While the value of public companies has grown from 105% of GDP in 1996 to 136% today, the number of these firms has been cut in half — from 7,322 to 3,671. Fewer, bigger companies are public. The number of new IPOs has similarly fallen; there were 160 US IPOs in 2017 compared to 624 in 1996. The decline in the number public companies and IPOs can be explained by rise of private equity, hedge funds willing to invest in private companies, and tightening public company regulatory requirements. These factors have changed the liquidity path equation for boards and CEOs.

But public companies are important. Valuation multiples in the public market provide the foundation for all other valuations — from late stage private equity, to growth stage VC, to early stage VC, to seed and all the way to angel. And public company status provides sufficient benefits to attract the most exciting high growth companies.

If you are able to build sufficient scale and momentum, an IPO exit becomes a viable company liquidity option for you. Going IPO brings many benefits. The company’s stature rises. Valuation multiples are superior. Access to cash from both equity and debt becomes easier. But it also brings challenges and risks. The process is onerous, time-consuming and costly. Regulatory requirements are stringent, and punishments for non-compliance can be significant. So the decision to go IPO should not be taken lightly.

In this chapter, we will address the following:

- To IPO or not to IPO

- CEO gut check

- Preparation for IPO

- The IPO process

- Cost of going IPO

- The public company life

To IPO or not IPO

Most weeks, one or more companies goes IPO.

Why? Given the cost of money and time, the consumption of CEO and top team focus, the loss of control, the loss of privacy and other downsides, what justifies taking this huge, virtually irreversible step?

Despite its downsides, public company status delivers many powerful benefits. Due to increased transparency and liquidity, the public markets generally display superior valuation multiples. In a public offering, significant amounts of capital can be raised. Shareholders can reduce positions or cash out (after the appropriate holding period). The company can obtain substantial funds to power growth initiatives, reduce debt, acquire companies or invest in R&D. And since the stock price is set by the market, it becomes easier to include stock in future acquisitions, preserving cash. Furthermore, public company status brings prestige to your brand, strengthening its market position and elevating its attraction for prospective employees.

However, the IPO path is not for the faint of heart. It’s filled with complex requirements, and involves substantial costs and risks. Any company that can reasonably consider IPO has other exit alternatives. There may be strategic acquirers large enough to absorb the transaction. And the private equity alternative is viable. Both of these exit paths are much simpler than going IPO. IPO wins out if and only if management and the board are convinced the company’s story is so compelling and the difference in valuation multiples so significant that it’s worth the risks, hassle and expense.

Here are some key questions to ask:

- Have you reached meaningful scale (usually more than $100M revenue)?

- Are you profitable or do you have a clear path to profitability within the next eight quarters?

- How compelling is your traction story? Is growth accelerating? Are your unit economics (LTV / CAC) strong and improving? Has your growth been steady?

- How compelling is your opportunity story? Is continued growth predictable and compelling, given trends? Do you have sustainable competitive advantage? Is the market large and expanding? Do you have lots of room to grow?

- How world class is your management team?

- Have you built the systems and controls necessary to execute on the stringent regulatory reporting requirements that come with being public?

- Do you boast a strong brand with a solid market reputation and a large fan base?

- As CEO, are you and your team fully committed to this path?

- Is the status of the financial markets favorable for your IPO now?

CEO gut check

Section 302 of the Sarbanes Oxley Act of 2002 specifies that a public company CEO must personally certify the accuracy of quarterly and annual reports. These reports are comprehensive, drawn from the totality of operations across your company. You are the CEO of a public company. Your CFO steps into your office and puts the certification document in front of you. He asks you to sign it. You pause. How sure are you that everything is fully accurate? If your certification proves false, the company can face an SEC enforcement action and civil penalties. You gulp. Then you sign.

Welcome to life as a public company CEO.

In 2012, Reed Hastings, Netflix CEO, was sued by the SEC for posting on Facebook that Netflix had exceeded 1 billion hours of monthly billing, with a promise that with the debut of House of Cards and Arrested Development, “we will blow those numbers away.” The SEC alleged that Hastings was releasing material information improperly — that it should have been released via the SEC and a formal press release. They sent Hastings a Wells Notice, recommending charges be brought against both the company and the Hastings himself.

