Precise pricing powers profit.

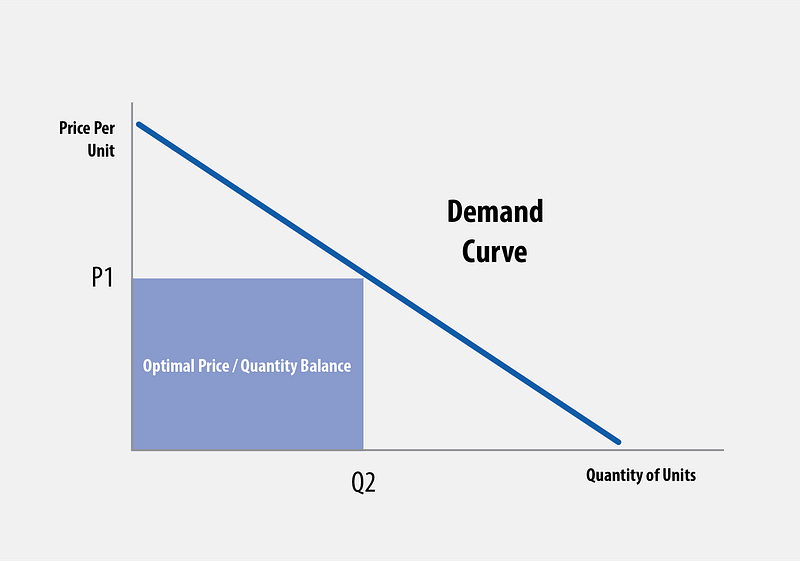

In Microeconomics 101, you learn that companies should price to maximize the area under the demand curve:

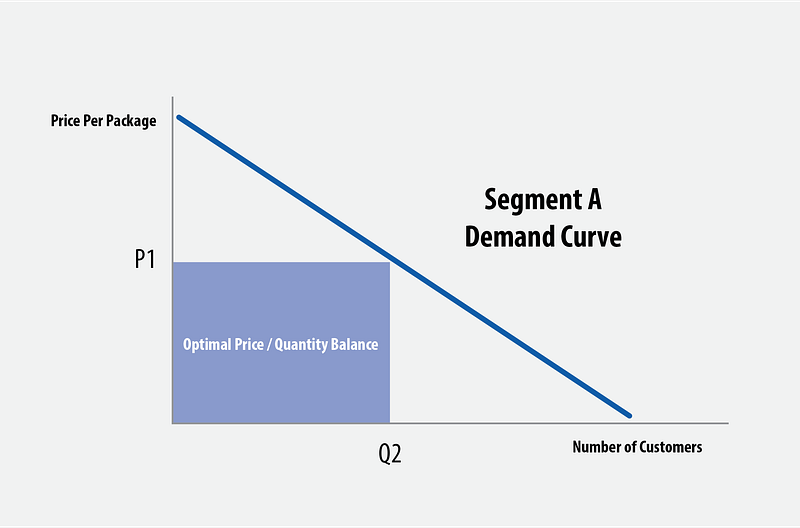

Demand curves should be estimated by segment. For a SaaS product, the x-axis (“Price per Unit”) becomes “Price per Package,” with Package indicating the average package for the segment (made up of a defined quantity tier). The y-axis (“Number of Units”) becomes “Number of Customers,” like this:

Estimating the demand curve is about estimating price sensitivity. In the case of an annual subscription for a consumer product, demand at $49 a year might be 40% greater than demand at $59 a year. Whereas with a large enterprise sale, the difference in demand between a $5M a year price and a $6M a year price might be modest.

Since you want to capture maximum value, understanding the relationship between price and demand is critical.

Segment-specific market dynamics will cause demand curves to vary. Sometimes they are very flat — where a slight change in price significantly affects the quantity. Flat demand curves are more likely at lower price points, or where competition is high and competitive pricing is visible. Commodities, airline tickets, and many online consumer and SMB subscription products all show flat demand curves. Sometimes they are steep — where demand is relatively insensitive to price. This is more likely to occur at higher price points, particularly when competitive alternatives are not obvious. Mission critical enterprise systems often fit this description.

