If your company has achieved at least $10M in recurring revenue with predictable future growth, low churn and proximity to cash flow positive, then you are able to add private equity to your exit options.

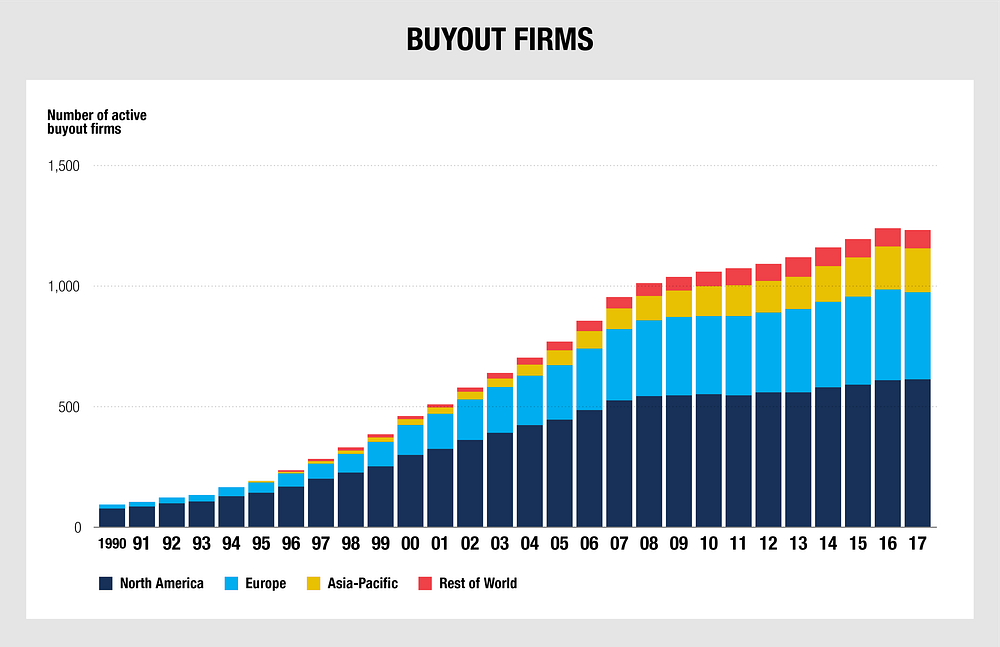

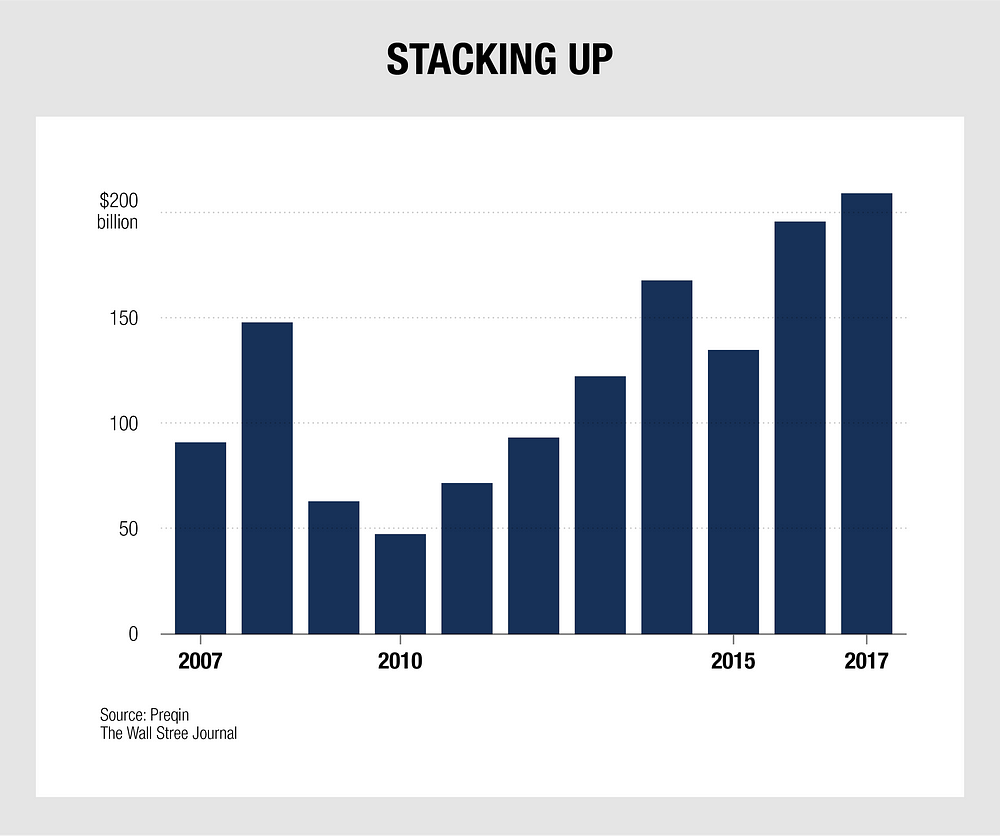

As of June 2017, global private equity capital under management stood at $2.83 trillion.¹ $1.7 trillion is in dry powder, ready to be deployed in platform and add-on buyouts. Furthermore, the number of private equity firms chasing buyouts has grown significantly:

