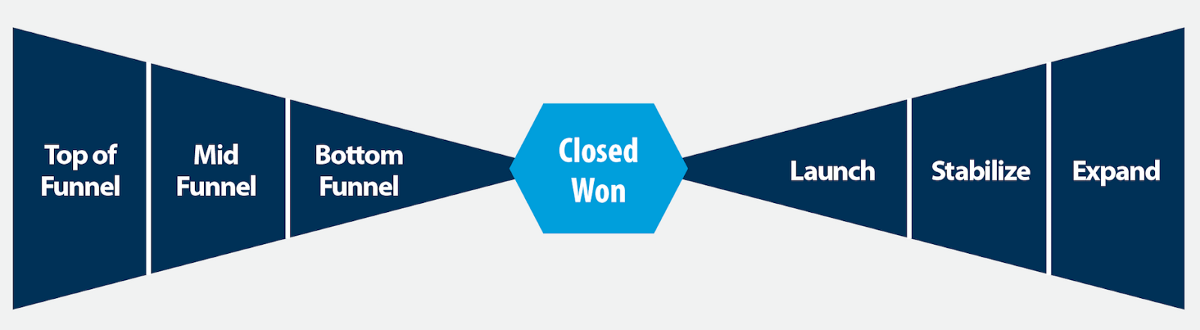

This chapter concerns the Bottom Funnel domain of the Bow Tie:

It took a lot to get to the “opportunity” stage. Now it’s time to finish strong. Great sales teams execute the journey from “opportunity to closed won” with a runner’s kick. The key, of course, is to complete the journey to conviction lock (“I’m convinced. Sign me up.”). Painstaking preparation results in strong execution, which results in the deal. Time and time again.

The sequence of steps from “opportunity” to “closed won” varies based on business model. For the Very Low LTV business model, it’s all automated — from the login page to inventory pages to shopping cart to “confirm purchase” page. For a Low LTV business — for instance, a B2B SMB SaaS business — a single demo leads to a trial close, with a follow-up call to finalize only if necessary. For a Mid LTV business, 2–3 meetings may be required to move from “opportunity” to “closed won.”

In this chapter, I’ll focus on the High and Very High LTV business models. These are the realms of the complex enterprise sale.

There are five building blocks to a successful enterprise sales strategy:

- Rifle prioritization

- Playbooks

- Prospect dossier

- Challenger sales approach

- People

Rifle Prioritization Model

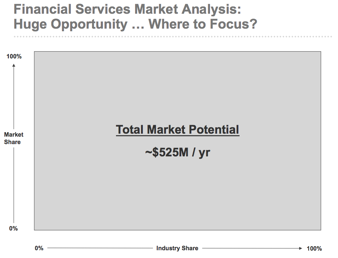

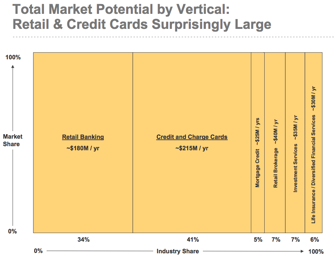

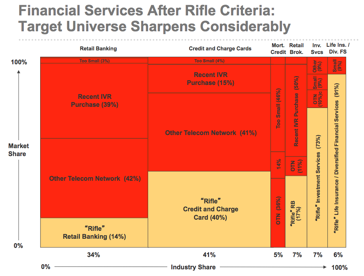

Vinod Khosla of Khosla Ventures developed what he refers to as the “rifle” prioritization model.¹ This model provides an analytically rigorous method for determining where to focus enterprise sales investment and effort. Ideally, all the data points necessary to conduct this analysis are accessible from previous work in the development of your segmentation scheme (see Chapter 4 — Customer Segmentation).