What drives the slope of the demand curve? Here are the factors:

- The degree of pain experienced

- The economic value of relieving that pain

- The competitive alternatives, and price visibility of alternatives

- Ability to pay

- The personas of the buyer, influencers, and users

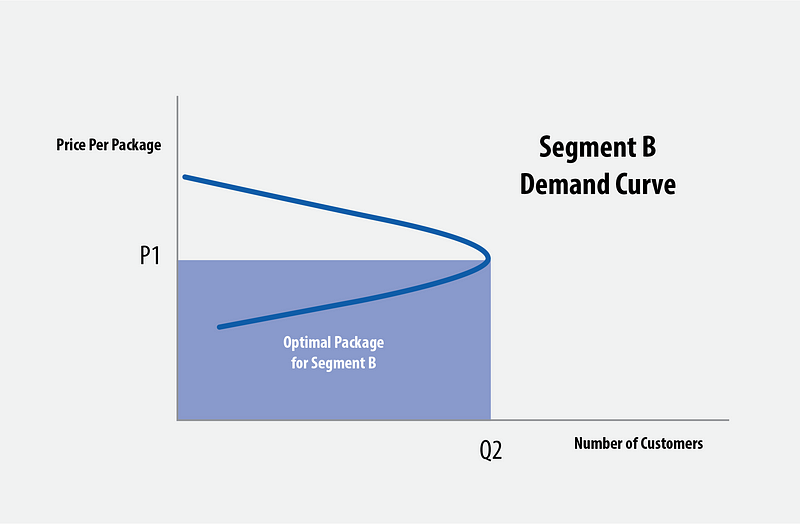

A dynamic that is often seen in enterprise SaaS products is demand curve inversion. Buyers may exhibit declining demand above a certain price point, but also below a certain price point. This makes sense: a buyer may perceive that if the price is too low, the vendor will not be able to provide adequate levels of customer support nor guarantee key Service Level Agreements (SLAs).

Such a curve looks like this:

Since demand curves may vary by segment, it is sometimes possible to differentiate pricing by segment to take advantage. But this only works when sufficient segment separation exists (e.g., national boundaries — higher price in Canada than the US). The buyer in a high price segment won’t take kindly to seeing similar customers in an adjacent segment receiving a lower price, so be careful.

Airlines have figured out how to get away with significant segment-based price variation for the same product. The weekday warrior business traveler segment pays top dollar. The consumer traveler pays a lot less, if and only if they include a Saturday in the trip (the normal family vacation / weekend getaway use case). Airlines have succeeded in capturing additional volume at a lower price without driving down the high paying customer segment’s price. If you choose to vary price by vertical or use case segment, find some credible basis of price differentiation, as the airlines have done.

Another example of segment-based price variation is in B2B software. Some software companies price on-premise software implementations differently than hosted implementations, even though the product architecture is the same.

Your determination of the demand curve will be an educated guess. But there are practical steps you can take to ensure more “educated” and less “guess.” For each of your top priority segments:

- Calculate the financial ROI of your product at different price points

- Plot competitor pricing on a graph

- Assess your degree of feature advantage vs. competitors

- Consider the references your customer will use to price compare — i.e. “my ERP costs this much per month, therefore this CRM should cost less”

- Assess ability to pay — are there natural price ceilings?

- Determine whether there are persona-based factors that might impact your assessment of the demand curve: for instance, are your buyers innovators, early adopters, early majority buyers, late majority buyers or laggards?

To get further clarity on price sensitivity in your top priority segments, ask your prospects reference questions:

- “Would you expect our product to cost more or less per seat than Salesforce.com? How much more / less in percentage terms?”