In Q1 2018, 23% of all private equity buyouts were in the IT sector — the most ever.² In 2017, 19% were in IT — 823 deals. In that year, $40B was raised by private equity funds for investments in IT.³ Most of this activity was in North America, but acquisitions occurred in Asia and Europe as well.

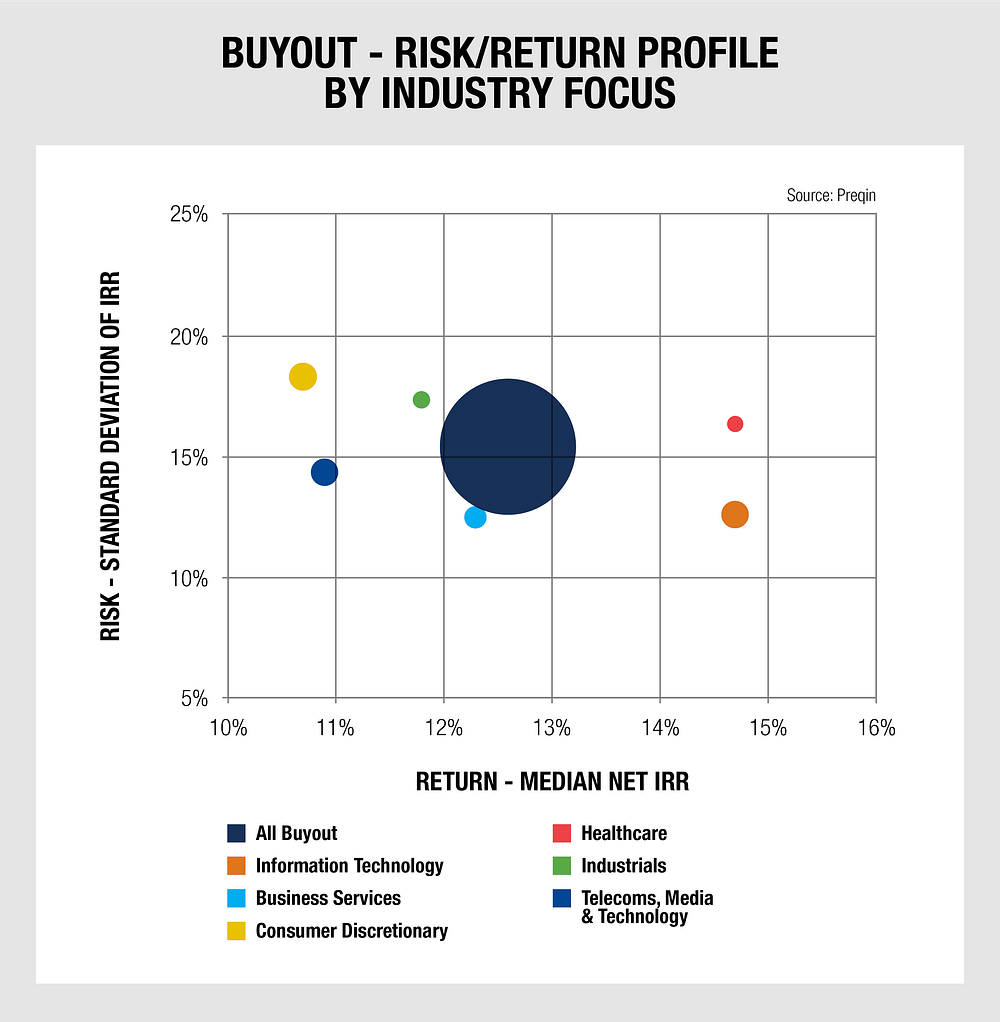

Why so much interest in IT? As the following graphic shows, IT investments have are averaging more attractive returns, with less standard deviation, than alternative investment sectors.