At dinner with friends, you let slip that a big channel partnership just closed. The next day, one of your friends buys 1000 shares in your company. You have just abetted insider trading, and are now at risk of criminal action. If a whistleblower in your company raises an alarm about a material deficiency in your controls, and you don’t take immediate action, don’t be surprised if the SEC comes calling, penalties at the ready.

As a public company CEO, your priorities are different than private company CEOs. You spend much more time on regulatory compliance, confirmation of solid systems and controls, and investor relations. The operation of the business, which once took up most of your time as CEO, now competes for your attention.

You walk around in a fishbowl. Your entire compensation package will be visible to all. Even changes to your health may be deemed relevant public information. From all quarters, you face relentless pressure to perform. Since your board is under the microscope , they put you under one. Your audit committee, made up entirely of independent board members, questions everything. While the markets like knowing you invest in the future, it is your short term performance that drives your stock price. One slip in one quarter, and the markets (and your board) won’t care about the future. They’ll punish you in the present.

Is this what you want? Speak now, or forever hold your peace. You step on the train to IPO with a one-way ticket.

Preparation for IPO

From the day you start your quiet period to the day you go public may be less than a year. But before that active process starts, there are at least two years of preparatory work.

Do your products deliver sustainable competitive advantage in a huge market? Do you boast low churn and strong unit economics alongside rapid growth rates? Is your brand well respected? Are operations fit and trim, with mature processes and no limitations on scalability? Are your technical systems optimized? Does data flow through your company cleanly? Are your analytics accurate, with one source of truth for each reported data point? If not, don’t go IPO.

You must make sure that all systems and controls — especially financial, but also including data and privacy controls — are at the public company standard. Everything must be “SOX compliant” (compliant with the strict requirements of Sarbanes Oxley). You need a CFO and financial team with public company experience. So too your Chief Data Officer and Chief Information Security Officer. Once on board, these leaders will need time to get their functions into public company shape. Weaknesses in systems will stop an IPO in its tracks. So don’t even think of starting down the IPO pat until you are absolutely confident they are rock solid.

Do you have a top echelon auditor? Have them conduct a comprehensive audit of your financials, going back at least three years. Resolve any accounting issues well in advance of the IPO process. Best practice is to initiate the public company disciplines, such as quarterly reporting, well before you go IPO. Prove to yourself that you can close the books and execute quarterly reporting (including a full Management Discussion & Analysis) within 40 days.

You will need to upgrade and build out your board. As a public company, your board must have a majority of independent board members. These members should be in place for at least a year prior to initiating the IPO process. Independent board members of public companies have personal liability for the information contained in the registration statement, so they need time to confirm the company has met all the requirements and has made factually accurate statements. The audit committee is made up solely of independent board members.

As you approach the launch of the formal IPO process, start to build relationships with key market actors, such as investment bankers and the financial press. Each large bank has analysts; the analysts assigned to your company will be major influencers on the direction of your stock. At least 18 months before you go IPO, you should begin to attend the analyst and investment banker conferences. And meet the press. Tien Tzuo, the CEO of Zuora, went on Mad Money to be interviewed by Jim Cramer two years before he went IPO. His impressive interview pole-vaulted his visibility and that of his company over the top. Cramer interviewed him again a couple of months after Zuora’s April 2018 IPO. Zuora’s stock price has been on a tear since IPO. Good news plus good press equals stock price acceleration.

As you approach the IPO process, you will begin to assemble the IPO team. The team includes company employees, external advisors and the SEC. Here’s the full team:

- CEO

- CFO

- SVP Investor Relations

- Securities counsel (lawyer)

- Independent auditors

- Underwriters (investment bankers)

- Underwriter’s counsel

- Advisory accountant

- The financial printer

- PR firm

- Pitch consultants

- Stock transfer agent

- SEC’s Division of Corporate Finance

One early step is to select your investment bankers. You will meet with many, and will hold a “bake-off”. You’ll first select two “bulge-bracket” bankers to bookrun the offering. For the most promising IPOs, the choice of bankers will come from a short list, with names such as Goldman Sachs, Credit Suisse, Morgan Stanley and Deutsche Bank. Then you need to choose two or three smaller firms to co-lead the underwriting syndicate. This list will include such firms as Jeffries, Piper Jaffray, Pacific Crest and William Blair.