- “Here is our product. Here is adjacent category Product B. Which would you expect costs more? “

- “If you had to choose our product with ‘abc’ features for $1000 a month, Competitor B with ‘bcd’ features for $1500 a month, Competitor C with ‘def’ features for $500 a month, or Competitor D with ‘ghi’ features at $2000 a month, which would you choose?” (Conjoint Analysis)

Steve Blank, in The Four Steps to the Epiphany¹, suggested the following two questions:

- If I gave you this product for free, would you take it?

- If I charged you $1 million a year for the product, would you buy it?

Blank asserts that answers to these two questions (such as, “What are you, crazy? I’d never pay more than $400,000 per year.”) will provide insight into the customer’s price sensitivity.

Ask enough of these questions to enough customers, and patterns will emerge. Once you have plotted the curve, you can quickly determine the price / quantity / commitment package that seems optimal for the segment. Before full rollout of any pricing scheme, your “educated guess” must be tested with a sample, iterated, and optimized.

Price to Penetrate

If you are an early-stage startup, customer acquisition is vital. You can’t allow the price to be the barrier to adoption. So all things being equal, lower is better. Of course, the degree of pain, the level of competition and competitor price points, the degree of market momentum and excitement about your company and its technology could lend you more upside. But step cautiously.

The more you are disrupting an existing market (replacing existing competitors) v. creating a new market (green field), the more you’ll need to undercut the competition to win big.

Even if you’re creating a new market, a premium pricing strategy increases incentives for competitors to enter.

In the marketplace space, (Airbnb, Expedia, eBay, etc.) a common pricing scheme is called “the rake.” The marketplace platform company charges a percent of the gross value of the transaction that was executed on the platform — that’s called the rake.

Bookings.com is Europe’s version of Expedia.com. It’s a big part of parent company Priceline. At the time Bookings.com entered the market, the prevailing “rake” was 30%. Bookings.com priced their rake at 10%. This was a bold strategic move, and it proved decisive. Merchants flooded to Bookings.com, creating a more compelling consumer experience, which in turn created a happier merchant, in a virtuous upward cycle. It was only many years later, with the marketplace fully established, that Bookings.com introduced a prioritization scheme where merchants could bid up the rake in return for more preferential visibility. The result is that Bookings.com’s rake is now estimated to be above 30%.

Bill Gurley, in a blog titled “A Rake Too Far: Optimal Platform Pricing Strategy,” applauded the strategy:

“You start with a low rake to get broad-based supplier adoption, and you add in a market-driven pricing dynamic that allows those suppliers who want more volume or exposure to pay more on an opt-in basis… This also allows you to extract more dollars from those suppliers who desire to spend more to promote themselves (without raising the tax on those that don’t).”²