If you are the CEO of a tech company headed towards exit, it’s clearly time to give a private equity exit serious consideration. There are more PE firms with more cash to invest. There’s more inexpensive debt available today. There’s the steady shift towards IT as the investment sector of choice for financial sponsors. Deal competition from the increased number of private equity funds focused on IT and corporations seeking strategic acquisitions is pushing valuations higher. For all these reasons, the discount spread that normally exists between strategic and private equity exits has vanished, especially for growing recurring revenue businesses.

Attributes of the Ideal Private Equity Acquisition Target

The private equity investment thesis depends on the post-acquisition strategy to drive investment returns. Downside risk must be low, and upside opportunity high. PE firms look for companies that are at cash flow positive, or close to it. Recurring revenue business models are favored. Revenue and logo churn must be low. Customer acquisition costs must be relatively low. Revenues below $10M aren’t interesting.

But along with the list of things PE firms care a lot about, there are things they don’t care as much about as other buyers. If you are not the market leader, that’s OK as long as your recurring cash profile is safe and growth is predictable. If the space you are in is out of favor, or your technology is aging, that can be OK too, as long as (once again) recurring revenues are safe and there is still predictable growth. And if you as CEO want to leave after the transaction is complete, that’s OK too — PE firms expect to change out management at some point anyway.

Once it’s clear downside risk is low, a PE firm’s focus turns to upside leverage. Here are the most important levers a PE firm will consider:

- Opportunities to reduce costs

- Price increase potential

- Potential for add-on, tuck-in scale acquisitions

- Leadership upgrade opportunities

- Channel partnerships

- Revenue engine improvements

Every private equity acquisition depends on an investment returns thesis. Once you have confirmed that your company is a viable PE target with modest downside risk, it’s time to put yourself in the PE firm’s shoes and figure out the investment levers. If you include a solid growth thesis in your PE pitch, you will be preaching to a responsive audience — but if you have no or limited demonstrated growth, then a profits or consolidation story will be required to generate interest and de-risk investment returns.

The Private Equity Investment Thesis

The case for private equity is based on performance. LPs pour money into PE firms in search of outsized returns. The top quartile of US funds has delivered net IRR ranging from 20% to 30% over the past ten years.