Khosla summarizes the rifle prioritization model in four slides:

Notably, segments are first prioritized by market potential. Then within these segments, sub-segments are assessed via a weighted numerical assessment of attractiveness, considering six criteria:

- Sales model required

- Marketing model required

- Decision-maker attributes

- Competition level

- Product requirements

- Market size

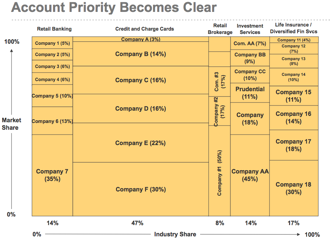

The resulting top-priority sub-segments are further analyzed to determine the companies within the sub-segments that offer the most significant opportunity. The same rifle criteria are applied at the company level.

This analysis results in a small number of high priority companies (20–30). These companies demand a sharp focus and an intense, multi-dimensional, multi-person engagement approach.

The rifle approach fits well with account-based marketing (ABM).

Account-based marketing has evolved to a company-wide approach called account-based everything (ABE) as coined by leading research and advisory firm TOPO.² In account-based frameworks, with a prioritized and limited set of prospect accounts, you can engage the right people in the right companies with a focused attack plan.

AE Playbook

The AE’s Playbook (see Chapter 16 — Messaging Schema) contains all an AE must know to be prepared to engage an enterprise customer.