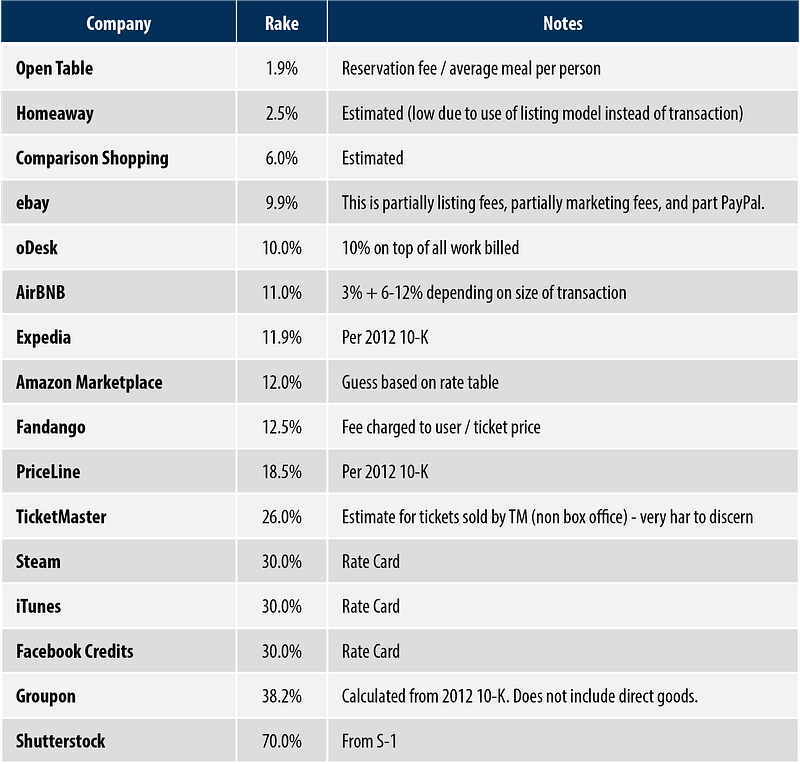

In the same blog, Bill notes the estimated rakes for various marketplaces:

Despite Bill Gurley’s rave reviews, it would be wise to proceed with caution here. With rakes so high, are Bookings.com, Groupon, Shutterstock, and perhaps even Facebook and iTunes opening the door to competitors by creating a big incentive for customers to seek alternatives?

Price to Expand (Upsells / Cross-Sells)

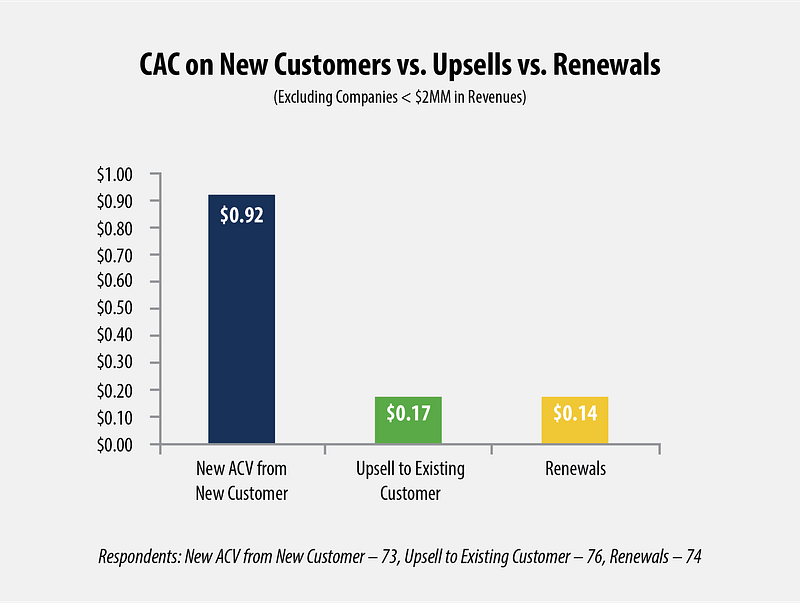

David Skok, in his blog “Pacific Crest’s 2013 SaaS Survey”³, shows the difference between the Customer Acquisition Cost (CAC) per dollar of Annual Contract Value (ACV) for a new customer and a renewal or upsell:

Given its cost efficiency, a pricing and packaging scheme that is optimized for expansion is powerful. There are multiple methods available to accomplish this:

Usage-based pricing, with tiers

- # of units multiplied by the price within a range of use; the price point goes down as you move upward through the tiers

- A risk of this approach is that there’s as much flexibility to reduce as to expand usage

Annual commitment to a capped quantity tier, with overage charges

- Has the benefit of capturing the price for 100% utilization regardless of actual usage

- As usage rises above the cap, there’s an automatic overage charge for the above-cap quantity (does not require that you upsell the customer)

Cross-sell products

- A la carte product offerings create expansion potential

In my work with tech startups, I have observed that in many SaaS companies, 50% — 70% of revenue growth comes from expansion revenue. So, design your pricing and upsell strategies to take advantage of this critical leverage point.