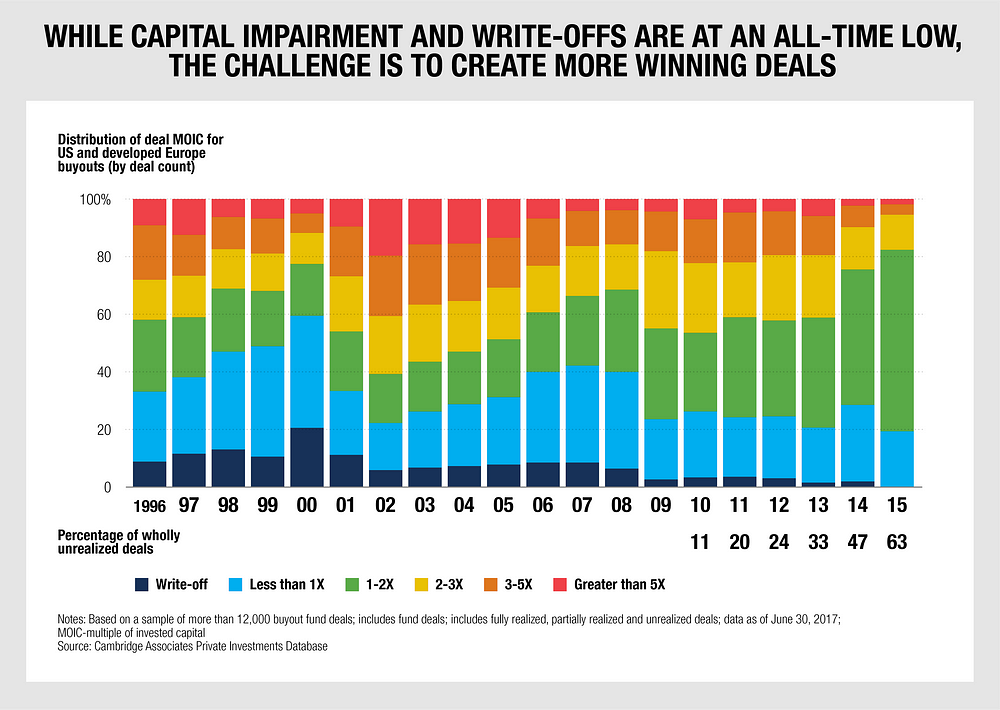

Here is the distribution of multiples at exit over time, for the US and developed Europe:

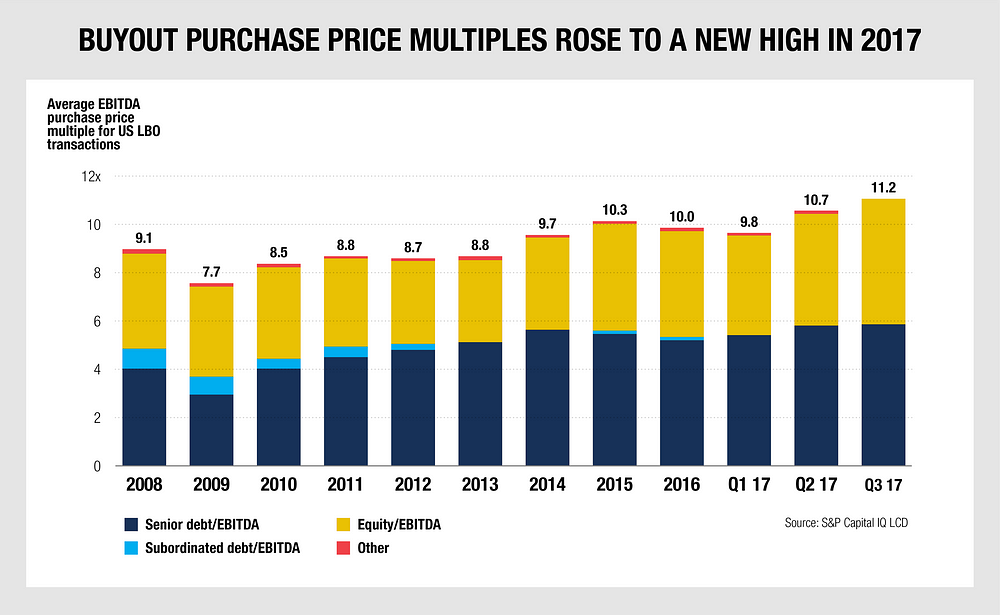

To achieve these outcomes, PE firms often use debt leverage to increase returns. The average hold time is five years, and during this time the mission is to build maximum value.

Two Bites at the Apple

As CEO, you and your top team have another important reason to consider a private equity exit: a second bite at the apple. In a private equity transaction, you can expect to receive cash for most of your equity. But most PE firms will expect the CEO to roll over some of it. A survey by the law firm Goodwin Procter found that 70.7% of PE firms “typically require” CEO to roll over a portion of pre-transaction equity. On average, this rollover portion constitutes 24.1% of the CEO’s pre-transaction holdings.⁴