While the path towards IPO is replete with myriad preparatory steps, process issues and regulatory requirements, it is at its heart a marketing exercise. You are “selling” your company to the marketplace. Never forget that investors buy stories (see Chapter 4). In the end, it is the story that counts.

The IPO process

The active IPO process involves the entire IPO team in an array of highly orchestrated activities. It starts with an all-team meeting to review the plan for the offering, coordinate roles and responsibilities, and nail down the timeline, especially the estimated filing date.

Your bankers will help you prepare an S-1 filing. JOBS act allows companies that are under $1B in revenues to submit the S1 confidentially, and only announce publicly when you are 15 days prior to road show launch. This gives companies more flexibility, allowing you to move further down the path towards IPO before your employees and the market know about it. The process is technical and complex. Your registration document will be well over 100 pages, and will detail every aspect of your business. Part I of the statement will address business operations, the company’s financial condition, financial statements and information about management. All of this information will be required to be in the prospectus. Part II contains additional information, not required in the prospectus.

The company’s financial history and status, its plans for the future, details about every member of the management team along with their compensation plans (including stock option plans), a list of all material agreements, a review of risks and a full exposition of financial projections are all exposed in the S-1. The Management Discussion and Analysis section addresses results of operations, liquidity, capital resources, off-balance sheet disclosures, key accounting policies, legal proceedings and any other material facts.

While the regulatory requirements are being addressed, you’ll begin to work with your bankers to craft your story. Highlighting the key metrics of the business that matter most (the ones the Street will track most closely), you will develop a story for each. Once the story is rock solid, if the timing is right, you’ll begin to prepare for your roadshow.

Everything in the S-1 must be scrutinized in due diligence. Multiple members of the IPO team will conduct independent diligence, seeking to ensure good faith accuracy of everything. Questionnaires will be distributed to you and your management team, asking them to review, verify and comment on all statements made in these documents. The underwriters will seek comfort letters from the company’s auditors, underscoring the soundness of the financial statements. You will select the stock exchange on which you want to list. NYSE is most prestigious, but has higher revenue and other requirements. NASDAQ is heavily weighted towards technology. Once everyone is satisfied the S-1 is solid, it will be filed with the SEC. At this point, you are ready to publicly announce your registration and intent to go IPO. You will then answer a series of questions and comments presented by the SEC, until their concerns have been satisfied and you are approved to proceed. You will then enter a waiting period that lasts up to the effective date of the registration. During this time, underwriters can share the red herring (the preliminary prospectus) with institutional investors and accept expressions of interest, but cannot transact any sales of shares.

The road show itself is a grueling but exhilarating experience. For 8–9 days, you will go through an unrelenting gauntlet of back to back meetings. From early in the morning until late at night, you will be presenting to groups, meeting 1:1, holding conference calls, holding Q&A sessions and traveling. You’ll start in NYC. You’ll fly on a private jet to Boston. Then back on the plane and on to the Mid Atlantic, then to the Midwest, then to the West Coast. In every conversation, on every stage you will be pitching relentlessly. Your story will be subjected to continuous stress testing. And so will you.

Every analyst assigned to your company will be initiating a position, and involving extensive research into your company. You will host many analyst meetings, and field a raft of questions.

By the time the registration statement is filed, the number of shares and the general dollar amount have been established, with a price range. But the determination of the final price of shares and the underwriter’s discount requires a negotiation process. The impact of the roadshow, investor interest, the state of the markets and other factors will influence these discussions. Final decisions are made in the pricing meeting. If your financing is substantially oversubscribed (by at least 10X) , then the IPO may be priced above the previously stated range. In such situations, institutional investors are then not able to purchase as much of the company as they sought. These factors place upward pressure on the price. The result of these discussions is the final price amendment, which is submitted to the SEC.