Mitigate Introductory-Phase Risk

Demand is impacted by the customer’s perceived risk. Customer risk is higher at the beginning of the product purchase cycle. For this reason, it is not uncommon to see risk-mitigation introductory pricing. Freemium, free trial, pay per use and Proof of Concept pricing are methods to encourage initial trial.

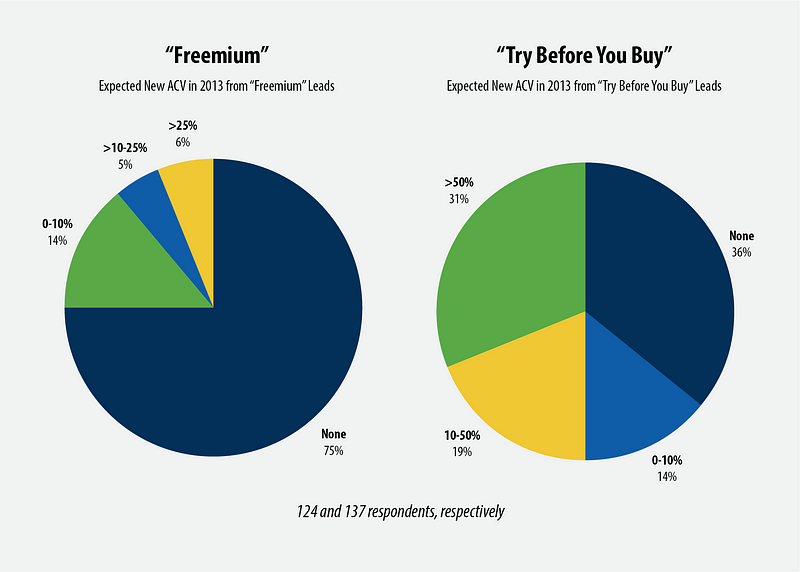

The Pacific Crest Survey (focused exclusively on SaaS companies) notes that about 25% of companies surveyed made use of Freemium with modest revenue results; Try Before You Buy (free trial) was used by 2/3 of all companies and drove significant revenue impact:

The “Try Before you Buy” approach makes sense because:

- It attracts high-quality prospects who expect to “pay-up” if interested

- Given a high conversion rate, companies can invest in customer success

- The cost to the company is contained since non-paying prospects are timed out — typically after 30–45 days.

Get Annual Cash Up Front

Annual contracts are better than month-to-month contracts. Cash up front is better than month-to-month billing.