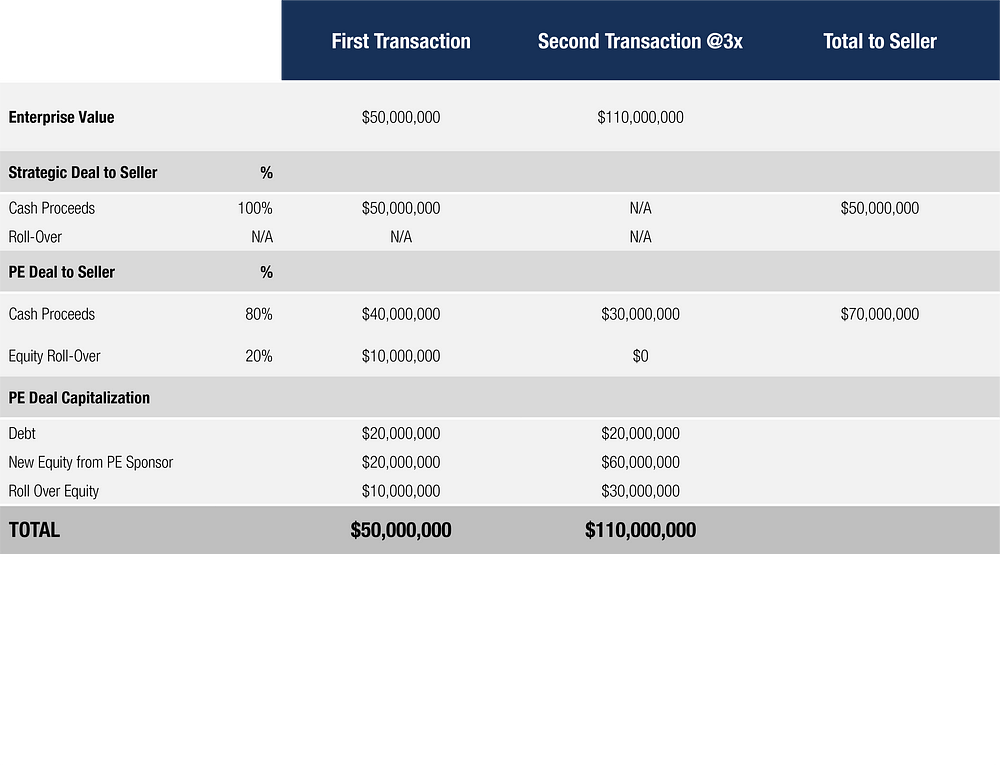

Assuming you drive the company’s performance post transaction and lead the company towards an exciting subsequent exit, your second bite might be even bigger than your first. Here is a fictitious example of how the math might work in your favor. In the first case, you sell to a strategic (“Strategic Deal to Seller”) and take a 100% cash payout, which yields you $50M. In the second case, “PE Deal to Seller”, you receive a lower initial cash payout — $40M of cash, with $10M allocated to an equity rollover — but assuming the second transaction achieves 3X (propelled in part by the PE debt leverage) then another $30M comes back to you — for $70M in total proceeds.

That’s two bites of the apple:

It’s even possible to have three bites, if your PE owner exits to another PE investor. PE to PE is a rising trend in the private equity world.

If you do agree to a transaction that includes a rollover requirement, make sure these shares are the same class of shares as held by the private equity firm — whether preferred or common. Your shares should rank pari passu in seniority alongside the PE firm’s own shares in the company (there are some exceptions to this, but as a rule they should be the same class of equity). Also, make sure to address what happens to those shares when and if your employment terminates.

Management Compensation

PWC’s 2016 compensation survey of private equity portfolio companies found that cash compensation for senior executives was consistent with public company comparisons.⁵ Management equity pools averaged 12%. Equity participation was usually limited to the first two to three levels of management. For technology companies, just 6.9% of employees received stock option grants. For PE firms, most (74%) stock option plans were structured to vest based on a combination of time and profit performance. Private equity firms tend to give out equity in a more sparing way than their venture counterparts, and there is a wide range of approaches to employee equity, so understanding an PE firm’s approach to equity will help you assess fit.

What to Expect if Owned by PE

Post acquisition, your board will be comprised primarily of PE firm principals. These principals will be active partners in all important business decisions. As CEO, you will interact frequently with them. If you value independence, you will not stay CEO for long.

In fact, Alix Partners’ 2018 Annual Private Equity Survey found that 58% of PE firms expect to fire the CEO within two years of an acquisition. 78% expect to do so sometime in the investment life cycle.⁶ A separate study conducted by executive search firm Reynolds and Reynolds found that for top performing companies, 38% of CEOs in the seat at the time of the transaction were still in the seat at exit. For bottom performing companies, just 23% made it to the finish line.⁷