The next step is the allocation meeting. As CEO, you, your CFO and your SVP Investor Relations will be closely involved in selecting the institutional investors who may participate. The company’s interests and those of your investment banker may diverge at this point, although the best investment bankers keep your interests front and center. Your interest is to secure institutional investors who are buying long, and who want to hold — not trade. Banks, on the other hand, make big fees from active traders, such as hedge funds — and so you may find your banker encouraging you to include these institutional investors in the mix. As CEO, will make the final decisions on the mix of institutional investors, and the allocation for each — make sure you have a stable investor base right from the outset.

At that point, a request for acceleration is usually made. If the SEC approves, the company can proceed to sell securities to the public. This is the day you’ve been waiting for. You will step up to the podium, ring the bell, and wait to see how the markets value your life’s work. As the first day of trading ends, you can watch your bank account as funds are wired, and celebrate with your companions on the long journey of company building.

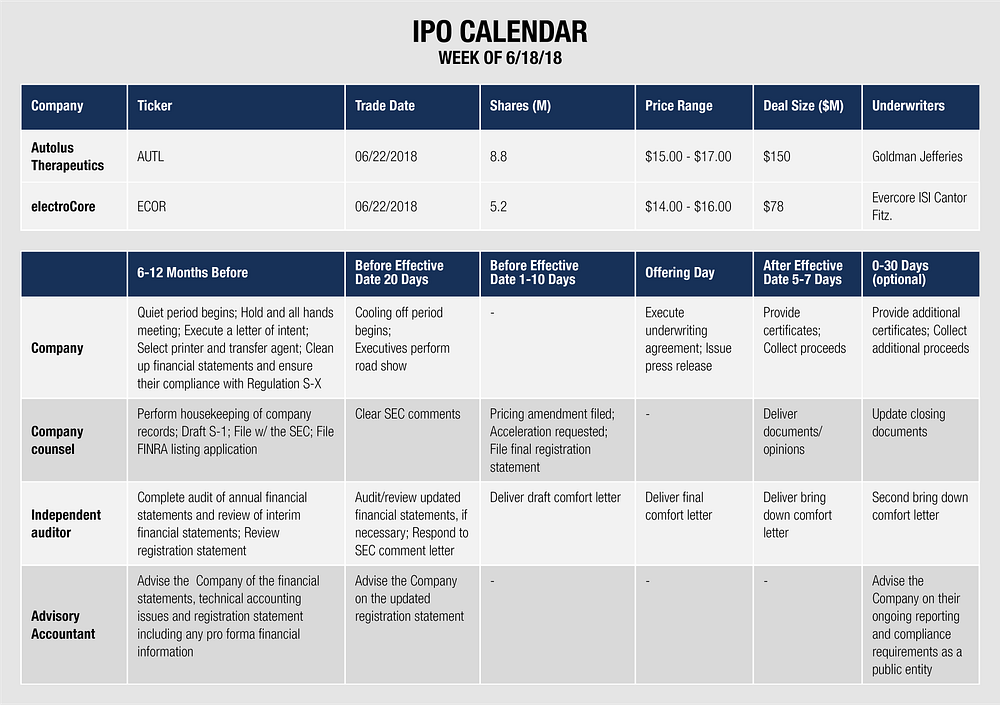

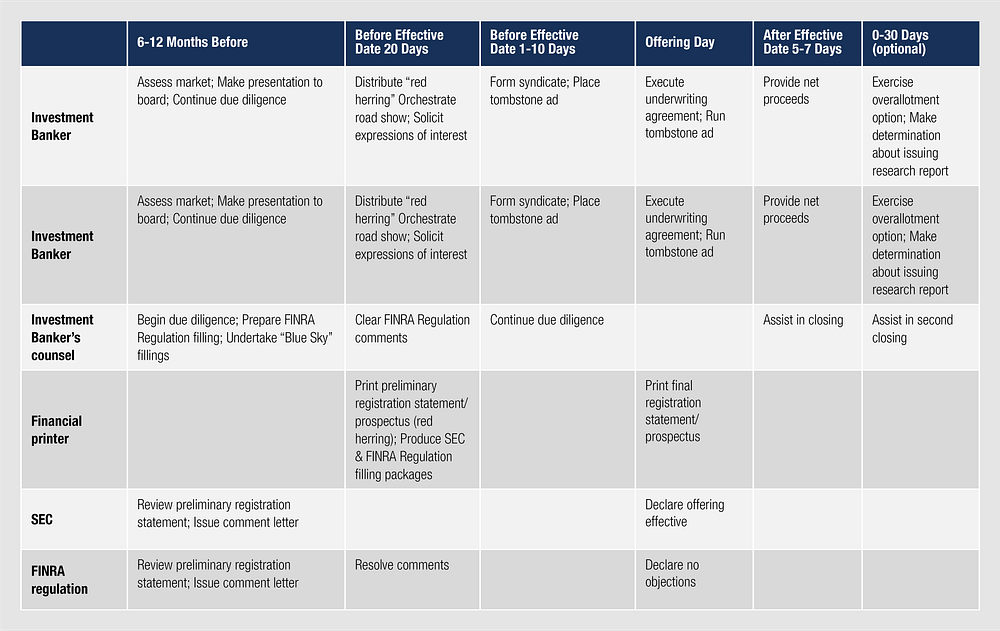

Price Waterhouse Coopers, in their “Road Map to an IPO”, summarizes the roles, tasks and timing of key milestones in the IPO process:¹

Cost of going IPO

Going IPO is expensive. So is being a public company.

Banker underwriting fees are generally 5–7 percent of gross proceeds (although Facebook negotiated that fee down to just 1.1%). That means if your IPO raises $200M, at least $10M will go to the bankers alone. Legal, accounting, PR, and printing costs can run well into the millions. You will also face fees for listing on an exchange, SEC filings and Blue Sky filings.

The ongoing burden of public company status drives substantial costs. One CEO estimated that Sarbanes-0xley compliance alone adds about $2M in increased cost to a business.² The cost of maintaining public-company standards in your systems and controls — to maintain data privacy and network security, and to make sure your financial systems are fit and trim — will be significant. You’ll even see a spike in liability insurance, as you pay to protect directors and officers.

The public company life