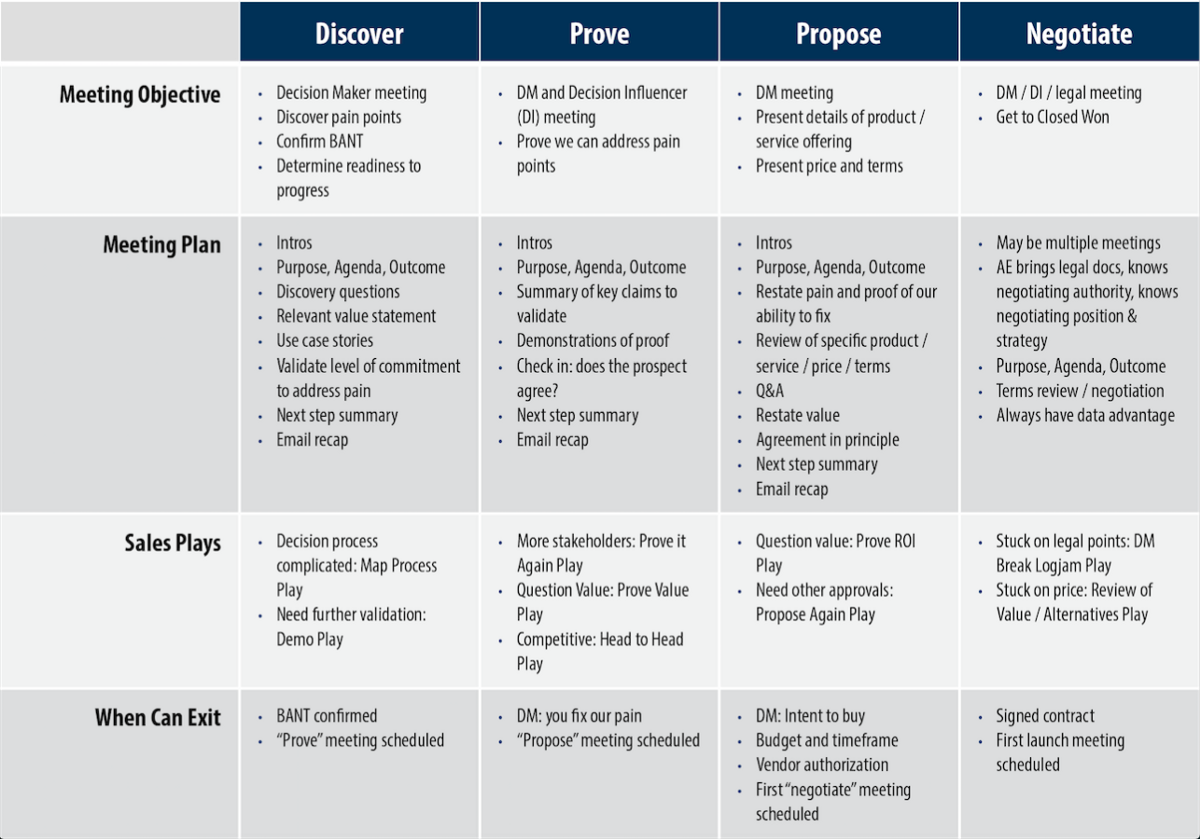

Here’s how meeting plans and sales plays chart the journey from “opportunity” to “closed won” through the discover / prove / propose / negotiate steps:

At Bottom Funnel, the sales engineer is often the AE’s best friend — in attendance at all opportunity stage meetings, ready to answer any technical concerns raised by the prospect.

Prospect Dossier

With 30–40 strategic prospects, you can now turn to the development of your prospect dossier for each.

The dossier includes a pain point thesis, the history of interactions, decision requirements, the organization chart, the key player profiles and an engagement plan.

Pain point thesis

- What are the specific points of pain within this company

- What is the impact of the pain, both short-term (tactical) and long-term (strategic) on the company

- What are the tactical and strategic impacts if the company buys our product / service

History of interactions

- Indicators of interest (leads data: number of leads; number of contacts engaging; recency and frequency)

- Past correspondence

- Past product usage

Decision requirements

- Contract signer

- Decision maker(s)

- Decision influencers

- Product users

- Blockers

- Company decision process (detailed map of the steps)

Organization chart

- Entire hierarchy down to the decision influencer level

- Location on org chart of the users of our product / service

- Key players highlighted and color coded by role

Key player profiles

- Name

- Title

- Role in decision

- Relevant responsibilities

- Motivations

- Persona

Engagement plan

- Who / what / when steps, with outcome objectives

- Your plan to move the account through the discover, prove, propose, and negotiate steps towards the “closed won” stage

The completion of a dossier requires data and significant research. If you see a pattern of increased lead activity from multiple people at your target prospect company (such as white paper downloads), that may signal active interest. Trade show booth visits, correspondence, and SDR notes are also important parts of the data set.

But raw intelligence gathering is necessary too. In the enterprise sale, it’s highly valuable to identify and cultivate a “mole.” A mole is someone who is “on your side” but sits inside the prospect company, with enough visibility to give you insight. A mole can help you firm up your pain point thesis, decision requirements, organization chart and key player profiles.

Challenger Sales Approach

The sales and marketing consultancy firm CEB researched the sales performance of thousands of sales executives across hundreds of companies. The company found that salespeople fall into one of five profiles, captured in the book The Challenger Sale by Brent Adamson and Matthew Dixon:³

- The hard worker

- The lone wolf

- The relationship builder

- The problem solver

- The challenger

The research found that particularly in complex enterprise sales, the challenger profile performed substantially better than all other profiles.

Forty percent of high sales performers used the challenger approach and more than 50% of all-star performers fit this profile.

So what exactly is the challenger profile?

Challengers are intelligent and confident — bordering on arrogant. They know so much about their customers, companies and markets — and the product they sell — that they can and do engage their customers in contentious debate. A challenger sales exec seeks to provoke a paradigm change in the prospect such that the prospect gains a new insight leading to a reframing of the current state and desired future.