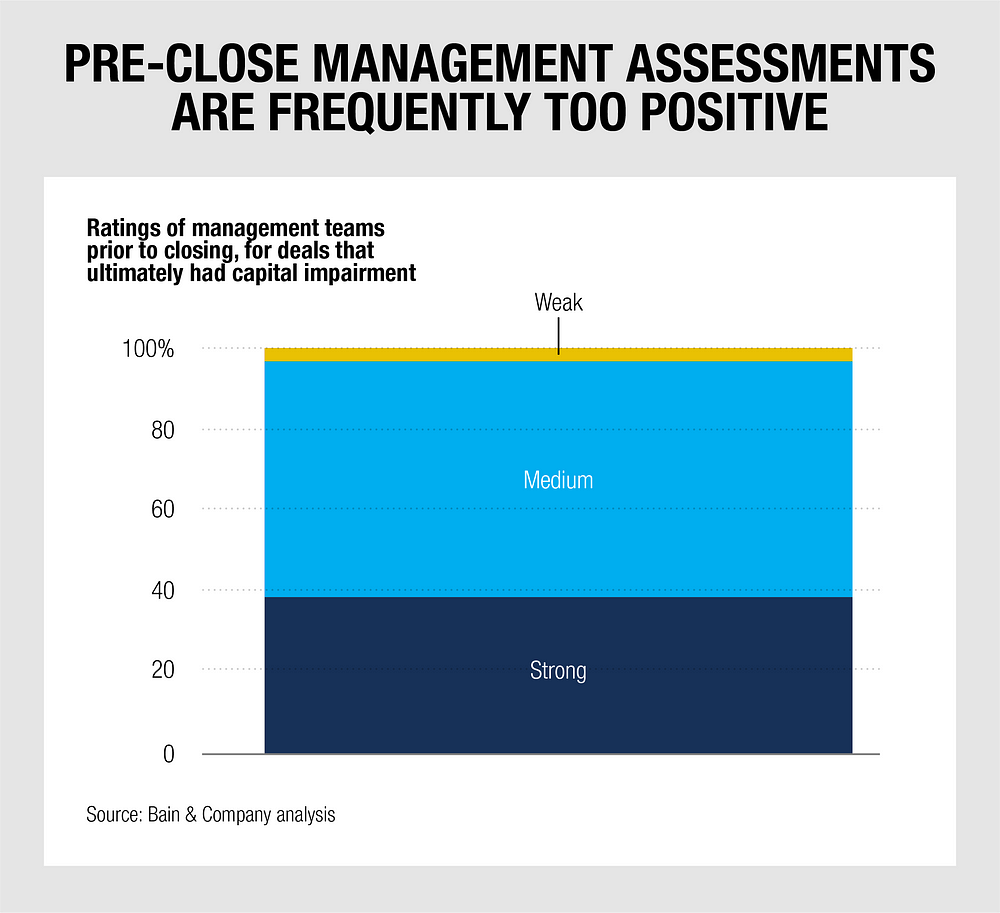

PE firms often start out believing that the existing CEO is a keeper, but then conclude otherwise over time. In an analysis of deals that experienced capital impairment, Bain Consulting found that initial impressions of the management team were often too positive.⁸

Your PE owner is acutely conscious of the need to act quickly if a CEO falls short of performance objectives or proves too independent. So if you want to keep running the company, you will need to focus on delivering immediate results. Operational performance, as shown by cost efficiency and strong revenue growth, will be paramount. PE firms want to see CEOs who act with urgency to drive the business forward.

While PE firms typically seek to minimize funding losses in the core business, they are happy to invest in add-on acquisitions where they make sense. In fact, you may be challenged to aggressively scour for accretive acquisition opportunities.

One thing you will not need to spend time on is fundraising, unless you head towards IPO. If continued funding is required, the PE firm will handle it.