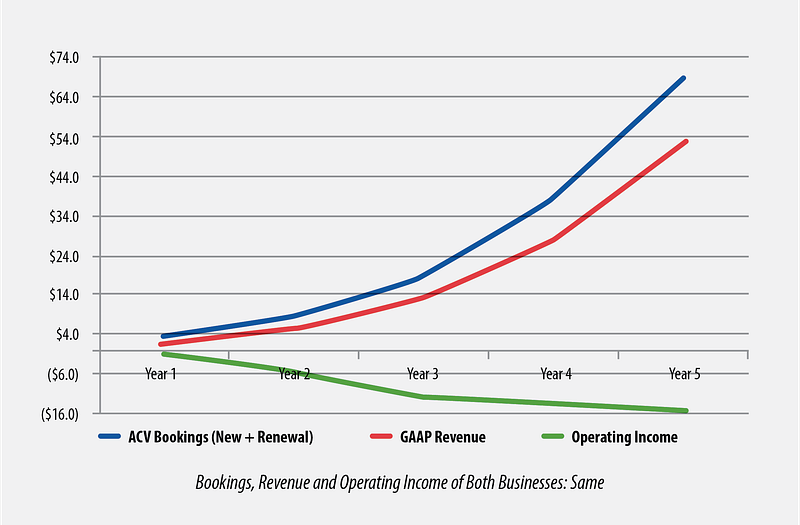

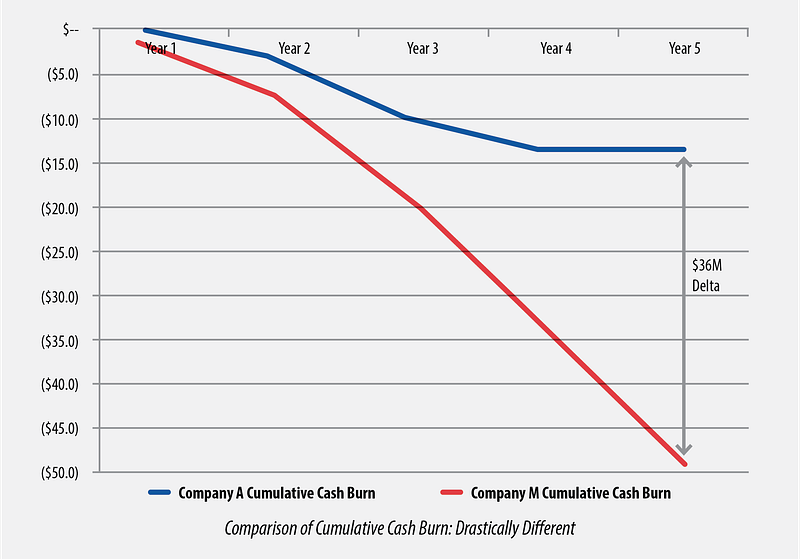

It’s hard to overstate the significance of cash up front to your company’s future success. Without cash upfront, there is an enormous funding requirement. This is at best dilutive, and under more precarious performance scenarios could be deadly. Nino Marakovic, from Sapphire Ventures, in a TechCrunch article on Jan 12, 2015, titled “Getting More Cash out of SaaS: Timing is Everything”⁴, created the scenario of two identical SaaS companies whose only variation was annual cash up front vs. paid monthly. Both companies shared the exact same GAAP bookings, revenue, and operating income:

But Company A required annual cash up front. Company M billed monthly. Here’s the cash effect:

In the example, the increase in cash required to support the monthly pay model — i.e. funding — was $39M.

If possible, require annual commitments, and get cash up front. But be prudent. If cash up front creates too high a hurdle given the competitive environment and intensity of demand, your best choice may be a month-to-month payment schedule.

Keep it Simple

You might have the most sophisticated “maximize the area under the demand curve” pricing model in the history of mankind. However, if it’s not simple it’s dead on arrival.

For instance, Oracle databases are priced by the number of processors. Salesforce is priced by the number of seats. Make it simple.

Essentially, pricing simplicity features the following:

- The unit of pricing is relevant to the product you offer and the customer segments you serve and is familiar to your prospects

- Alternative packages are clearly and rationally differentiated

- There aren’t too many alternatives: three to five is a good range

For a B2B SaaS company, it might look something like this:

Summary

These pricing considerations all come together in the design of your pricing scheme. Throughout this review of pricing and packaging, we have excluded from pricing design the gross margin of your product. While it is true that high software margins must prevail for a startup (the Pacific Crest study showed the median margins at 76%), smart pricing decisions are always “outside in.” Make your pricing segment-centric; let gross margin be an outcome, not a decision driver.

There you have it. If you can price to maximize the area under your demand curve, price to penetrate, price to expand, mitigate introductory-phase risk, get your annual cash up front, and keep it simple, you will have built a market winning pricing scheme.

Price to perfection; the results will be priceless.

- Steve Blank, The Four Steps to the Epiphany, 2006

- Bill Gurley, AboveTheCrowd.com, “A Rake Too Far: Optimal Platform Pricing Strategy,” April 18, 2013

- David Skok, “2013 Pacific Crest SaaS Survey,” forentrepreneurs.com

- Nino Marakovic, “Getting More Cash out of SaaS: Timing is Everything,” TechCrunch, Jan 12, 2015

Thanks to the terrific manual