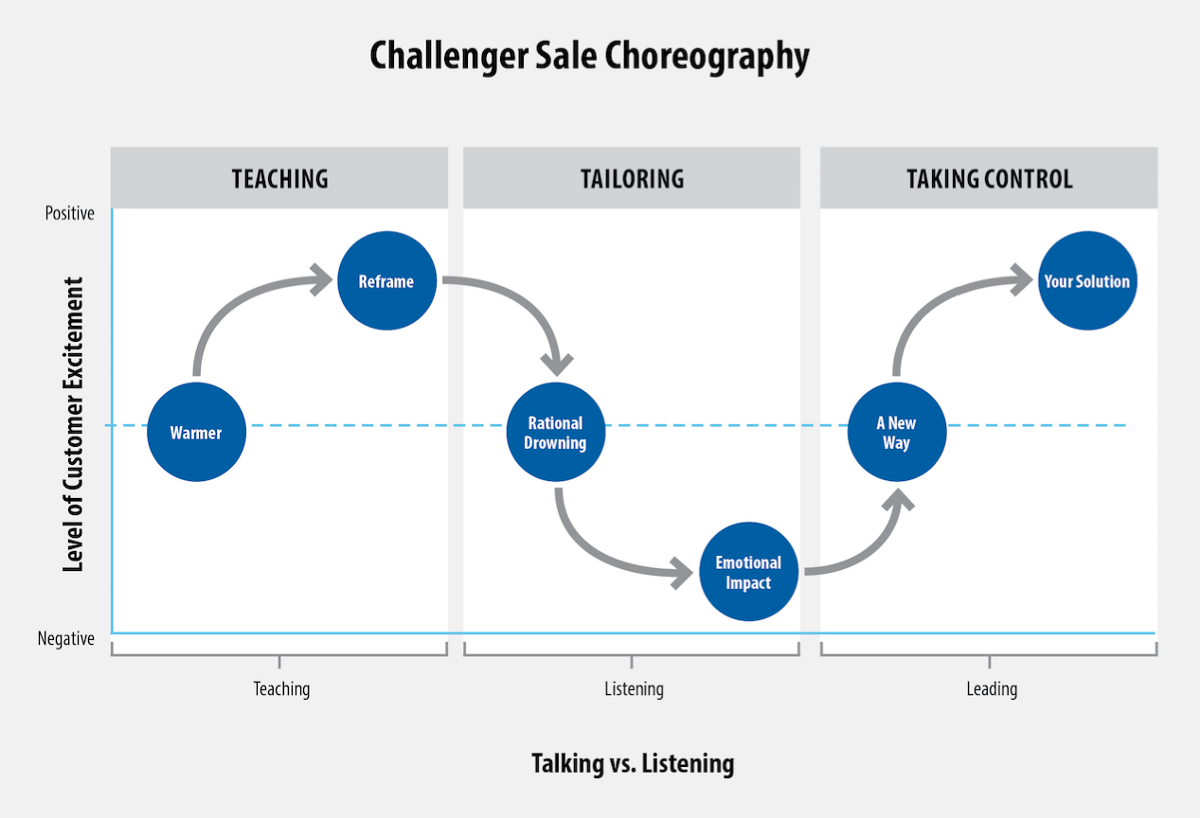

The challenger takes a prospect through an emotional journey that looks like this:

Source: The Challenger Sale, Adamson and Dixon

So how does this challenger approach align with the “opportunity” to “closed won” journey (the discover / prove / propose / negotiate steps)?

In the discover meeting, the challenger starts by first confirming BANT, the prospect’s pain points, issues, and opportunities. Next, the challenger frames these in a new light. Reframing paints a picture of an alternative future for the prospect, where pain points are relieved and new ideas emerge. This teaching phase seeks to move the prospect rapidly to the “aha” moment, where the prospect begins to see a potential future free of pain and filled with opportunity. The first goal is simple: the “aha” moment. This step is significantly advanced if the company has built a sales ready product (SRP).

This teaching phase leads into a tailoring phase. Using the discover / prove / propose / negotiate steps, this may occur in the second meeting — the provestep. Here, the challenger asks “leading the witness” questions, encouraging the prospect to acknowledge how difficult life is with these pain points, and how risky the future looks if they continue unresolved. The challenger’s goal here is to listen, learn, and build constructive tension.

In the prove step, the challenger takes control. All decision stakeholders move through the proof points that justify the claims made about the pain relief capabilities of the proposed product / service. Depending on the complexity of the sale, there may be multiple such meetings. With proof points confirmed and accepted, the challenger moves on to the propose step, laying out terms and persistently moving the conversation away from price and back to value.