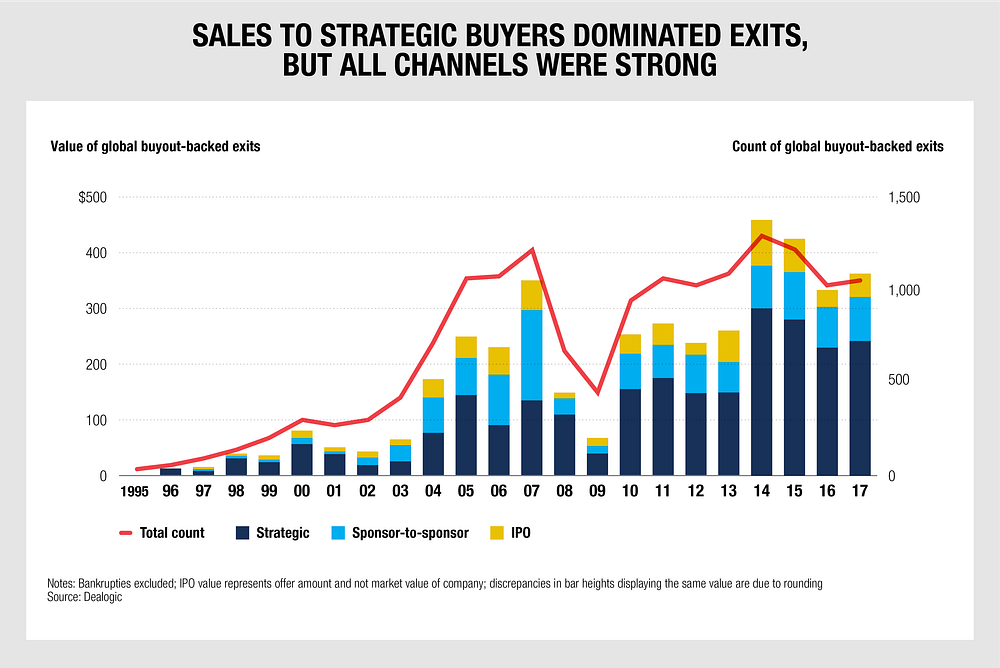

The goal, of course, is to build value to the point where you can achieve a highly successful exit. There are three possible exit pathways: sale to a strategic, sale to another PE firm, or IPO.

Private Equity Firms

Thoma Bravo and Vista Partners have both raised 10-figure funds for investing in technology. And that’s just the tip of the iceberg.

Here’s an illustrative list of PE firms active in the technology sector:

Fund size is loosely correlated with deal size. The very large funds pursue big deals — for instance, Silver Lake Capital took Dell private. Very large buyouts of mature companies are the domain of very large funds, while the smaller funds are doing smaller deals. It is also worth noting that many of these investors have multiple funds (e.g., Accel-KKR has a buyout fund and a growth equity fund; Vista Equity Partners has three different buyout funds targeting small, medium and large transactions). Some do both venture capital and PE buyouts (e.g., JMI, Insight Venture Partners).

Summary

Regardless of the firm, you can expect PE investors to be sharp deal makers. So come prepared, and make sure you think carefully about the upside (e.g., two or three bites at the apple) and downside (e.g., greater risk of being replaced) of the PE exit path. As they say, “be careful what you ask for — you just might get it.”

. . .

Notes

1. “2018 Preqin Global Private Equity & Venture Capital Report | Sample Pages”, Preqin, 2018, 14, http://docs.preqin.com/reports/2018-Preqin-Global-Private-Equity-Report-Sample-Pages.pdf.

2. “Preqin: Private Equity Buyout Funds Focus On IT Sector”, Finalternatives, 2018, http://www.finalternatives.com/node/36319.

3. Ibid.

4. “2015 Survey | Rollover and Incentive Equity Terms in Middle Market Private Equity”, Goodwin Procter, 2015, 5, https://www.goodwinlaw.com/-/media/files/publications/newsletters/private-equity-update/2015/rolloversurvey.pdf.

5. “Greater Sharing — Even Greater Expectations | PwC’s 2016 Private Equity Portfolio Company Management Compensation Survey”, PwC, 2016, https://www.pwc.com/us/en/hr-management/publications/assets/pwc_private_equity_stock_compensation_survey_2016_pwc.pdf.

6. “Survey: Misalignment Between Private Equity Investors, Portfolio Company CEOs Triggering Costly Turnover”, Alix Partners, 2018, https://emarketing.alixpartners.com/rs/emsimages/2018/pubs/EI/AP_Annual_Private_Equity_Survey_Mar_2018.pdf.

7. “What Makes A Great PE Portfolio Company CEO”, Russell Reynolds Associates, 2016, http://www.russellreynolds.com/en/Insights/thought-leadership/Documents/What%20makes%20a%20great%20portfolio%20company%20CEO%209.28.pdf.

8. “Global Private Equity Report 2018”, Bain & Company, 2018, https://www.bain.com/insights/global-private-equity-report-2018/.

. . .

To view all chapters go here.

If you would like more CEO insights into scaling your revenue engine and building a high-growth tech company, please visit us at CEOQuest.com, and follow us on LinkedIn, Twitter, and YouTube.