Life as a public company CEO is demanding. Every word you say will be parsed. Every decision you make will be second-guessed. Financial markets move on fear and greed. If your company demonstrates a track record of consistency, if your projections are regularly met, and if you exhibit a pattern of transparency when problems arise, then the market will reward you. If you can do this while posting rapid growth and rising profitability, the rewards will be significant — and you can mobilize your company to change the world.

Analysts are the voice of the market. Their positions on companies influence the actions of hedge funds and other institutional investors, and by extension the entire market. At conferences, they will seek more information than you are prepared to give. On your quarterly calls, they will ask tough, skeptical, uncompromising questions. They will demand short term results, but seek a long term strategy. They will question profit projections, and call you out when past projections fall short. And if an analyst’s opinion turns negative, it will be very hard (and time consuming) to turn it back around.

Momentum is a powerful thing. Traction creates belief. Investors act on belief by buying your story. Because you can raise cash, you can accelerate growth, buy companies, grab markets and continue to scale. Momentum.

But if you cut corners — if you overpromise and underdeliver, or are forced to make material restatements of financial results, or if you fail to run the company effectively and your growth engine stalls out — the markets will punish you. And frankly, your board will probably remove you.

No company is free from challenges. Every public company CEO faces a continuous stream of tough decisions, made under the relentless gaze of Wall Street. It’s not for everyone. But perhaps it’s for you. If you bring enough ambition, vision, discipline and guts, a public company future is available to you.

Now go make it happen.

. . .

Notes

1. “Roadmap to an IPO | A Guide to Going Public”, Price Waterhouse Coopers, 2011, 35–36, https://www.pwc.com/us/en/deals/publications/assets/pwc-roadmap-to-an-ipo.pdf.

2. Ryan Allis, “How To Be A Public Company CEO”, Making a Difference / A Blog by Ryan Allis, 2008, http://www.ryanallis.com/how-to-be-a-public-company-ceo/.

. . .

To view all chapters go here.

If you would like more CEO insights into scaling your revenue engine and building a high-growth tech company, please visit us at CEOQuest.com, and follow us on LinkedIn, Twitter, and YouTube.