Finally, the challenger works through the negotiations in the negotiate step. Here, the challenger moves the prospect to conviction lock (“I’m convinced! Sign me up!”), ending in a “closed won” deal.

In an enterprise sale, the four steps (discover / prove / propose / negotiate) often must be revisited multiple times at several levels to help decision-makers and decision-influencers achieve internal consensus and create momentum towards a deal. The engagement plan anticipates this iterative, multi-stakeholder sales motion by laying out a path for effective execution.

People

Like fighter pilots, it all comes down to the people. Are your enterprise sales executives top guns?

- A top gun is wicked smart. You can’t engage in a productive debate with a smart, confident senior executive prospect if you don’t possess high intelligence.

- A top gun is confident, bordering on arrogant. She fully believes she understands the customer’s problem better than the customer.

- A top gun is emotionally intelligent. He can read reactions and sense power relationships. Using these insights, he can adjust his approach to optimize his position.

- A top gun is thoroughly trained. She deeply understands the product and has committed to memory the key components in the messaging toolbox.

- A top gun is genuinely prepared. He has studied the prospect dossier. He helps to architect the engagement plan and knows how to execute it. Before each meeting, he has assembled all necessary data and support tools and has researched the profiles of every attendee. He is exacting in his knowledge about how to manage the agenda for each meeting and how to lead towards a defined outcome objective.

- A top gun is competitive. She wants to win. She wants to post bigger results than every other enterprise sales executive, every time.

- A top gun yearns for recognition. When excellence is achieved, he expects public accolades from top leaders.

- A top gun is well-paid. Depending on deal size, complexity and domain knowledge requirements, a top gun may earn from $300K OTE to $500K OTE or more, with upside.

To build a team of top guns requires the following:

- A highly promising, competitively advantaged product / service offering

- A VP sales to whom top guns will look up to and learn from

- Rigorous recruitment practices

- Market-based compensation programs

Role of the CEO:

The CEO is the hub of the enterprise sales wheel. She must ensure the rifle analysis is precisely accurate, resulting in the prioritization of the right prospect accounts. In best practice High LTV and Very High LTV companies, the CEO is directly engaged in the development and execution of prospect engagement plans. For example, early on in his company, Geoff Nudd, CEO of ClearCare, held a weekly meeting with his VP sales to review the status of each of the company’s top 10 industry prospects. Within an 18-month period, 9 of 10 had purchased his product.

Role of the VP sales:

Who’s your Viper? In the movie Top Gun, Viper was the commander and chief instructor of the US Navy Fighter Weapons School (aka the “Top Gun School”). He oversaw the classroom training and led the training sorties, taking the pilots through engagement after engagement to hone their skills and prepare them for the real thing.

If enterprise selling is key to your company’s success, then your VP sales is your “Viper.” Your “Viper” should be the ace of aces. And must be a “best in class” developer of top gun talent.

The VP sales and CEO partner together to oversee sharp enterprise sales execution. The VP sales drives weekly oversight, always ready to jump right in if the situation requires it.

Summary

Effective enterprise selling is a game-changing competency. If one new deal is worth $500,000 or more, 200 could make you a public company. As CEO, it’s on you to build the team capable of making that happen.

Design for excellence, and execute accordingly.

. . .

If you would like more CEO insights into scaling your revenue engine and building a high-growth tech company, please visit us at CEOQuest.com, and follow us on LinkedIn, Twitter, Facebook, and YouTube.

. . .

Notes:

- Vinod Khosla. “Project Rifle: A Quantified Decision Making Approach.” Slide deck. khoslaventures.com. March 1, 2010.

- Tom Scearce. “The Account-Based Everything Framework.” Blog post. blog.topohq.com. n.d.

- Matthew Dixon & Brent Adamson. The Challenger Sale: Taking Control of the Customer Conversation. New York: Penguin Group, 2013. Print.